Money & the World

Super Bowl Ads Are Super Expensive. They’re Also a Better Deal

We pride ourselves on being thrifty and effective. So why did we buy some of the most expensive ads on TV? Because, dollar for dollar, it’s actually a better use of our money. We crunch the numbers to show you why.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple, a company founded in part on the principles of lowering fees and disrupting legacy companies, does not seem like the kind of start-up that would invest in Super Bowl ads. But it just so happens that another one of our founding principles is: look at the data. That’s why we’re investing in Super Bowl ads for the fifth time.

OK, let’s start with some facts. Super Bowl ads are insanely expensive. If you know one thing about them, that’s what you know. Conventional wisdom holds that they’re flashy, overpriced, and all about bragging rights — exactly the sort of stuff we’d normally avoid. But it turns out that if anything — dollar for dollar — they’re actually a little under-priced. Here’s why we think that.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

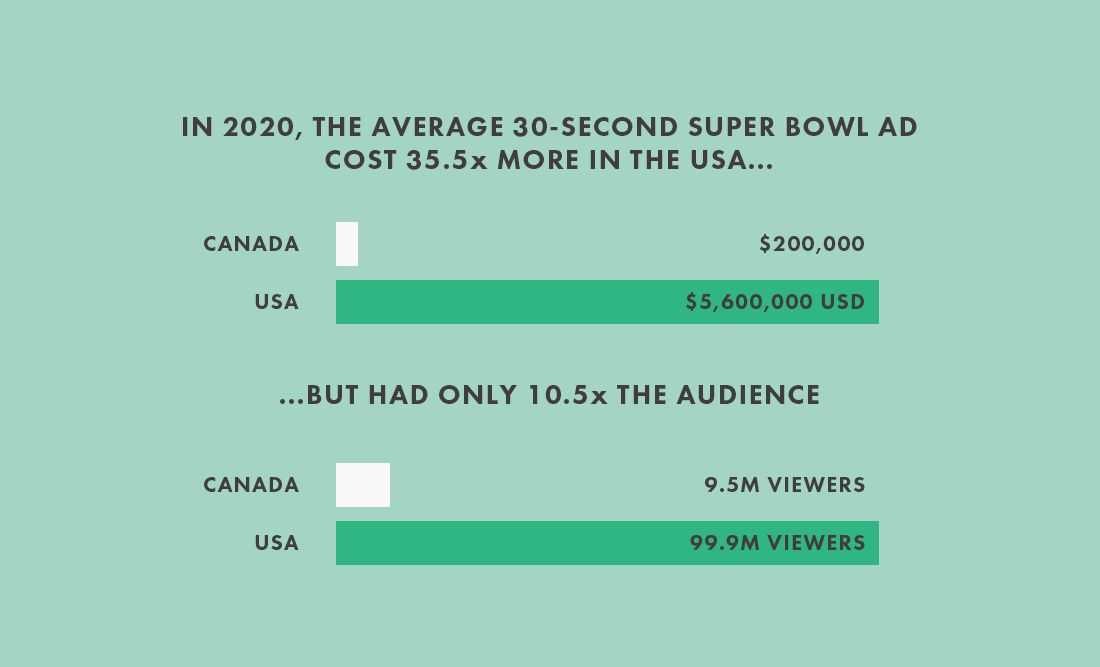

This year, it will cost about $5.5 million USD for a 30-second ad in America. But there’s a key clause in that sentence: in America. In Canada, it costs much less — about 95 per cent less. In fact, three ads — a 30-second ad, and two 15-second ads — cost less than what you’d pay in the U.S. for just one 30-second spot.

