Money Diaries

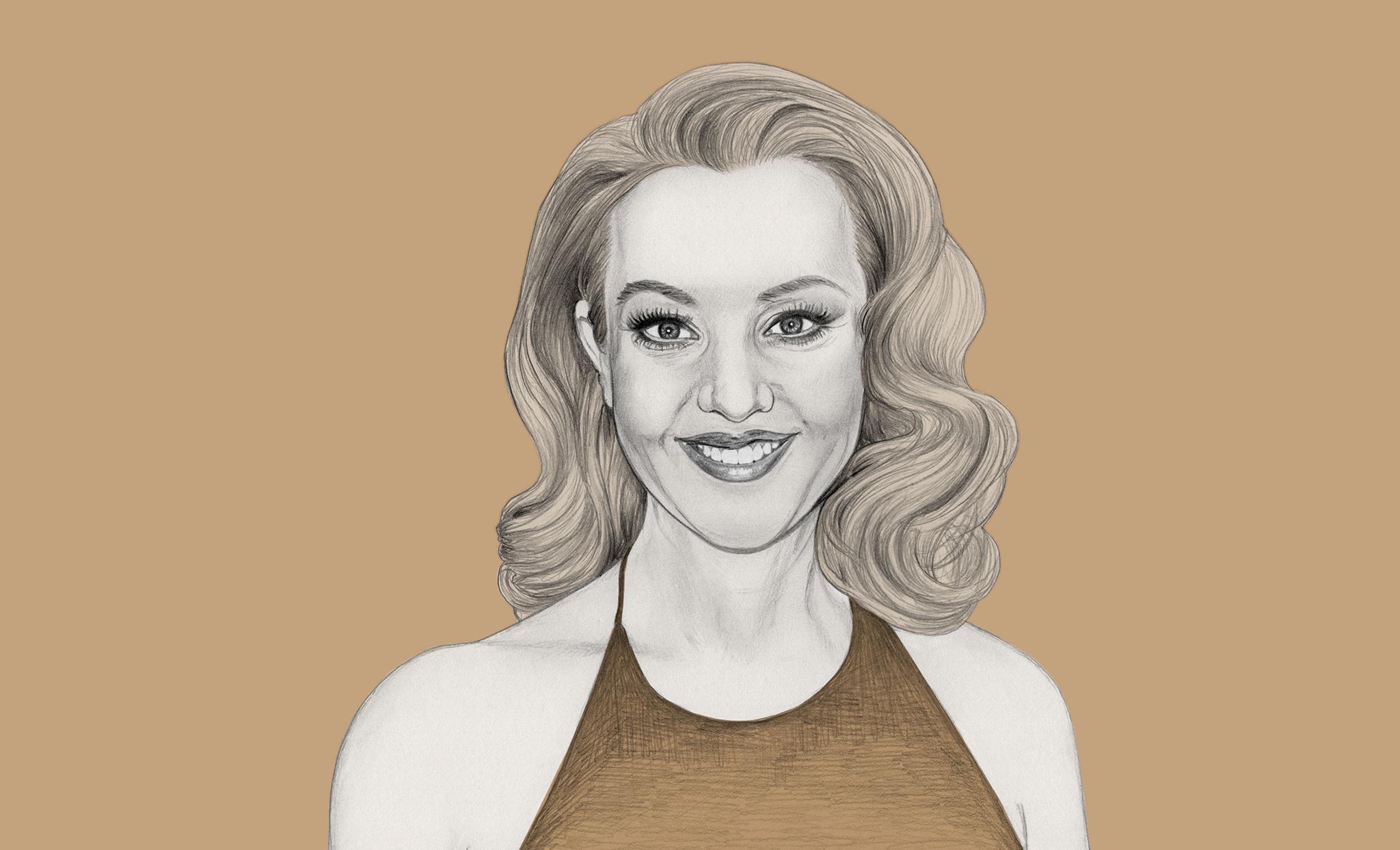

Why Wendi McLendon-Covey Was Still Freelancing on the Set of 'Bridesmaids'

The star of 'The Goldbergs' tells us why she always kept her side gig and why she'll never live in L.A.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

After I graduated from college, I was working at a hotel near Disneyland with my best friend and thought, this sucks so badly. I hate everything about this. There has to be something else in life. My friend and I had gone to shows at this comedy improv group the Groundlings, and we both thought, Oh my god, what if we took classes here? What would that be like? So we started taking classes on the weekends and that was the highlight of our week. We just kept going with it and loving it and I thought, OK, well, I’m just going to keep going until they tell me to stop. At some point, they’ll probably tell me I’m no good at this. But they never did.

