Money & the World

What's the Smartest Thing You Can Do With Your Tax Refund?

You may soon find yourself with a big tax refund burning a hole in your pocket. How should you spend it? We pitted investing against Italian sports cars (and yaks) to find the scientific answer.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

The average tax refund is between $1,600 and $2,700. For a lot of people, that's the biggest chunk of discretionary income they'll see in a year. So what are you going to do with it? There's a lot of pressure. There's a lot of temptation.If you're like most of us (i.e. a human being) you may be having visions of all the stuff you could buy, do, eat, drive or text on. But what's really going to make you happy?

To help you figure out the answer, we employed some really complicated math and tons and tons of science in our patented Tax Refund Joy Over Time index. Here are our super data-driven results.

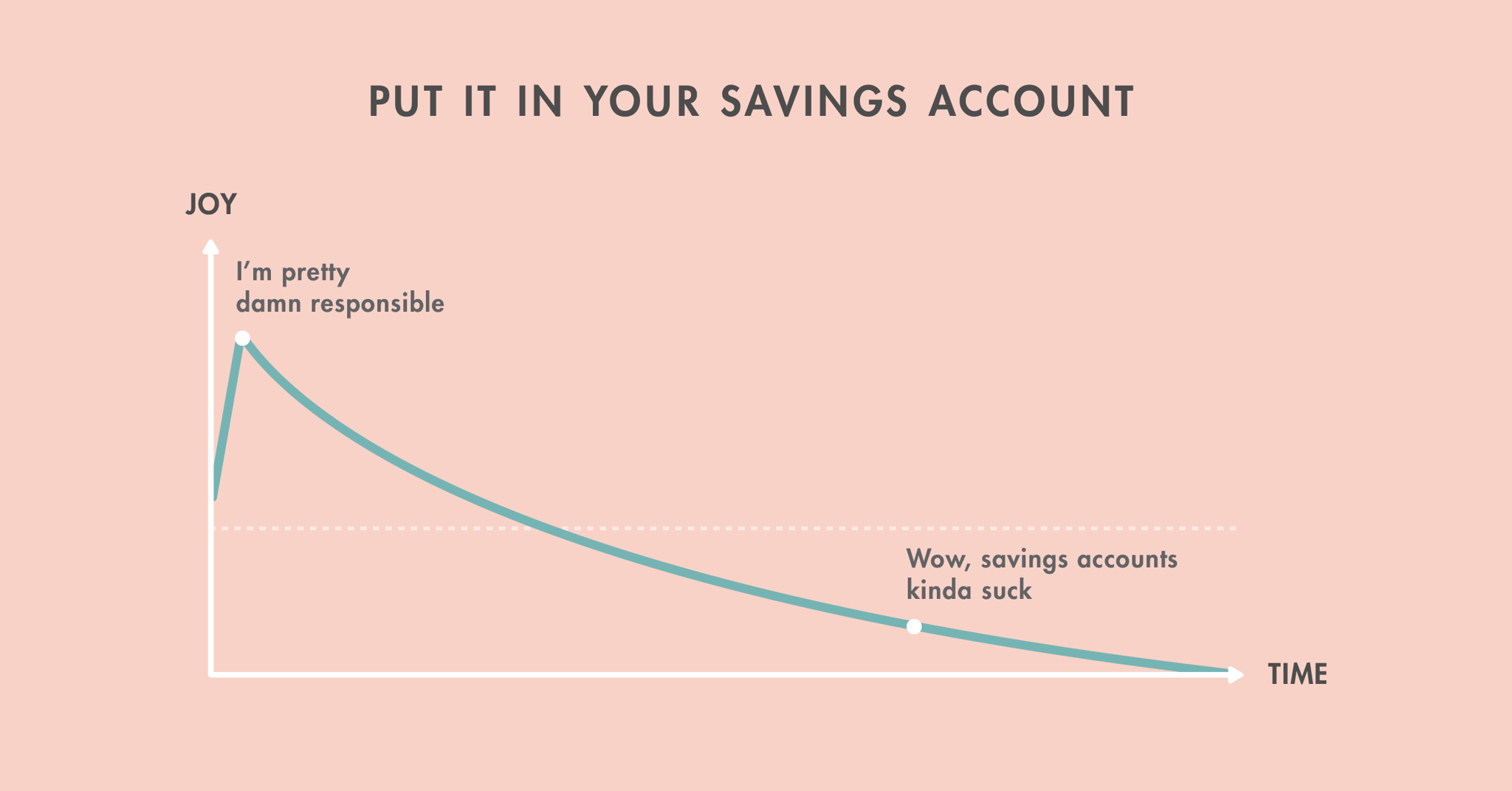

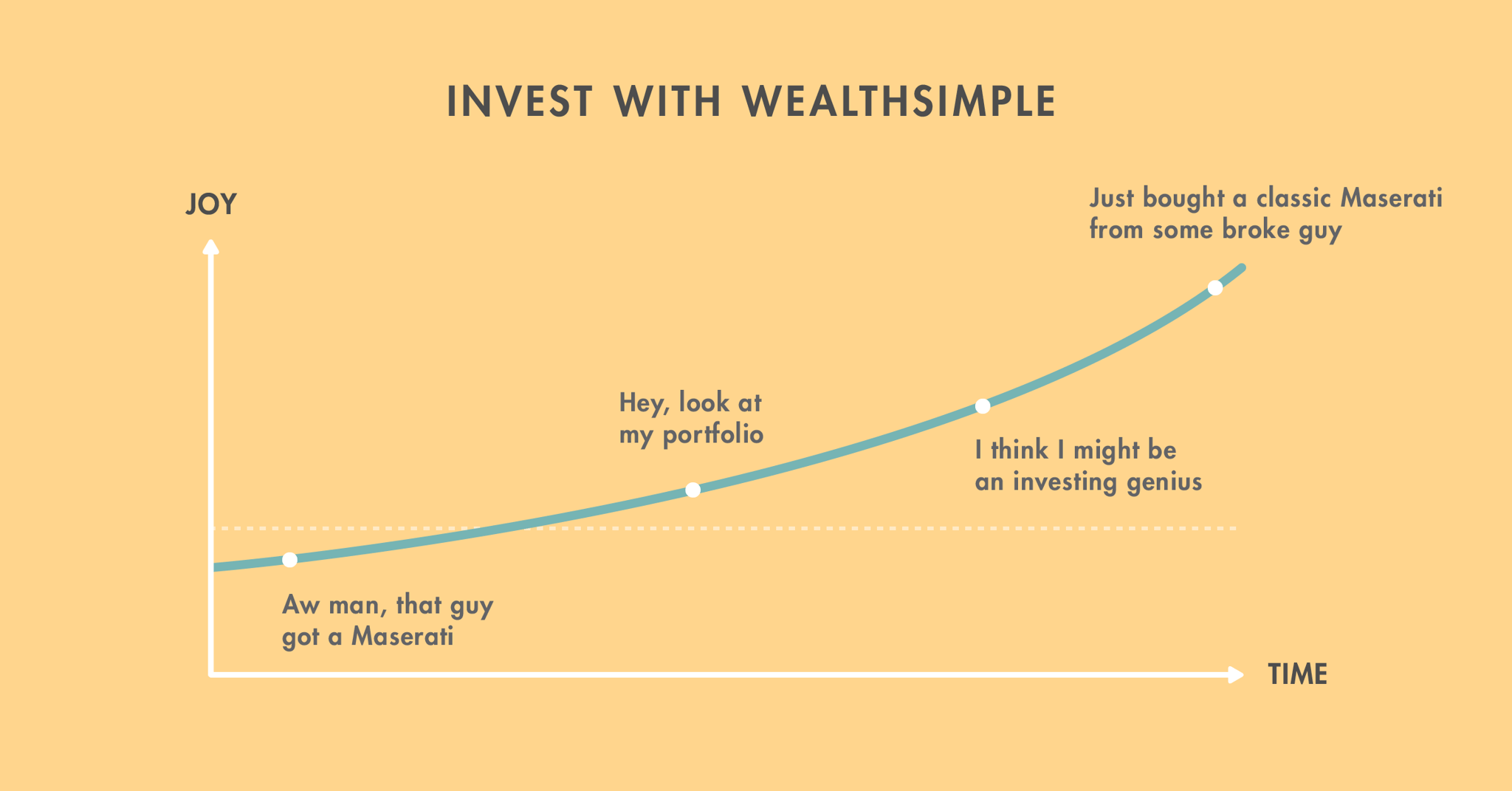

You’ll feel a rush of joy after that deposit — “Look at that, it’s all there. I didn’t use it to buy a collection of hoverboards!” But then you start to see what your peers are earning by investing their money in (you knew we were going to say it) low-fee, optimized growth portfolios with an average rate of return of 6% annually. Suddenly 1% (that's about as well as you could do in a high yield savings account right now) won't feel so hot. Your joy level will drop another 15 microsmiles (we made up that measurement) when you realize that, since inflation is about 2%, you'll actually be losing money by keeping it in a “high-interest” savings account.

