Money Diaries

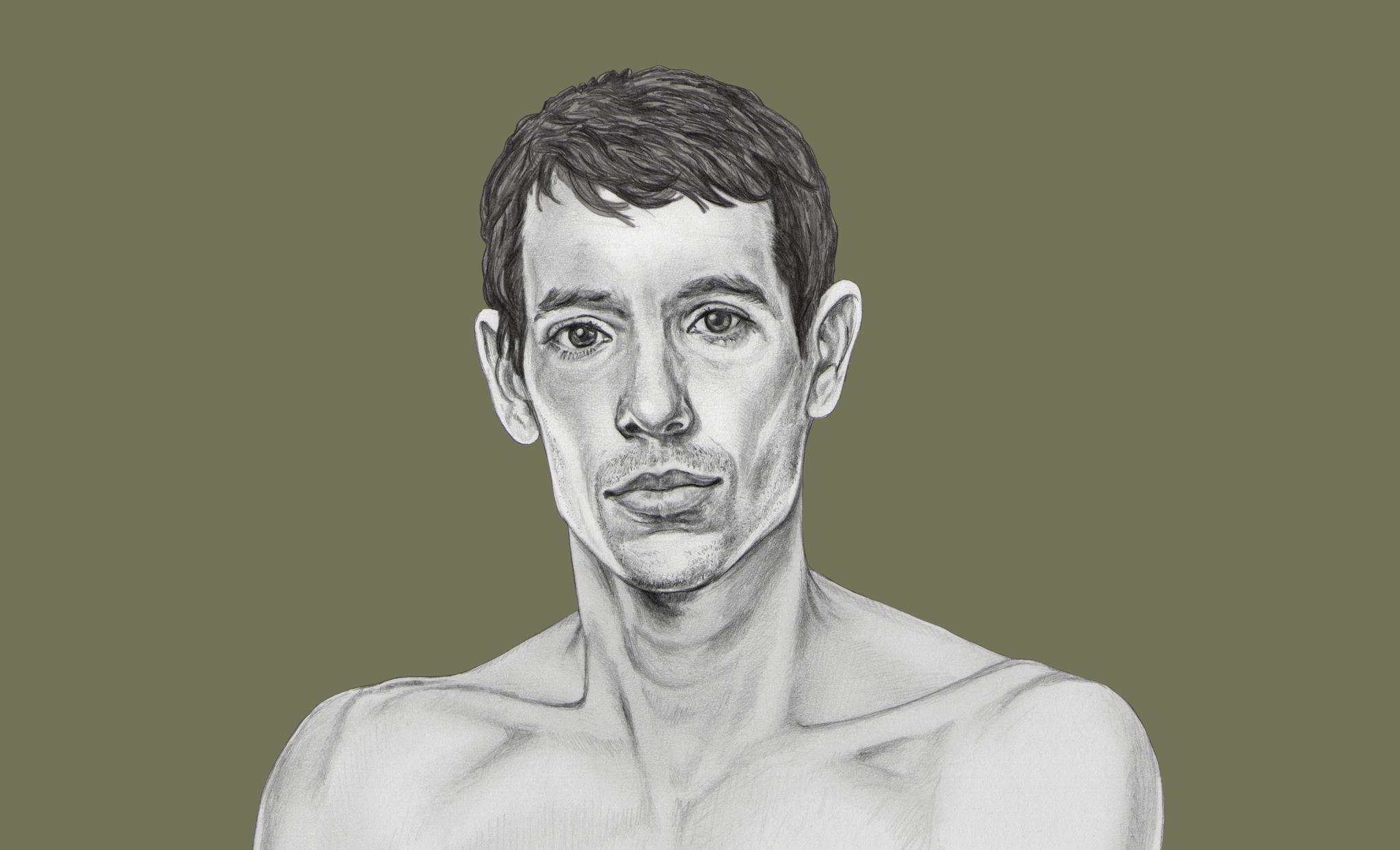

To Be the Best Rock Climber Is to Earn As Much As an Orthodontist

Alex Honnold, arguably the world's greatest climber, tells his story, from dropping out of the engineering program at Cal to finally moving out of his van.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

Last year, I moved out of my van. I’d been living out of a van for fourteen years. I bought a house in Las Vegas, a classic cookie-cutter house in the suburbs. It’s just functional. In some ways, it’s not unlike van life was. It’s cheap, it’s easy, it’s close to the airport. It’s close to the rock. Property there is really cheap. I didn’t have any furniture at first, so I lived in the van in the driveway for the first couple weeks. It felt more like home than an empty house did.

