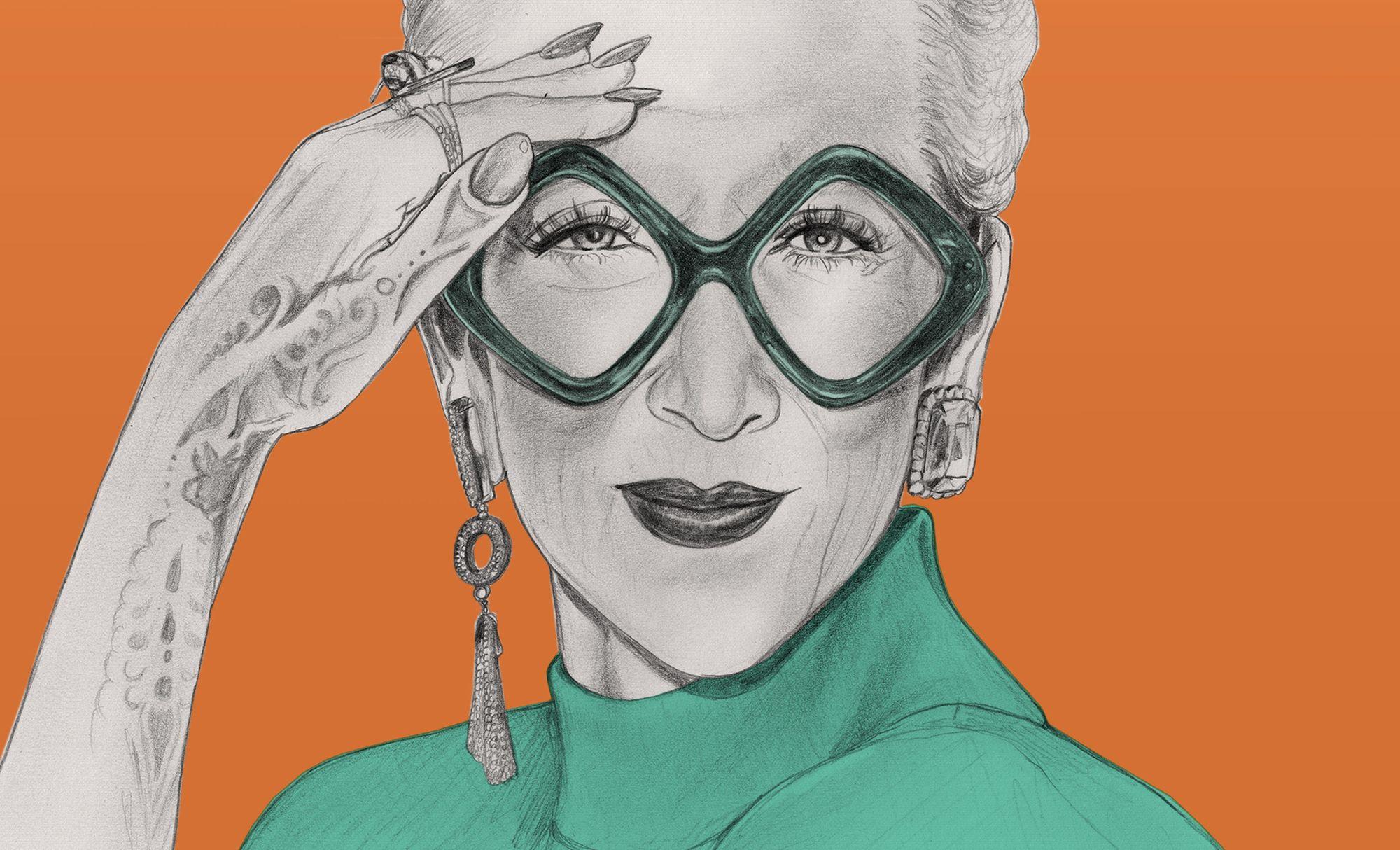

Money Diaries

Bobbi Brown Was Terrible at Budgets. So She Decided to Make More Money.

The makeup impresario and beauty entrepreneur tells us that you don't have to be good at everything. But you do have to know what you're good at.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries” where we ask interesting people to open up about the role money has played in their lives.

