Money Diaries

Joel Kim Booster Was in Massive Student Debt Until Two Years Ago

Before he was cast in Sunnyside or had a Comedy Central special or wrote for Billy on the Street, he was raised working class in Illinois, saddled with huge student debt, and worked marathon hours doing customer service for Groupon. Joel Kim Booster shares his money story.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

There’s a little anxiety right now. With COVID, I don’t know when I’ll have consistent work again. Working without knowing when my projects will actually be able to exist is absolutely, completely demoralizing. I’m one of those people who, if I don’t have work to do, I sort of go crazy. I really wish I could see this all as a snow day but if I let myself sit in bed I think I’d never get out. Part of it is just a survival instinct: just keep working and keep creating work for myself. Whether or not it goes anywhere, it’s just something to do. I guess it comes from my past.

I grew up lower-middle class in Plainfield, Illinois. My dad was an engineer, which wasn’t exactly a blue-collar job, but he worked in the agriculture sector. Essentially, he built tractors for a living. My mom, she did a couple of different things. She worked retail and then also was a home health aide while I was growing up. She was in and out of full-time employment for a lot of the time until we basically needed her to be employed full time.

It’s tough to explain, because we grew up in the suburbs, but I definitely remember feeling poor. There was definitely an emphasis on saving and frugality. My parents taught me from a really young age about the importance of saving and coupons and not buying brand names. We were on the forefront of bagged cereal — like off-brand bagged cereal.

It’s pretty wild, I have been conditioned to hold onto all of my money. I’m so scared to do anything with it. I just like to have it sit in my one account and look at it every day.

They tried a lot of different experiments with us, too. My parents are Reagan/Bush Republicans, and now they’re unfortunately Trump Republicans as well. But growing up, there was a period of time they would give us an allowance and then take part of the allowance away and put it in a jar that was supposed to represent taxes. These taxes were partially going towards something for the whole family to enjoy, but it was also an early way to instill in us a resentment of taxes. We’d go to a movie or something like that with this money, but they’d emphasize how unfair it was.

At the same time, I was really provided for. There’s a lot of this stuff that I look back on and realize how difficult it must have been for my parents. There was almost an entire year that my dad was laid off and they really did step up in a lot of ways. We didn’t go to the big grocery store anymore, we went to the Aldi. I didn’t really understand why, but I remember we would eat shit on a shingle basically twice a week.

I was pretty sheltered and I didn’t have a lot of friends growing up because I was homeschooled. I didn’t understand the class differences in my town until I was in late junior high, when I was starting to get really involved in my church’s youth group. I remember one birthday I really, really wanted a Nintendo 64 because everyone had one. I was such a little shithead about it and I cried. I remember pushing my mom so hard. And they decided, if I could get my brother and sister on board to make this our joint birthday gift for the entire year then yes, we could have it. Only in hindsight do I realize that that was probably really tough on my mom as much as it was frustrating for me.

The year my dad was laid off, they literally postponed Christmas. I remember thinking, that’s bad-ass that my mom can just move Christmas. But now looking back on it, it was absolutely because my parents didn’t have enough money and were embarrassed and didn’t say that’s why it was.

I wrote "Kate and Sam Are Not Breaking Up" in Chicago. I wrote a lot of it at my desk at Groupon.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I got a job at 14, which was the youngest you could be to get a job in Illinois at that time. I was one of the only of my friends for a long time who had to work. I got a job at the library. That was really important because my parents were like, “This is as much allowance as you’ll ever get from us.” It wasn’t a rude thing, they just couldn’t afford anything more. And my parents told me very early on, like sophomore year, that I wouldn’t be going to college, or at least they would not be able to bankroll it. That was an ever-present thing in the back of my mind in high school. Once you get up to those last couple years of high school, that’s all everyone is talking about.

My senior year, my parents found out I am gay. It was a really tumultuous situation and I ended up moving out at 17 and moving in with a friend. It was not an ideal time for me to be thinking about college but what ended up happening was that I applied to one school, Millikin University, because it was the only school that I knew of that you could apply to completely online; and it was the only school that you didn’t need an application fee for. I don’t even think I had a checking account at that point, so there was just no way I could pay for application fees.

It was a small private school, and I got in. And the parents of the friend that I was staying with told me to take out loans. That was the conventional wisdom of the moment. It was like, oh well, like I’ll just take out loans, I don’t need to be supported by my parents, I can just take out some loans and be fine. Because I didn’t have a cosigner, I sought out a lot of private loans — the private lenders don’t care if you don’t have a cosigner, they’ll just let you take out as much as you want because the interest rates will be so high when you graduate. I was young and stupid and I didn’t have a lot of people who were helping me. It was not easy. I worked three jobs through college too, just to pay living expenses. I resented everyone who didn’t have to have an off-campus job, to have to do that. It’s hard for me to say that I regret anything because all the decisions I made have led to this moment where I feel very happy and secure and successful, but ultimately I could have been a lot easier on myself if I had made a few different decisions.