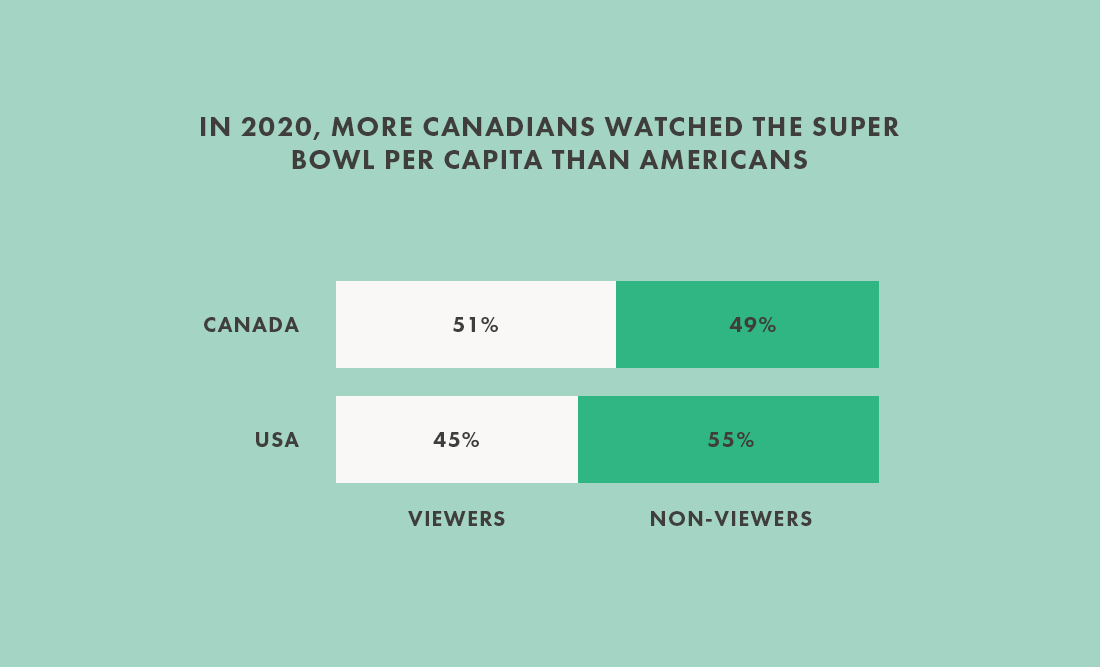

Of course, that’s still a lot of money. And, you might be saying, there are fewer people in Canada — not to mention that those people may not be as interested in the Super Bowl. Well, it turns out that a higher percentage of Canadians than Americans watched at least some of the game last year: 51 per cent of the population here versus 45 per cent there.

What about average numbers of viewers? Last year’s Super Bowl drew a record average of 9.5 million Canadian viewers — the highest viewership since 2015 when the previous record was set. (By the way, the number of Canadians who watched last year’s Super Bowl is also at least three and a half times more than the number who watched the Stanley Cup final in recent years!) But in America, Super Bowl viewership has actually gone down since 2015. Still, since there are more people in America, you might wonder whether, per capita, you’re still getting a better deal by running your ad in the U.S. Nope. Ad people measure cost in price per thousand viewers. Our 30-second Super Bowl ad, assuming a similar viewership to last year, will cost at least 65 per cent less per thousand viewers than it would if we advertised in the U.S. Which means you get nearly three times as many viewers in Canada for every dollar spent.

Does all of this still hold true in the midst of a pandemic, with so many other demands on viewers’ time? Even if this year’s Super Bowl doesn’t set any new records, the numbers from recent years don’t lie. A Canadian Super Bowl ad is still a good deal, and should be for some time.

Which is why we figured the Super Bowl was a great way to launch our new ad campaign: “Anyone Can Do Their Taxes.” It’s the official unveiling of our low-fee, high-ease online tax filing platform, Wealthsimple Tax. (You may have known it as SimpleTax, the Canadian-favourite tax software we recently brought into the family). Even if you didn’t watch the game, you'll probably see our ads somewhere in the coming months (and on our YouTube channel).

