Money Diaries

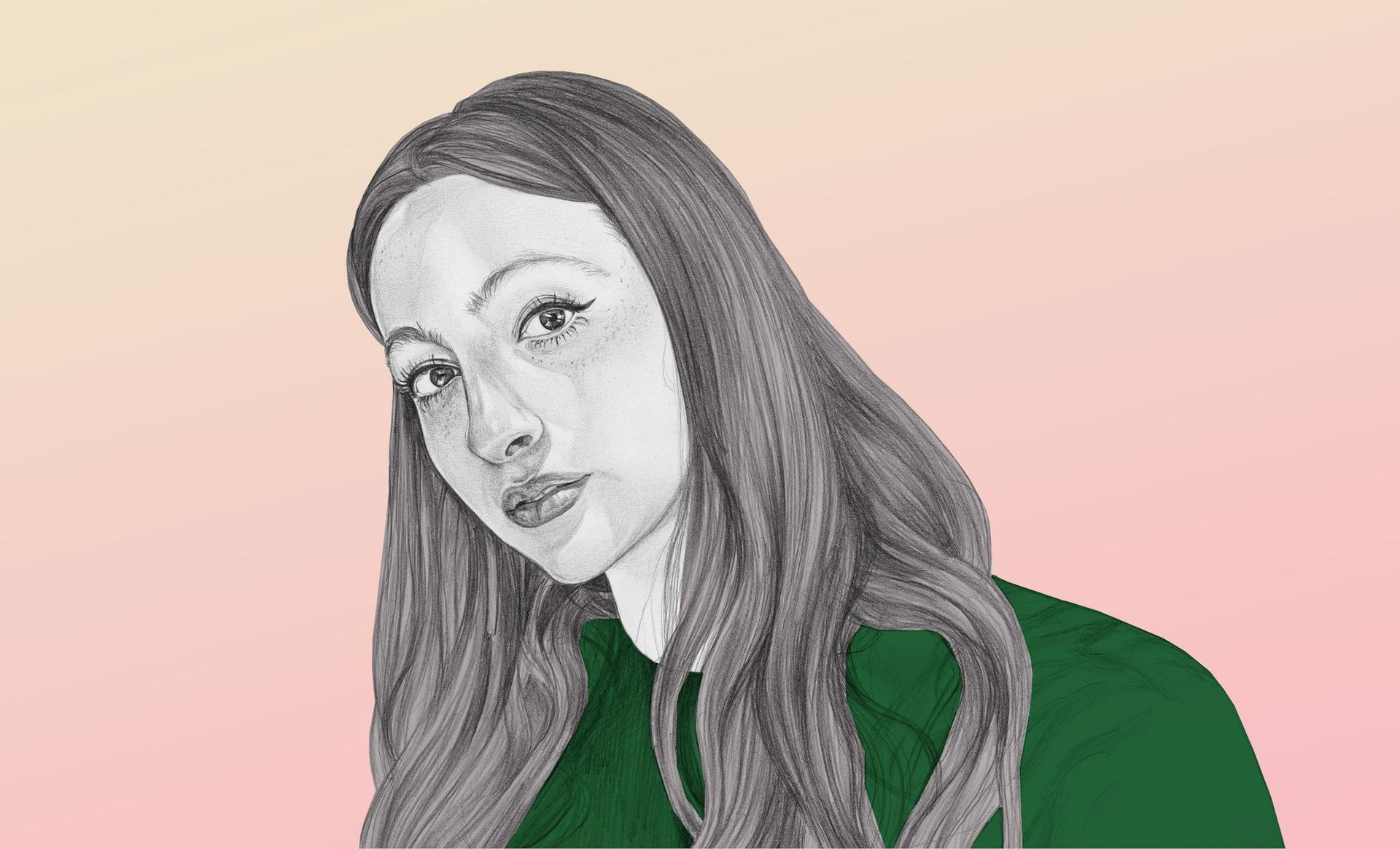

Alison Roman Is the Patron Saint of Home Cooking and Everyone’s at Home

She always wanted to cook and never thought much about money. But life gets strange when everyone’s wondering what to do with half a pound of broccoli and some dry kidney beans and you know the answer. The chef and cookbook author on her pandemic money story.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Alison Roman is the author of the cookbooks Nothing Fancy and Dining In.

I mean, honestly it’s been wild for me. I’m in Hudson, staying in with two friends. I was just supposed to be here two weeks and now I’m kind of here indefinitely. We just have our little quarantine pod, it’s our new little life. I mean, I work at home anyway, I work alone, so a lot of these things are pretty regular for me.

In a way I’m not busier than usual. But I’m spending more time on social media, answering questions, and fielding interview requests from people who don’t typically cover food, which is funny. I mean, I love that part of it. It’s always been a part of my life, it’s just a lot heavier. Like all things on social media, the more you give, the more you’re asked. I don’t know if it’s the algorithm or human nature, but last Monday or Tuesday, I started noticing there was just more appetite from people who don’t normally cook, or they use Blue Apron so they’re not used to looking at raw ingredients in their pantry and turning them into something edible. And I’m happy to be the person helping. That’s been my goal the whole time. I feel like it’s my time to shine, though obviously during grim circumstances. I’ve been doing the same thing for so long, but it’s nice that, even in this insane darkness, cooking is a thing bringing people joy and a form of stability. Something positive.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I’ve never really cared about money. I don’t covet material things. Even as a kid, most of the things I wanted were experiences and freedom. I wanted to take trips with my friends. I asked my parents for a pager because I wanted privacy. They made me pay for it. We were middle class, or even upper-middle class, but they never just gave me things. So I had weekly chores to pay for the pager and then I got a job making smoothies at Jamba Juice — my first foray into the culinary world.