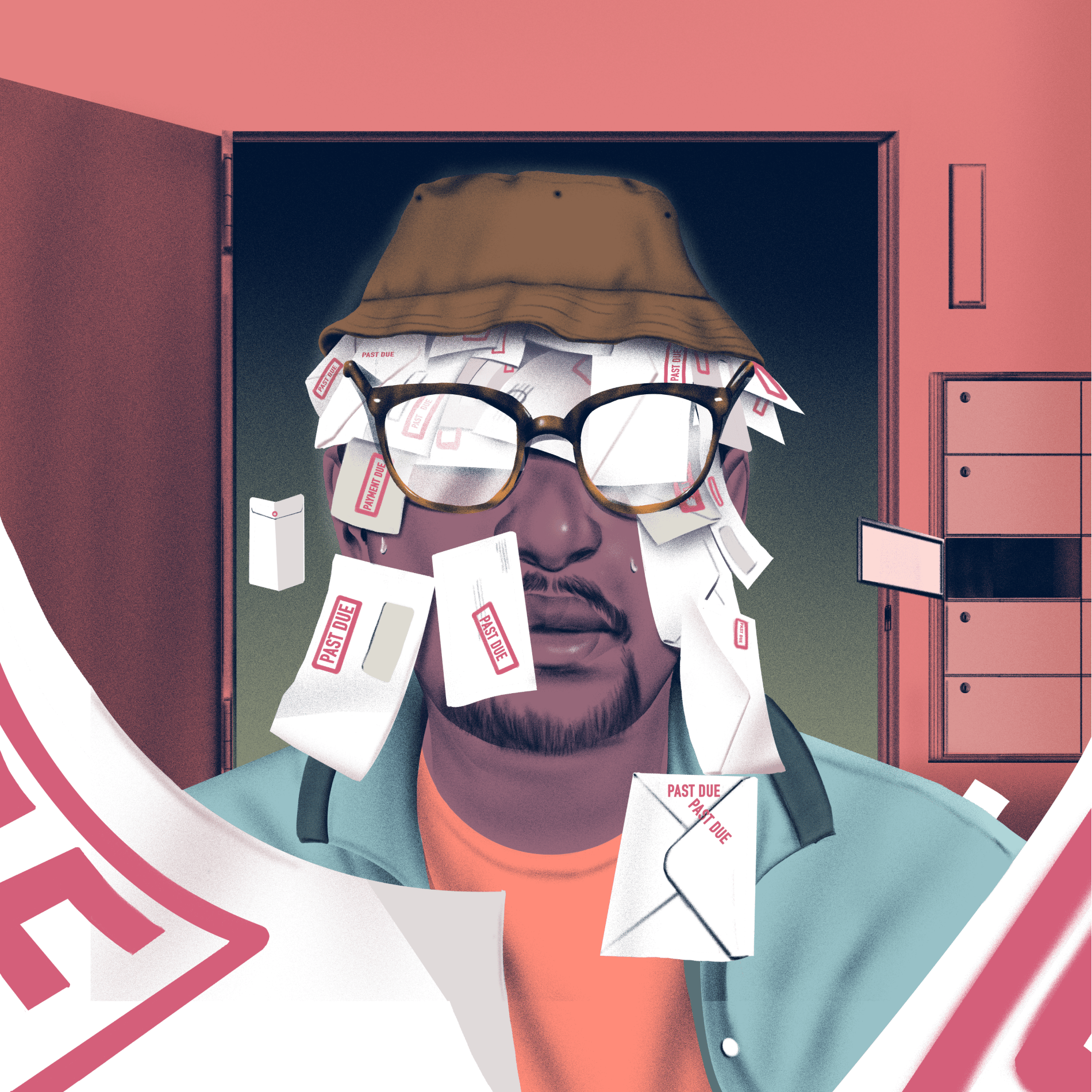

During college, I didn’t think about my loans at all, it was just an imaginary number. Eventually I had to meet with a financial-aid advisor at the college. I remember this woman looked at my debt and she looked at my major. She said, “How do you plan on paying these back?” Some of them were private so I couldn’t defer payment. There was no clear pathway to paying off these loans before I was 50 — it was just so much. I will never forget this because she said, “What were you thinking?” It was one of the most demoralizing conversations I’ve ever had. I almost went to grad school because I was so afraid of having to pay my loans back.