All I ever wanted to do was be an actress. That was not really encouraged when I was trying to actually make those decisions, and yet neither was my going to college. I grew up in the ’80s, and it wasn’t a given then that you were even going to go to college. My parents thought that the best path would be to become a stewardess and live within a five-mile radius of them. So in order to do what I really wanted, I made sure that I never, ever asked for money. I made sure I had all my ducks in a row financially so that they could never say to me, “Well, you know, it’s time to give up.”

Both my parents worked when I was growing up — my dad for Coca-Cola and my mom for Boeing. And neither went to college. We were by no means poor, but very middle class. We didn’t take extravagant vacations; we had only one bathroom in the house for most of my life. They gave us what they could. They both worked a lot and instilled a very good work ethic in us and also made it very clear that saving was important, and you don’t just go and blow your money on stupid things. They laid a good foundation for that. You know how parents exaggerate sometimes when they get mad and say things like, “Well, we don’t have any money!”? They didn’t really mean we have no money. It’s just something that adults say. But as a child, it scared the hell out of me. I thought, Oh no, we’re going to starve. It made me very anxious. But as I got older, I realized they’re just histrionic. Still, I stayed at home for a long time and saved money, for better or worse, and I didn’t move out until I got married when I was 26. But once I moved out, I never went back, and I’ve never asked for money.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I think it’s kind of worth it if your college-aged kids need to stay home a little bit longer just to save money. Better they do that than go out and rack up a bunch of debt before they’re ready and then have to come home anyway.

I did end up going to college, but I really wasn’t sure why I was there, because I knew what I wanted to do. So I kept taking breaks. I was miserable! It took me a while. But by the time I grew up a little bit, got married, whatever, it was like, just finish. Just get a degree in something so you have it. I ended up getting a degree in liberal studies with a creative writing major, which has been useful, believe it or not. Doing the acting thing, you gotta learn how to research, and when you're a liberal studies major, you learn to research all kinds of different things and look at different points of view. And look, I went to Long Beach State. I went to a state school. I didn't rack up any student loans, because what is the point of that?

Meanwhile, I looked for jobs that gave me flexibility so that I could go on auditions. But I always had a job. I never wanted to be one of those desperate actors just waiting for their next gig, who might have to take something that they didn’t want to do to pay the rent.

But none of that has been as good for me as my training at the Groundlings, which I use every day. As far as investing in yourself, that was probably the best investment. After a long time taking classes, I eventually got into the Groundlings company. It was hard, but it really gave me the boost I needed to get my career started. I made those connections, and I got more confident, and I proved to myself that I wasn't crazy for wanting or thinking that I even could do this for a living. It was really the springboard I needed. All that money that my husband and I spent on classes and costumes and gas for my driving up there and going to writing meetings — it has paid off in spades.

Meanwhile, I looked for jobs that gave me flexibility so that I could go on auditions. But I always had a job. I never wanted to be one of those desperate actors just waiting for their next gig, who might have to take something that they didn’t want to do to pay the rent. The struggling part of acting did not appeal to me at all. I was responsible, my husband and I had money in the bank — we never played the struggling card. Even when I started getting some success, I had a part-time job. I had a part-time job up until 2012, which means that all throughout my Reno 911 days, my Lovespring International days, my Rules of Engagement days, my Bridesmaids days I had a job.

This job was at a social work journal that was published at Cal State Long Beach. I was working for this brilliant professor who was just a kook, and I loved her so much. She was so supportive of me. She said, “Look, I know what you’re doing. You’re doing this Groundlings thing, and you weren’t put on Earth to edit this journal forever, but just please don’t ever quit because I don’t want to train anybody else.” So I said, “OK.” She goes, “I don't care what you do, where you do it, just turn in your work and keep this thing going, and you’ve got my blessing to do whatever you want.”