I left for college at 18 but I dropped out to work in a restaurant. I didn’t have a plan, I didn’t have any goals, I just wanted to be in a kitchen. So I moved to Los Angeles and got a job as a line cook. I was making $7.25 an hour and my studio apartment cost $795 a month. I was living paycheck to paycheck but I was happy. I loved being in a restaurant. I loved learning how to cook. I loved reading about cooking. I was obsessed. A couple years later, I moved to San Francisco and found an apartment and a job at a restaurant. I worked constantly, I made no money, I went into my overdraft on my account every week. But I valued freedom and happiness over financial stability, and I refused to believe that I could enjoy something so much, and be good at it, and it wouldn’t work out in my favour.

I finally left San Francisco because I realized I didn’t want to own a restaurant, and I didn’t want to spend my life working for somebody else. I wasn’t sure what else was possible so I decided to move to New York and try writing. I was broke, but that didn’t deter me. I wasn’t like, “I can’t move across the country because I don’t have money.” I was like, “It sucks that I don’t have money, because I’m moving across the country.”

In New York, I found a room on Craigslist and I started emailing food bloggers to see if they needed an intern. In the meantime, I got a job at Momofuku. They had just opened Milk Bar and I was doing desserts. I was making about $35,000 a year which doesn’t go far in New York. But I’ve always spent the money I have on things that buy time. Like, I paid someone to wash my clothes, and I’ve never looked back on that. I feel like there’s a stigma about it but the extra time is worth more to me than the $20 to have someone else do it.

Recommended for you

Natasha Rothwell's Character in “The White Lotus” Finds an Angel Investor. Her Real Life Didn't Quite Work That Way.

Money Diaries

Money Diaries: Pride Edition

Money Diaries

She’s a Toronto Legend, Model, and Style Icon. And She Was Nearly Homeless

Money Diaries

Anthony Bourdain Does Not Want to Owe Anybody Even a Single Dollar

Money Diaries

It took me about two years in New York to get out of restaurants. Bon Appétit was doing a relaunch and I heard they were looking for recipe testers. I applied and they brought me in for an interview. They were like, “Have you ever done this before?” So I said, “Yeah!” It was a lie, but I figured that, working in a restaurant, you test and workshop recipes all day. They hired me for $50,000 a year, and I told myself, “I can never make less money than this.” That wasn’t about the money. I wanted to work toward something, even if I didn’t know what it was. Pushing myself to earn a certain amount of money also pushed me to work harder, and get better. After a year or two, they bumped me up to $65,000 a year, and after four years, I was making $80,000. But then I got an offer from BuzzFeed for $100,000. It was the most money I’d ever seen, but more importantly, it felt like a signal that I was getting somewhere.

I only spent about seven or eight months at BuzzFeed. New opportunities just kept coming in. Now I have a biweekly column in the New York Times, so I get paid every other week for that. I get paid separately to do cooking videos at the Times. I occasionally do partnerships and recipe development. And I have a great literary agent, who got really good deals for my books. I just closed a deal for a TV show, which I’m focused on this year. And there’s a ton of other stuff. I do so much weird stuff. Occasionally, I even cook private dinners and give the proceeds to charity.

Having more money hasn’t really changed my lifestyle. I guess I buy nicer clothes and go on nicer vacations. Last spring, I took myself to Japan — I used credit card miles to pay for my flight and hotel. I am obsessed with credit card miles. That’s probably my favourite thing about having some money now: being able to use a credit card, pay it off, and get free things with the miles. I totally game the system. I love it. But otherwise, when I travel, I prefer Airbnbs to nice hotels. I prefer street food to restaurants. I prefer dive bars to wine bars. I’m a pretty bare-bones person, anyway. It’s not like, just because I have money, I want to spend it.

In fact, I probably spend less time thinking about money now than when I was broke. Now that I know I can make my rent every month, and my bank account’s not in overdraft, I don’t really think about money at all. I have a manager who helps me. I never look at my credit card statements until I’m doing my quarterly taxes, and my accountant does most of that. Then I have a financial advisor, who makes sure that I’m making retirement contributions, which I would never have done on my own. I’ve touched base with her since the market crashed, just to see if I should be worried. She said my money is not in anything that I need to worry about. It’s all very long-term — I’m not planning on touching it for 35 or 40 years anyway, so there’s plenty of time for it to recover.

Right now, I’m much more focused on trying to help people get through this. There’s a huge culture in the culinary world of telling everybody, “You’re doing it wrong.” That makes people more afraid of cooking, and it makes them feel bad while they’re doing it. I want to be an alternative. That’s always been my goal. In all the articles and books I write, I try to be authoritative, but also forgiving. You can try something different. You’re not going to burn it if you cook it an extra five minutes. And now everyone’s hand is forced, because who knows what ingredients you have or if you’ve ever tried cooking before. People write to me like, “What would happen if I used this ingredient instead of that one?” And I tell them, “I don’t know! Why don’t you try it and see what happens?” It’s better to cook with the wrong ingredient than not to cook at all. And in a way, this is a chance to reach those people.

It’s hard to talk about silver linings, because of the insane magnitude of the death toll and the unemployment rate. But I do think there’s a silver lining when it comes to human connectivity and compassion — and it can lead to a rekindling of people’s enthusiasm for home cooking, and their empowerment to do it, so it’s less of a chore than something we find joy in doing together.

As told to Wil Hylton exclusively for Wealthsimple. Illustration by Agata Endo Nowicka.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.