I wasn’t born with the natural brains and talent for business that others were. And if I get bored, forget it. I’d sit in a college classroom with some professor lecturing on something I wasn’t interested in—it was torture. But I was always able to figure out how to get things done. When I was at the University of Arizona, I had these cowboy boots that didn’t fit over my calves—I have very strong calves—so I grabbed a pair of scissors and cut the top off the boots. I probably destroyed those boots, but I made them work. That’s kind of how my mind works. When I started my company, I also had a new baby, and I was exhausted. I couldn't do the whole rigamarole of taking off my makeup, so I would take it off with a baby wipe. I walked into the office one day and said, “I have the craziest idea. Let’s make makeup remover wipes.” My partner said, “That’s disgusting.” Famous last words.

Growing up in the suburbs of Chicago, I’d say we were upper middle class. My mom stayed at home, and my dad was a lawyer—we lived on his salary. Chicago was a practical place, with a practical attitude about money. We always had a nice car, but we didn’t live extravagantly. My parents gave us an allowance growing up, and they gave us chores to do to earn that allowance. Whether we actually did the chores or not? I’m not sure about that.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

My first job was at Carson Pirie Scott department store, selling children’s shoes. I was 16. It wasn't that my parents told me I had to get a job; it was more like I asked if I could get one. All my friends had jobs there. And I want to take this opportunity to apologize to all the babies I put shoes on—it wasn't my forte. Before I even had that job, I was into retail. I actually had a store in my basement with girlfriends. We called it LBJ for Lynn, Bobbi, and Janice. We sold jewelry that we made and other little things. The problem was it was in my basement. Not much foot traffic through there! We didn’t think that through, I guess.

I was very moved and touched by the work ethic of my grandfather, whom we called Papa Sam. Papa Sam came to the United States from Russia, with literally nobody and nothing. He started out delivering paper, eventually moving on to selling wallets and handbags before going into the car business. He ended up owning several car dealerships. By the time he died, he was widely known in Chicago as Cadillac Sam. I remember watching how hard he worked and how he treated people. I think of him as the Harvard MBA I never received.

I didn’t land in New York City with a trust fund, but I had some help at the beginning. My dad had a very traditional job as a lawyer, but he supported what I was doing. When I graduated from college, he said, “I’ll pay your rent for one year, and I’m going to give you a small budget for food every month.” It was $250. He said, “I want you to spend the money on really good food so you eat properly.” I did what I was interested in, and I was always interested in makeup. When I was in college, we had an assignment to do a film. I didn’t think about anything but the makeup in it. Did I worry about what the subject of the movie would be? Eventually. But first I thought about the makeup I wanted. I guess that was portentous.

I used to owe more in interest on my credit card than I owed for stuff I bought on the card.

When my husband, Steven, and I got married, he was in real estate and I was a freelance makeup artist, so I was constantly traveling for shoots. When we had a baby, I didn’t want to travel anymore, so I did catalog work. Then the real estate market crashed. We were living on my catalog salary, and Steven was going to take a corporate job. I said, “That’s a terrible idea. You are the last person I’d expect to work for someone else.” Around that time I had an idea for this lipstick. We didn’t know what would happen with the lipstick, but Steven went to law school, and that’s when we started the business. Steven has been everything—not only to me but to my business. People see me as this incredibly well-connected, entrepreneurial thinker, but in reality some of those things aren't my strength. What I am good at is getting the right people to work for me. It’s probably not the advice that women want to hear from me, but I trust Steven. He's great with our investments, and he’s always really happy when we have to pay a lot of taxes!

Recommended for you

She’s a Toronto Legend, Model, and Style Icon. And She Was Nearly Homeless

Money Diaries

Stories From Our New Economy: Bullish on Bidets Edition

Money Diaries

Shangela Would Like to Remind You to Tip Your Drag Queen

Money Diaries

Karen Russell: A Brutally Honest Accounting of Writing, Money, and Motherhood

Money Diaries

I’m not really great at math, but since I was a waitress, I can tell you what 20 percent of anything is. I get all the concepts—you spend less than you make and all that—but finance is certainly not my expertise. I’d be sitting in meetings, and the president of Bergdorf Goodman would talk about a lot of things. Steven would turn to me and say, “You know what this means, right? This means you can buy that washer and dryer for our house.”