Recommended for you

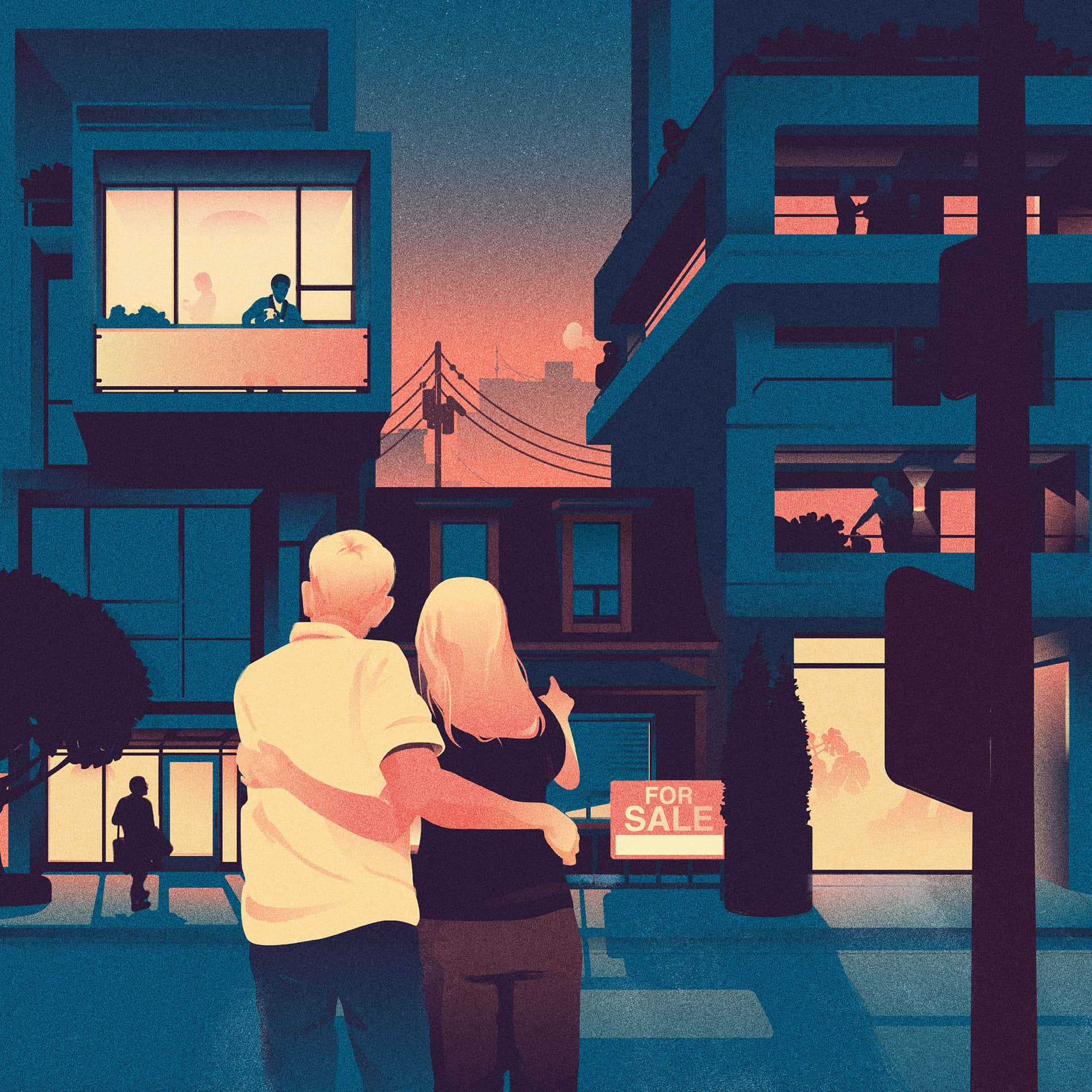

This Is Not Normal: A Letter From the Toronto Real-Estate Forever Boom

Money & the World

Prediction Markets Are, Suddenly, Everywhere. Wall Street Wants In

Money & the World

GME, Doge, Supreme: How Getting Rich Went Full Internet

Money & the World

The Ten Words That Defined This Topsy-turvy Year in Money

Money & the World

Oh, and one note about the economics around these ads. While we did hire the best creative partners imaginable — in this case the brilliant director Matthew Swanson, along with a trio of familiar figures (wink) — we didn’t use a big expensive ad agency. We made them in-house.

So if you’re wondering why a new, nimble, digital-first company (with, for the record, more than 1.5 million users and $10 billion in assets under management) would buy a Super Bowl ad, it’s simple: it makes a pretty good investment. Which is something we pride ourselves on knowing.

*Notes:

(1) “Cost per thousand viewers” are for audiences aged 2+.

(2) $200,000 was the cost of a Canadian Super Bowl ad on the high end, per The Globe and Mail in 2020.

(3) When we mention Canadian Super Bowl viewers, we’re including both English and French language networks.

(4) When we mention last year’s U.S. Super Bowl audience, we’re only counting the average audience of 99.9 million who watched on TV, and not people who digitally streamed the game.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.