It was really stressful, but it also prepared me really well for what my life looked like in my early twenties and quite honestly what it looks like now. I worked those three jobs, but I was also involved in student productions and main-stage productions. I was in rehearsal, I was in classes, I was at work, I really didn’t have a life. I managed to make it work. When you’re 18, 19, 20, like, you can run on three hours of sleep and still get shit done and have fun.

My parents and I reconciled, but from the day that I moved out, at 17, until now, I have never taken money from my parents and they have never been really privy to anything regarding my financial situation. That was really stressful in the moment but a point of pride now.

They’re not super invested in my career, per se. I know they’re proud of me but I know that they are proud of me mostly because I pay my own rent, I’ve paid off my student loans, I am getting by, and am financially stable. To them, that’s an impressive thing, more impressive than being on a network show or anything like that.

It was so demoralizing to look at the principles and see that it was still larger than the amount I had taken out even though I was paying two times more than my rent every month for it.

Recommended for you

It’ll Work Itself Out (It Actually Won’t)

Money Diaries

Natasha Rothwell's Character in “The White Lotus” Finds an Angel Investor. Her Real Life Didn't Quite Work That Way.

Money Diaries

She’s a Toronto Legend, Model, and Style Icon. And She Was Nearly Homeless

Money Diaries

Karen Russell: A Brutally Honest Accounting of Writing, Money, and Motherhood

Money Diaries

After I left college I moved to Chicago. It was awful. I lived in a studio apartment for $500 a month, which now seems insane. At the time it felt like the biggest extravagance that I could ever imagine. I worked very briefly at one call center that I got fired from unceremoniously. Shortly after, I started temping for a company called Groupon. I started there very early, within the first year or so of Groupon being a company. I eventually got hired full time and I ended up working there for almost four years. Initially, though, I worked 45 hours a week for that company in their customer-service department. My college life was so get up and go from sunrise till late at night, so it felt very normal to work a nine hour day and then go immediately to a rehearsal or an open mic, do that until 10 or 12, and then go home and do it all over again. By the time I left Chicago I was managing remote call centers in Ohio from Chicago as a 24 year old. It was really silly.

I was very lucky that Groupon, at least in the beginning when it was still a startup, was very into this culture of hiring artists, actors, comedians, and writers. It felt very safe at the start.

The stakes felt much higher than they even did in college. I needed that job because if I didn’t have health insurance then I’d be completely fucked. If I didn’t have a job, I wouldn’t be able to eat — I was stealing food from Groupon every day!

I wrote Kate and Sam Are Not Breaking Up in Chicago. I wrote a lot of it at my desk at Groupon. I don’t remember if I made any money off of that. For the plays or shows that I did in Chicago, I would make a weekly stipend of $50 or something like that. I certainly never made any livable wage working as an artist in Chicago. But opportunities did arise. I remember getting very close to getting parts in roles at the big theaters, like Steppenwolf. I had a come-to-Jesus moment where I realized I wouldn’t be able to take those jobs if I got them because it would require me to quit my job at Groupon and I didn’t know what I’d do after that. One happened when I moved to New York for Groupon, too, when I was coming up as a comedian. I had to turn down so many early jobs because I needed to maintain the day job that I had because of insurance.

Stand up was my solution to building a resume in the arts world. I could do it at night. It was all on my schedule. I wrote and performed everything myself. It slowly took over my life and became the most artistically fulfilling thing that I’ve done in my career.

I couldn’t be a writer until I knew that I was going to get a job that I would be secure enough in. My manager was so frustrated with me because he was like, “You need to take the risk and jump on this job,” and I could never do it until I started writing for Billy on the Street. When I started to headline comedy clubs after I did Conan [in 2016], that really did move the needle. When you’re a headliner at a club, your rate goes up a lot.

Even with these jobs coming more consistently, I wasn’t able to make a dent in my loans until last year — even despite paying well above my minimum payments on every single payment. It was so demoralizing to look at the principles and see that it was still larger than the amount of debt that I had taken out when I originally took out the loans even though I was paying two to three times more than my rent every month for it. It just felt like a pit I was dropping money into. It wasn’t until I was cast on Sunnyside and was making the amount of money that I was making doing a huge broadcast network show that I literally just took a couple of paycheques and did it all in one fell swoop. It was the only way. If I had done it at the rate that I was doing it — the interest was just so outrageous.

I am very lucky that I am at the point in my career where I can afford to turn down roles. But everybody’s line is going to be different and you have to really come into this industry knowing exactly where that line is for you. 'Is this something that I can do and be proud of?'