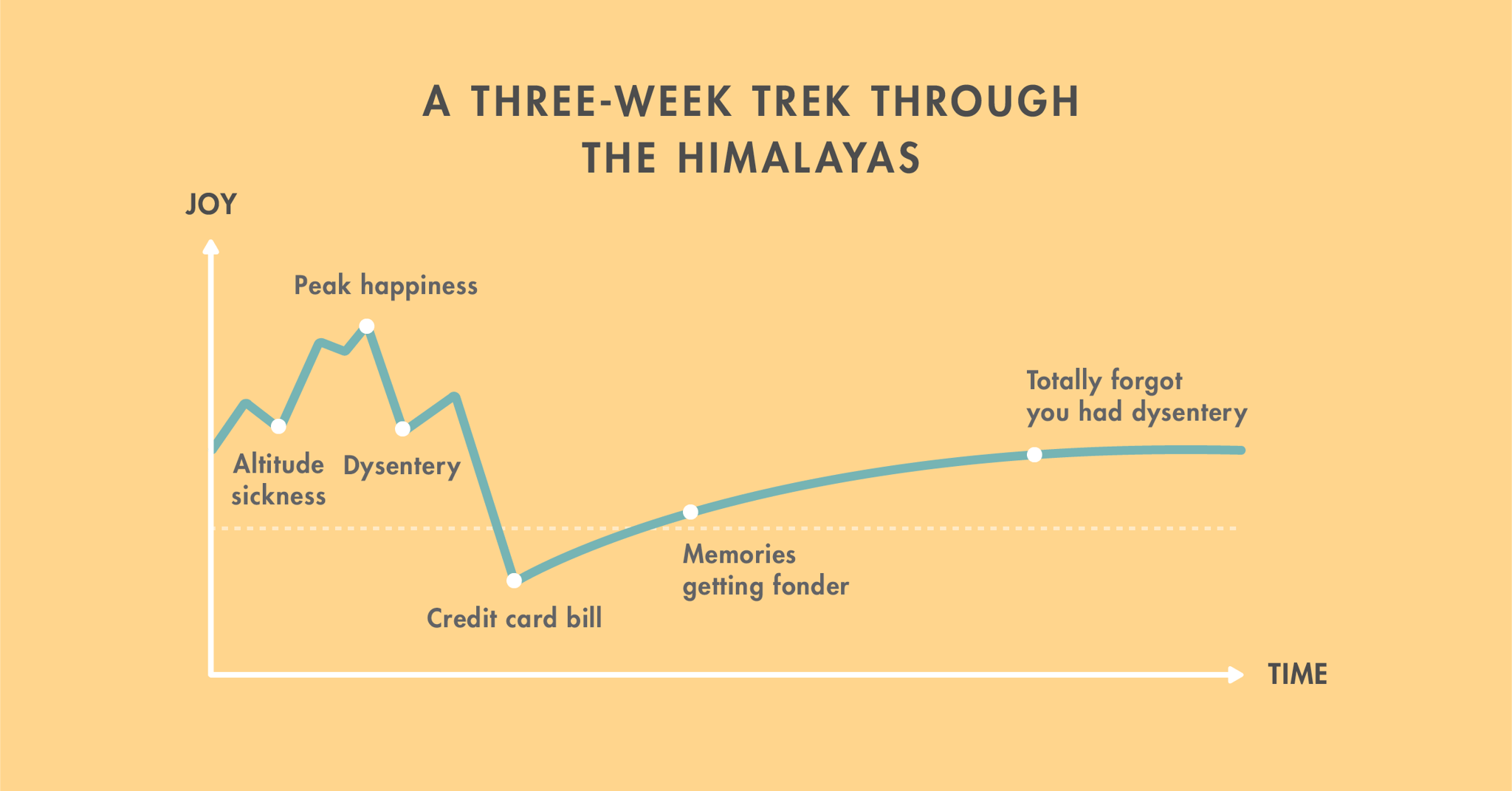

Trip of a lifetime. We're not going to argue with that. You're not going to be 86 years old talking about that pair of Adidas Boosts you bought when you were 32 (you're not, right?). Maybe that initial case of altitude sickness might bury the enjoyment at the beginning. But when you make it up to the very top of the world? And get to hang out with a yak? That's a high joy-ometer. Which will plummet slightly when you get home and see your credit card bill. And later, you might feela twinge of regret when you realize you didn't max out your retirement account and catching up is harder than staying on pace. But still, for years and years you'll be kept good company by a long, easy-sloping y-axis of fond nostalgia.