I have also never been great at sticking to a budget. I used to owe more in interest on my credit card than I owed for stuff I bought on the card. I remember being really young and calling my dad in tears, and I thought he was going to say, “You’ve got to learn how to live within your budget!” Instead, he said, “Forget about following a budget. Why don’t you just figure out how you’re going to make more money.” I’ll never forget that. Even when I was at my company, I never worried about not having the money to do certain projects. It was “Okay, okay, we don’t have the budget, but how are we going to do it anyway?” Because what I am great at is competition. I like to sell a lot of things. I like to make money. I like to turn a profit. I like figuring out how to get it done.

We started our first company in 1991, and in 1995, we sold it to Estée Lauder. I don’t even understand how that happened, but it did. Like most of our discussions, Steven and I were in the car when we had a conversation about what being bought by Estée Lauder was going to change. But we liked our house, we liked our car, so we didn’t need major life changes. We talked about sending our nieces and nephews to college. I’m so proud and grateful that I could do that. And just recently we founded an organization called Reaching Out Montclair. It aims to provide essential needs for underserved children and their families who live in or near Montclair, New Jersey. We sent three kids to college — one from Montclair and two from Telluride, where our son Duke went to high school. One splurge for ourselves was buying four floor seats at the Metropolitan Opera. And we bought a catamaran that we named TYLL, which stands for “Thank You Leonard Lauder.” It’s not one of those megayachts or anything. It’s a pretty small boat — but it's a boat!

You know the worst thing I do? I walk into H&M and I don’t try on the clothes that I buy. Whatever doesn’t fit, I give to charity.

After the company was sold, I stayed on. The financial side, as I said, wasn't my primary interest. But last year, when we hit the $1 billion mark, I was certainly well aware of that. Yep, when I left the company after more than two decades, it had made $1 billion in sales. To me, a billion is the number attached to how many McDonald’s hamburgers are sold. Or that TV show “Billions.” That’s a pretty crazy number.

I don’t really spend a lot of money on myself. I love really good handbags, but I’m not that girl who walks around with a Birkin anymore. I do have one, and it’s a beautiful Birkin, but it’s too showy, and it’s really heavy and impractical for me. I’ll find someone to give it to someday, but for now it looks really beautiful in my closet. I’ve collected lots of great handbags over the years, and what do I do with them? I bring my nieces into my closet and let them take whichever one they want. You know what the worst thing I do is? I walk into H&M or Brandy Melville and I don’t try on the clothes that I buy. Whatever doesn’t fit, I give to charity. We do collect art. Not necessarily famous or expensive artists, but what we have, we love. We also have a major collection of dog paintings. We really like Pop art. One day we will buy a Keith Haring or maybe a Warhol. I’m a huge Warhol fanatic.

I've made enough money so that I never have to work again, but that’s not me. Since I left the company, I’ve come out with a book, “Beauty From the Inside Out”; I’m a creative consultant for merchandise at Lord & Taylor; there’s my lifestyle website, Just Bobbi; and a wellness company is in the works. With this new company, I’ve got venture people handing me checks saying, “Do whatever you want,” and my husband is like, “No way!” I do a lot of speaking appearances—for some reason banks like people coming in to speak. You spend an hour or two with some really nice high-wealth individuals talking about things. So between the speaking and Lord & Taylor’s Just Bobbi brand, I have a pretty good income. My husband’s bookkeeper just informed me that my new company is already in the black; we’re not negative. I didn’t think that would happen so quickly.

We’re developing a new hotel, which opens in the fall, in Montclair, New Jersey where we live. And I spend a lot of time with our family. My sons are very practical. They enjoy the finer things in life, but all three are hard working. The youngest is the most like me. He’s a photographer, but he’s got the best camera—he likes his toys. My oldest is really into travel and food; he works in tech. My middle son is a strength and conditioning coach. It’s amazing when you sit back and look at your kids and realize every hardship you endured to make these amazing people. That is the most incredible feeling.

As told to Jane Larkworthy exclusively for Wealthsimple. Illustration by Jenny Mörtsell. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.