I keep my money pretty tight now. I have an accountant and I incorporated a couple years ago because I have a lot of different revenue streams coming in. My accountant has definitely been helpful in terms of pointing me in the right direction of what kind of investments I should be making and giving me suggestions, but I have never had sizeable savings. I lived paycheque to paycheque up until I got “Sunnyside.” It’s pretty wild to now have this freedom to put my money in some imaginary thing, even just putting it in a retirement account seems sort of insane to me at this point. I have been conditioned to hold onto all of my money because you never know when the next thing is going to come. I’m so scared to do anything with it. I just like to have it sit in my one account and be able to look at it every day. It’s such a strange thing. This is the first period in my entire life in which I don’t have anxiety about looking at the balance of my checking account.

Now it’s nice because I have the financial security to say no to a lot of things. I know that I can pay my rent for a while and I don’t have to go in to audition for everything. Not everybody is that lucky. The industry has the power and they can write something that is shitty and say, “do you want to do this?” and if you say no they know that there’s a million other people who will do it. I feel for people who are young in their career who are taking parts that don’t make them feel great, or parts that don’t present the ideal representation that they want to be portraying. I am very lucky that I am at the point in my career where I can afford to turn down roles. But everybody’s line is going to be different and you have to really come into this industry knowing exactly where that line is for you. You have to ask yourself the tough question before you even go in for the audition: “Is this something that I can do and be proud of?” Asking yourself those questions early and seeing that line before it even becomes an issue is really, really important.

When you grow up poor I think two different things happen. There are two main reactions to poverty when you get money as an adult. One is like, I did this, and you hold onto it in a boot-strappy way, like, anybody can do it if they work hard enough. But it has also highlighted the randomness of success and financial success in general. I think about how fucking lucky I am all the time. Holding onto money seems silly and I like spending it on people that I think are important and causes that I think are important. I just don’t feel like I’m going to be around for that long so why have all my money in some weird investment account when I could just be spending it on stupid shit for my friends? Maybe that’s not ultimately the best way to be going about it but, who knows? I like to support causes. I just recently gave to the Portland Bail Fund because of what’s going on in Portland. In terms of charity, I have a set number of recurring donations that I do every month to a specific set of organizations because I find it’s more intentional. It’s not just, oh here’s some money, and then I don’t think about it anymore. It keeps it front of mind for me and expands the way I look at it. Beyond charity, I ask myself: How can I get involved in that cause physically as much as possible beyond just giving?

Everything changed with covid. We were just about to start shooting my show with Quibi, Trip, right when everything shut down. It got pushed to next spring. We were one of the many shooting casualties of covid. We are still shooting it but it’s not going to happen until next April or May. My podcast is still going, obviously. I’m still mostly living off of writing work from shows like Big Mouth and stuff like that, but money from the podcast is definitely a portion of my income as well. I’m doing a bunch of voiceover work in the animated space, and I’m writing a bunch. People are still ― wildly ― buying shows. I’m getting ready to take out some new projects and hopefully set myself up for a busy non-covid.

At the same time, though, I never look at my comedy through the lens of is this important because it never will be. It’s dick jokes on Twitter. Trying to make the work important is a really dangerous trap for me. That’s not how I’m funny, it’s not why people think I’m funny. Abstractly, comedy and levity and escapism is always going to be important for people in tough times like this. In that way, I think all of us creating work that makes people laugh and gets people’s minds off of the everyday horrors we’re living through is great. But is the content of my work important during this time? No.

It’s really, really hard for me to make content during this time partially because what I do is not something that is meant for this time. I’m not great at front facing videos, I’m not great at creating internet content. What I do and what I love to do and what I’m great at doing is live, in-person comedy, with a room full of people. But it’s also comforting because I don’t think anybody cares. There’s just more important shit going on. The Black Lives Matter movement has obviously caused a reckoning for our industry. Part of it is reorienting the way we’re hired. There are still so many “diversity” programs in Hollywood that actually just create another step and another added layer of labor for people of colour. Instead of sending us through these arduous, often low-paying or non-paying diversity programs meant to discover diverse voices, just start hiring diverse voices and giving us the on-the-ground experience in the rooms.

I have done diversity showcases, I have done all of those things. I’m right there too and I’m grateful for the experience they gave me, but with a lot of it, I always had to wonder, like, why didn’t I just get in the room? Why did I have to prove that I was good enough to be there with this added step that a lot of people don’t have to go through? I think at this point we just need to start seeing our work and valuing our presence instead of asking us to do these extra steps. As told to Will Schube

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.