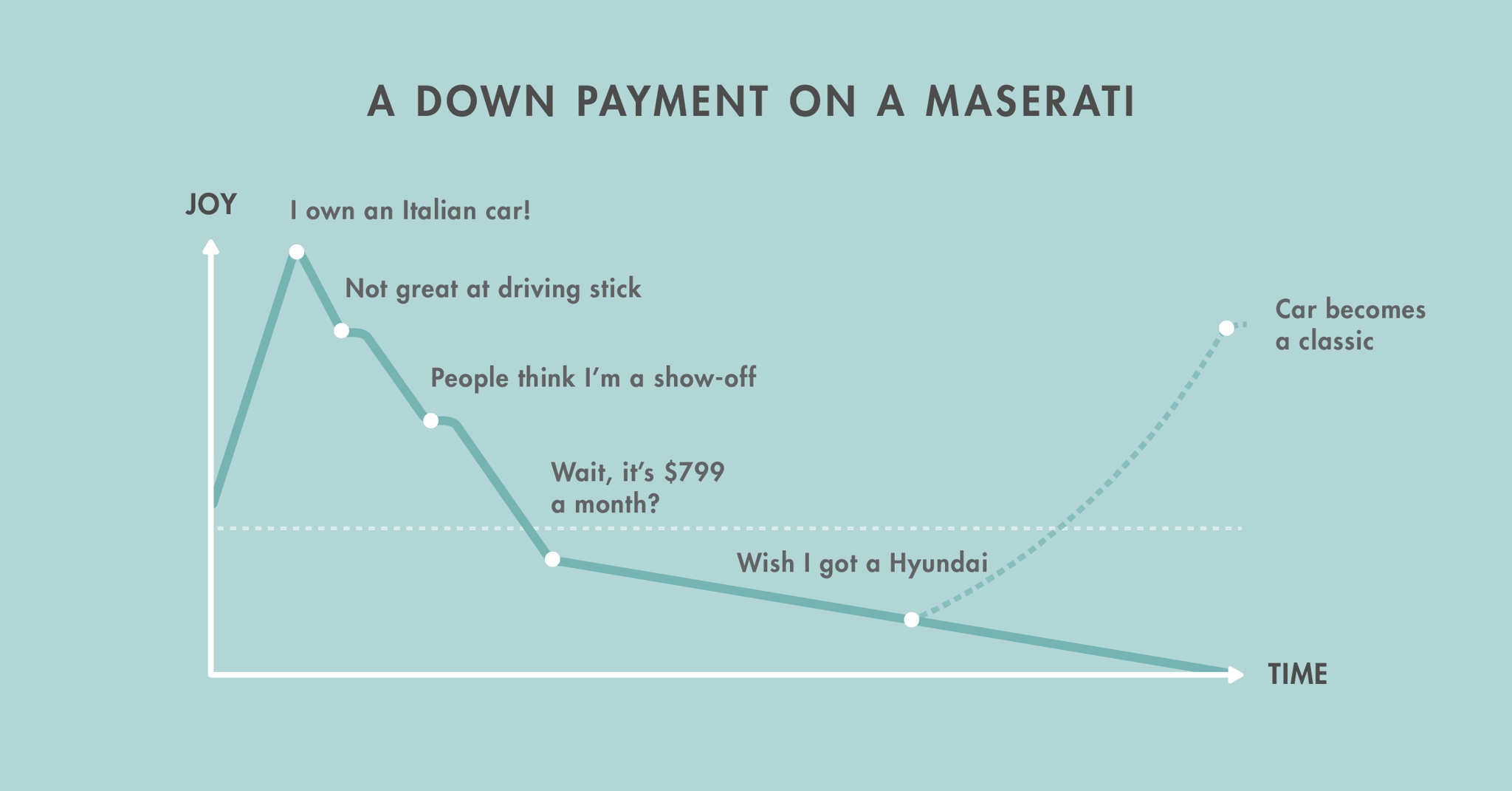

OK, your tax return probably won't make for an entire downpayment — the Quattroporte is like $100,000. You'll hit peak-ridiculous-car joy when you accelerate off the lot thinking: these hand-stitched Italian leather seats actually belong to me! Joy will decrease when you realize that dropping “my Maserati” into conversation is not winning you friends. Joy decreases more precipitously when you realize how much it costs to buy an Italian transmission. Also: man that thing guzzles gas. If you're like us you'll just keep hearing the words of Dave Nugent, Wealthsimple's Chief Investment Officer: “Cars are not assets, they are liabilities.” Keep your car long enough, though, and it just may become a classic and renew the joy. But probably not.