Recommended for you

That was a dream, an absolute dream to be able to have that kind of flexibility. I didn’t have to clock in at a regular time; I just had to make sure my work was done. I could go on campus at 10 o' clock at night, or 5 in the morning, or whenever, turn in my work and then go and write sketches and perform every Sunday and every weekend. I kept this thing running for 12 years. I’d be in my trailer on set editing things, and on location with my computer and my manuscript editing. It gave me a sense of stability that I had this steady income coming in.

The thing about acting is everybody thinks you make a ton of money. And the money is good when you're working. But you can go a long time between jobs.

The thing about acting is everybody thinks you make a ton of money. And the money is good when you're working. But you can go a long time between jobs. What was weird working on the campus of Cal State Long Beach was that people eventually started figuring it out. I never went around telling anybody anything. But they’d start figuring it out, and it was like, “Who’s that sloppy girl sulking around in her pajamas?” People were like, “Why are you doing this? You must be making so much money being on television.” It’s like, not really. Not after you pay out your agent, manager, attorney, publicist, and taxes. You can’t act like, “Oh, I have this TV job, I’m going to go blow all my money on a car” or something — like the money is going to come like this forever. No, that’s not how it is. You’re a freelancer, so you really have to save.

In 2011, Bridesmaids was a big hit, but initially it didn’t pay a lot of money. We were paid fairly and we got box-office bonuses, of course. But initially, like I said, you pay 20 percent right off the top to all your reps, and then you pay taxes on the whole thing. There was no way I could have quit my job at the journal. I needed it. And I had a crap manager at the time who didn’t even want me to do it. If I had just sat around listening to his advice, I would have not worked at all that year. I was thrilled that it did well and it gave me the strength to fire him and get a better team of reps who actually got me working — as opposed to this guy, who would call me on Ambien and rattle off a bunch of sentences that meant nothing.

In 2012, when the journal eventually folded, I was working quite a bit. At that point it was like, well, I guess I really am getting too busy to do this. But I was bummed that I didn't have that stability anymore.

And then the next year I booked The Goldbergs.

Here’s what happened: After Bridesmaids, Paul Feig was going to do a show on HBO with Goldie Hawn, and I auditioned to be Goldie Hawn’s daughter, and I got the part, but then the whole thing caved in on itself and went away, which was devastating. But within a couple of days, I had offers to do other things, and one of them was a pilot for ABC, which I did. They filmed it twice, it didn’t go either time, but once you’re on the radar for pilots with a network, they consider you for other things, so that’s how The Goldbergs came up. I was thrilled that they wanted me for it, and I was in talks for other projects, but that was the one that really spoke to me. Adam Goldberg showed me footage of his mom, and I thought, Oh my gosh, she’s nuts. I want to play this woman, this has to go. That actually came to pass and we got picked up. I was so thrilled, but they only picked us up for 13 episodes at first, and then mid-season they gave us our back nine. I never felt secure. You never feel like, oh, I’ve made it, this is gonna run forever. Because you don’t know. You never know.

One thing my husband and I have started doing is investing in real estate. We live down in Long Beach, which is a lot cheaper than L.A., but I grew up here and I’m never leaving — I actually do still live within a five-mile radius of my parents, just like they wanted. So we started buying houses. We’ve got four rental properties now, and I’m raring to buy some more. And yes, we have investments in other things, and stocks and bonds, and blah blah blah, but real estate, you can actually see it, you can drive past it, you can check in on it. It just makes me happy to do that — to see my investment. I plan on working until I’m 105. I don’t want to outlive my money. So you’ve got to keep sowing seeds.

I always just wanted to be able to wake up every day and do something that I love doing and to make money doing what I love. My goal was never to be filthy rich or to have all kinds of fame and notoriety. I wanted to be able to live a creative life and do what I love. I’ve attained that, and I will fight like hell to keep it going. It was never, oh, I have to do this many movies, or I’ve gotta win this many awards. It was to never have to work at a shitty hotel ever again.

As told to Joanna Rothkopf exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.