I think I’m the world’s highest paid professional rock climber, but the sport has a minimalist ethos about it. I really value that about climbing. Buying the house was just an adult strategic maneuver. I did it because there’s no income tax in Nevada, so I save enough on my taxes to help with the house payments. So far, I think it was a good decision. If the house burned down and it wasn’t covered or something, that would be a financial disaster. But I think it’s covered through the mortgage?

When you add up the house in Vegas and my family’s cabin in Lake Tahoe that I bought and my other accounts, I might be worth not far off $2 million. My financial life has slowly gotten more steady as the climbing industry has really ballooned. A rising tide raises all ships.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I grew up solidly middle-class. My parents were both language professors at the local community college in Sacramento. I never felt like we wanted for anything, but I never really wanted much, either. Our family vacations were road trips across the States to visit my mom’s family on the east coast, my sister and I tucked in the back seat. We weren’t the family that was flying to Europe on ski vacations.

At 14, I started working at the climbing gym, belaying birthday party kids and cleaning up, just doing scrub work. I made minimum wage, if that. As soon as I had a job, my dad took me to the bank and opened a retirement account. It seemed a bit overeager, since I only had $400 or something. But it was a good lesson.

I like to say that I’m a moderately successful orthodontist. I’m still getting paid far less than the lowest member of the NFL.

When I was 18, I enrolled in an engineering program at University of California Berkeley. But I was unhappy at school. That summer I placed second in the youth division at the National Climbing Championships. After that, my dad died of a heart attack and some of the pressure to stay in college went away. My mom espoused a bit more of a “follow your path” philosophy. I took a semester off to train for and climb at the World Youth Championships in Scotland. I never went back.

I’d wound up with my mom’s old minivan, and that was my base. I’d use it to drive to Joshua Tree to climb or I’d drive to LA to see my girlfriend. My orbit was tiny, and really cheap. I destroyed that van fairly quickly; it died on me one day, and for the next year I lived just on my bicycle and in a tent.

From 2004 to about 2009, I lived off less than a thousand bucks a month.

My first year on the North Face team, I basically just made gas money. Then, in 2009 there was a three-year contract that was small, just enough to drive around the state. My second three-year contract was bigger — by itself it wasn’t six figures, but with other sponsorships it was. That was in 2012. I thought I should start a foundation while I’m in my prime, while my name means something. I started it that first year I made six figures, 2012. The Honnold Foundation mostly funds solar energy projects. I think last year I threw in about $80,000 of my own money.

As recently as 2007, I was going to Walmart and buying 88-cent pasta and 50-cent pasta sauce. Now I would never buy the grossest pasta sauce. Now I don’t look at the price at the gas station quite as much. I just don’t stress about it anymore. My daily breakfast is unsweetened muesli with hemp milk and berries. Hemp milk is kind of pricey, and half a carton of berries every morning, that’s sort of extravagant. That’s not food I could have eaten before. I like to say that I’m a moderately successful orthodontist. I’m still getting paid far less than the lowest member of the NFL.

Most of my friends are scraping by at the poverty line. Pretty much all of them are better climbers than me in some way, but they’re painting houses or whatever they need to do to fund their climbing. It’s never gotten too awkward, though. I think it’s because I’m not out buying Rolex watches. I think the main thing is that I still value being a good climber more than anything else. The kind of thing I’d splurge on is an adult tumbling class. I’m really bad at jumping and bouncing, and it would be fun to take a class like that. Something I can do on rest days. That’s maybe $100 an hour. In the climbing world, that seems so extravagant, to pay $100 per session.

The guiding principle I try to live by is: don’t spend money I don’t have. I’ve never been in debt and I’ve never bought extravagant stuff. I spend money on gifts for my family sometimes. A while back, I got my sister a laptop. The one she was using was old, it was trash, so I just sent her a laptop. But I didn’t buy any Christmas gifts for anyone this year. I spent half a million dollars on my family’s cabin in Lake Tahoe so we could keep it in the family. It’s this really rustic cabin that my Grandpa bought in the 1950s. Both my grandparents and my father are buried under the bird-feeder there. That could be the closest thing to a potential financial disaster — it’s relatively expensive and it’s not generating any income.

I don’t know how much money I spend every month exactly. I get all my gear through my sponsors. All my travel is covered through them too. I went on a trip to Antarctica in December that cost like $20,000. That’s straight corporate — I don’t pay for that. I eat out a lot more now, and I spend more on food and gas than I did before. I’m also largely covering my girlfriend’s food. Maybe it’s a couple grand a month?

I think I define success as just being able to do the things I want to when I want to. Being able to fund the lifestyle. There’s no number that makes that possible. A lot of it has to do with how happy I am with what I’m doing.

As told to Katherine Laidlaw exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.