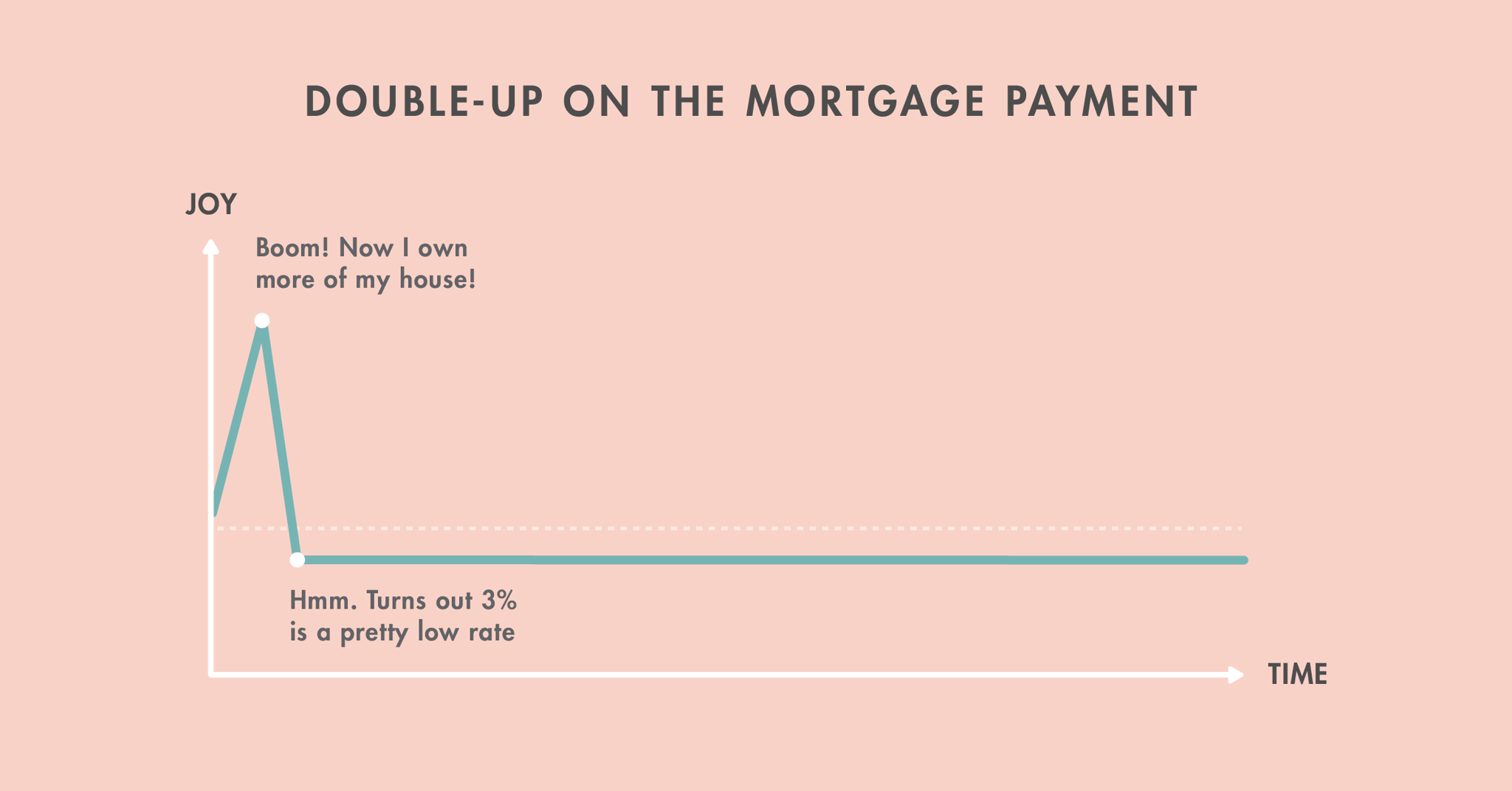

Sounds great, right? Gets you one month closer to paying off that house. And you get that little spike of joy when you make the payment. But a lot of mortgage rates are historically quite low. If you have, say, a 3% interest rate, you stand to make a better return on your money by investing it in the markets — 6%, historically, if you put it in a diversified, low-cost, optimized portfolio (you know, like the ones we’ve designed at Wealthsimple).

