Money Diaries

Writer Sloane Crosley Tells Wealthsimple Why She Hasn’t Given Herself a Raise Since 2009

The author of the New York Times bestselling essay collection "I Was Told There'd be Cake," tells us how it was formative to grow up with parents who were cheap and extravagant at the same time.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

This is the latest in our original series "Money Diaries," where we ask interesting people about the role money has played in their lives. Sloane Crosley is an author of I Was Told There'd be Cake and the novel The Clasp (just out in paperback), and is a frequent contributor to GQ and The New York Times.

The richest I've ever felt was probably when I got my first book advance. The first cheque was something like $4,500. It was the biggest cheque I had ever seen. Actually, years ago, I worked for Scott Turow’s agent, and I used to send him cheques. So it's not the biggest cheque I had ever seen made out to anyone, but it was definitely the biggest cheque I had ever seen for me.

It was not like I was rolling in it, so I had no business doing this, but instead of putting it all toward rent, I bought this blue Givenchy bag. I got it on sale for $1,200. I wasn’t even a big fashion person, so that was definitely the nicest thing I owned by far. But for years, I felt like that bag owned me. It felt way too grown-up for me. It's not that I mind the idea of having a lot of money, but I'd never want to be a “rich lady.” If something is what I consider very expensive, I do think of all the other things I could buy with that money or what that money could do in the world at large. I don’t believe in the necessity of a selfless or monastic life, but that exorbitant handbag screamed “there are starving children in Haiti.” Now I’m slightly older, and it's so beaten up and well-loved that it finally feels less guilt-inducing.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I remember my first emotion around money was confusion. If we can call confusion an emotion. I couldn’t figure out why my grandmother, my father’s mother, who had almost no money, could annually walk me into Neiman Marcus and let me pick out any toy I wanted, but my other grandparents, who were rich and lived in this huge house with all these secret passages in a sick place in Scarsdale, would send me, for my eleventh birthday, a backpack made for a nine-year-old that they had found at a thrift shop. It was just a bit confounding as a kid. My sister and I were brought up in an incredibly small house, so small that when I brought home friends and boyfriends, they’d be like, “Wow, not much privacy, huh?” I used to be so jealous when my mother would talk about all the nooks and crannies in the house she grew up in. She would check my jealousy by saying, “They're not that fun when you're using them to hide.” My grandmother was not a paragon of motherhood.

I hate to use the phrase “penny wise, pound foolish,” but my parents demonstrated a certain good-natured impracticality with money. I remember they were always trying to save money by turning off the lights. I would go to the bathroom and come back a minute later and the lights in my bedroom would be shut out. There was also heavy monitoring of paper-towel usage. It was a real “close the windows; we’re not heating the great outdoors” house. So they were pretty frugal about that stuff, but then they would blow it out on a vacation to Hawaii or on Steuben crystal—you know, those crystals in the shape of animals. Or they would decide that they didn’t want to go out for an expensive meal—cook instead, right? But then my dad, who is an amazing cook and does nothing halfway, would go out and buy the most gourmet ingredients money can buy and make these incredibly elaborate meals. There is a little bit of that in me, almost a bad dieter's attitude toward money. I’ll pick the package of Manchego that weighs the least in the supermarket. I’ll go out of my way to go to the cheaper salad place in New York City or buy the mouthwash that’s on sale. I think about that stuff. But then I’ll go out for an $80 dinner. Or like my dad, I’ll decide that pancakes shouldn’t cost so much at a restaurant when you can make pancakes at home…but if you don’t have any of the ingredients, pancakes are suddenly a $30 endeavor.

I always wrote, though not always with a mind toward making it my career. I think that's the way it should be: be in your little room with no one watching, that sort of thing. I worked as a book publicist at Vintage for about nine years. I stayed in that job after my first essay collection, I Was Told There’d Be Cake, came out in 2008. And yeah, it was a best-seller, but no, I didn’t leave my job. I actually didn’t even leave after my second book came out, which was also a best-seller. But like all things, “best-seller” is a relative term. There was a basic concept of how money and security work that was imbued in me. My mother’s been a special ed teacher for over 30 years, and my dad was an executive for DDB Needham, a big advertising firm. I wasn’t raised by rogue artists, by people who were industries of one. It’s like a lost headline from The Onion: “Nice Jewish Girl From Westchester Quits Job for No Health Insurance.”

Recommended for you

Natasha Rothwell's Character in “The White Lotus” Finds an Angel Investor. Her Real Life Didn't Quite Work That Way.