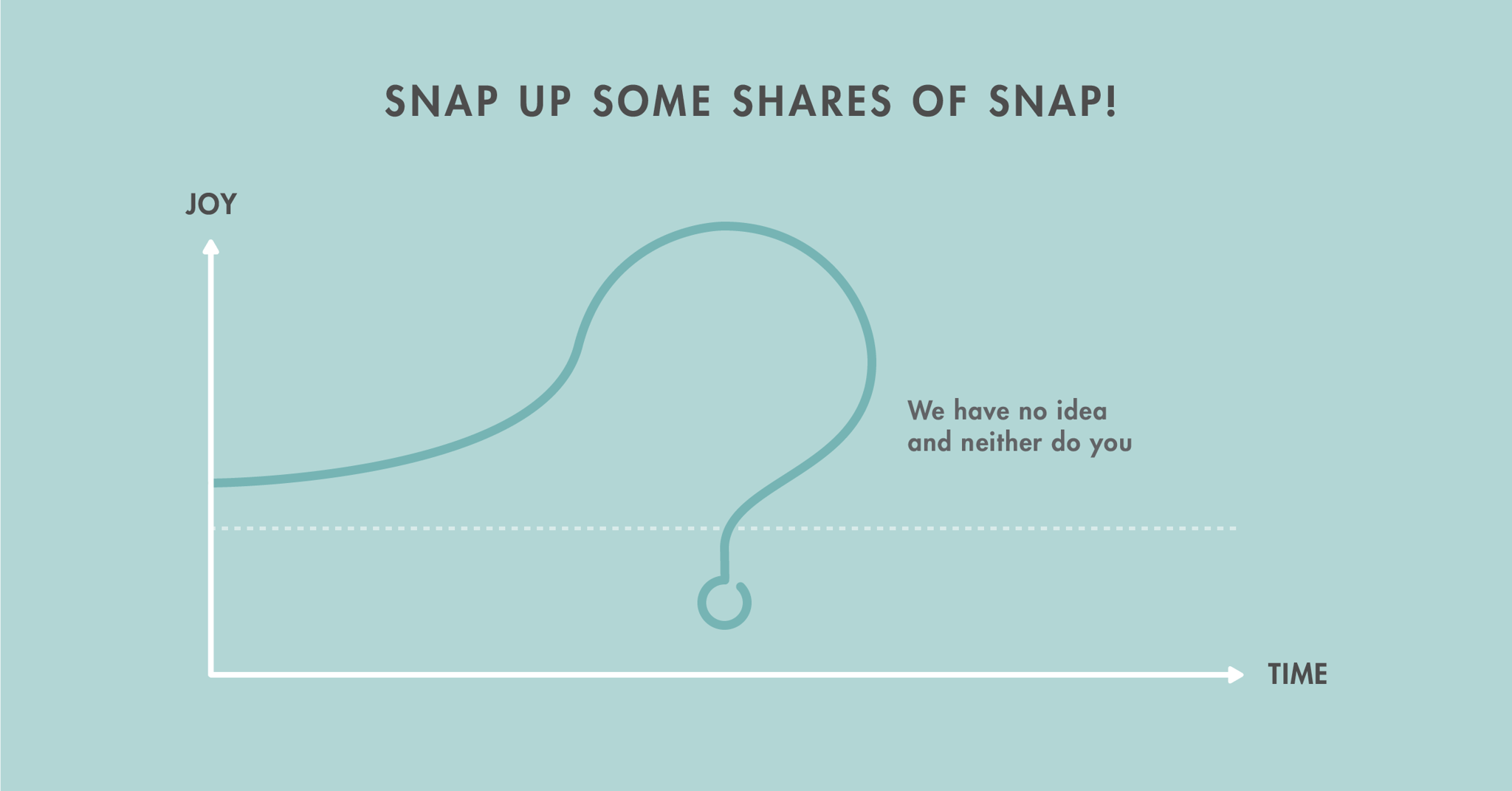

Who knows the future of Snapchat's parent company? You could feel like a genius, you could feel like an idiot. Like picking any stock you'll probably feel like a genius then an idiot then a genius for a while, and then maybe massively regretful over time.(Note the answer to that crucial “Who knows the future” of an IPO question is: no one. Not even the founders of Snap.)

It's low-cost, it's optimized, it outperforms pretty much anyone who thinks they're good at picking stocks. And all you have to do is click here to get started — in the long run it's the smartest thing you can do with your money. Sorry, Maserati.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.