Money Diaries

How to Quit Your Job and Bike Around the World for $17,000

Money Diaries

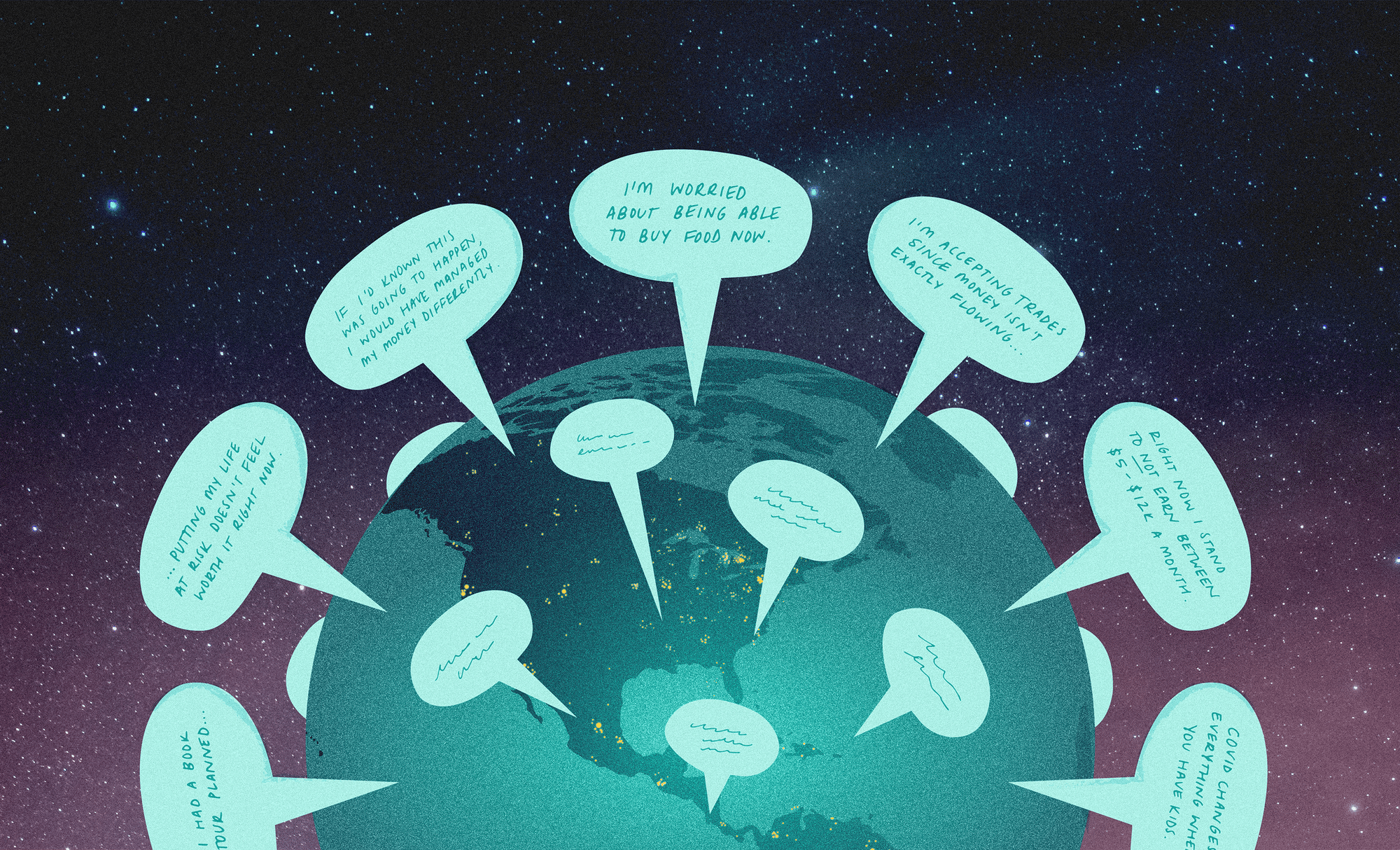

Pandemic Money Diaries — Panic at Trader Joe’s Edition

Money Diaries

Emily Ratajkowski Is Not a Commodity

Money Diaries

You asked if my authors resent my success. Not really. You have to think about whom Vintage publishes. It should come as no surprise that Alice Munro was not insecure about whether or not I had a paperback-original collection of essays.

Whenever I get a cheque now, it goes to my company account because even though I don’t earn a spectacular amount of money, it comes from a variety of sources and warrants being incorporated. Weirdly, the title in my life I’m most proud of isn’t on a book; it’s the name of my corporation: Good on Paper. So, basically that’s my business account, and I pay myself from that. I’m on salary, which means I can give myself raises. Have I? No. This is sort of embarrassing. It’s never occurred to me before that I haven't given myself a raise since I started it in 2009. If I ever feel that I’m spending too much money, the first thing that gets cut is usually clothing. Not that I was ever going on Pretty Woman–esque shopping sprees because A) I don't have that much money, and B) I'm not a prostitute.

HBO bought my first book, and I wrote the pilot and some other pilots, so yeah, I made some more money, but my lifestyle really hasn’t changed. I rent a one-bedroom apartment in the West Village. I don't think I have enough money to buy the kind of place I'd want to buy yet. I guess it’s possible that I do, but I'm just too scared. I mean, what’s my life going to look like in five, ten years? I don't particularly enjoy thinking about those things, so not buying a place may be a way of avoiding it. One of the pieces of furniture that I write on the most is an old Ikea sofa that I can't replace because there's a carpet beneath it and the springs have popped out of the sofa so much they're hitting the ground and pulling at the carpet. So I'd have to ruin my carpet to get rid of the sofa. And I like the carpet.

I don't know how much money I’d need so that my lifestyle would change dramatically. I have some investments and a savings account, so it's not like I'm totally keeping my money under the mattress. But I still feel that money could go away any minute. What’s the magic number that would enable me to feel rich? A million dollars in cash? Two million? I don't even know. Put it this way: I will buy a place when I think that if there were some unforeseen cost, either in the closing or the roof caving in, it’d be no big deal.

If I had a billion dollars, I would probably buy a vacation home in France or Maine or somewhere in the South, maybe an island off the coast of Georgia. I would buy a car to have in the city and a space for it in a garage. I would travel first-class all the time. I’d buy a bigger apartment or a townhouse, and then I think I would just buy really nice lighting, which is a fortune. I think it's a common dream when you're weaned on New York City rental lighting. In the ceiling of every living room of every rental apartment in New York you’ll find this glowing boob light. You turn on the light and it’s the all-seeing eye of the lone boob. Those boob lights really make you start to appreciate good lighting.

As told to Andrew Goldman exclusively for Wealthsimple, the largest automated investing service in Canada. We make investing simple, smart and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.