Finance for Humans

You Probably Shouldn't Panic Sell to Avoid Drawdowns

There’s almost always a reason to dump your stocks. History suggests caution.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Hi. If you’re landed on this article, it’s probably because something spooky is happening in markets and you’re a bit anxious about what to do next. In that case, welcome. We’d love to talk through some things with you.

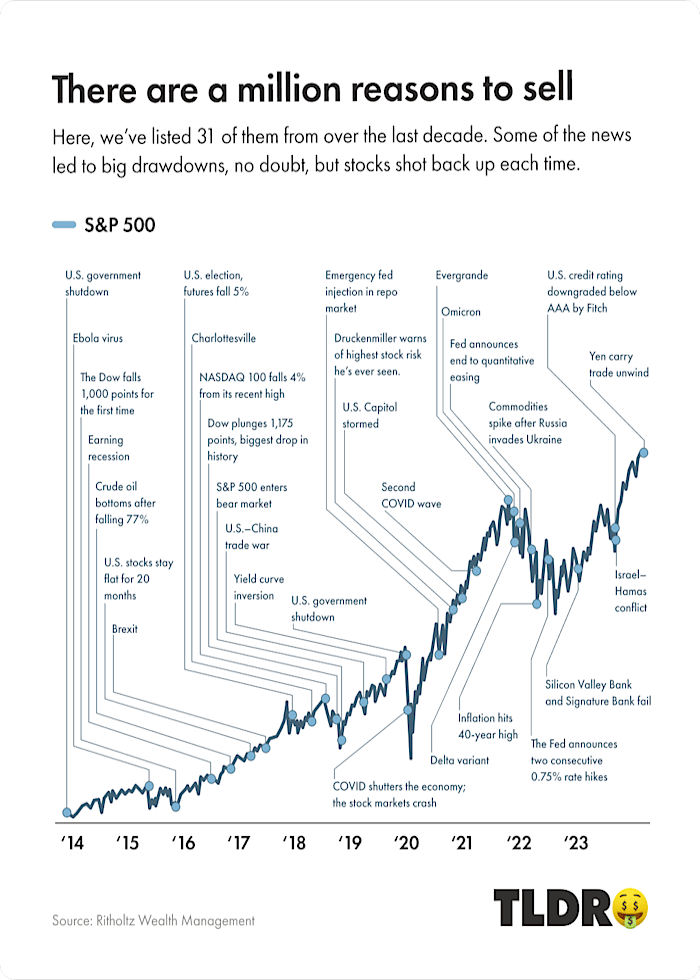

We first published this story in September of 2024, when stocks were soaring, despite a lot of scary stuff in the news: conflict in the Middle East, the war in Ukraine, etc. In other words, there would have been plenty of moments when it would have seemed smart to hit the eject button to dodge a stock downturn. But doing that would have meant missing out on healthy returns.

Recommended for you

That was true in 2024, and it’ll likely prove true now. What makes us say that? Well, the stock market has basically been in one long bull market since 2009. But along the way, there have been hundreds of rational-seeming reasons to get scared and sell your shares, as this chart reminded us (you can see part of it below). And the same will surely hold true in the future. But, if you’re a diversified, long-term investor, staying put is almost always the right move, even if the doomsayers are occasionally right, as they’re bound to be sooner or later. Why? Keep scrolling.

Panicking even for a little bit can cost you lots of money.

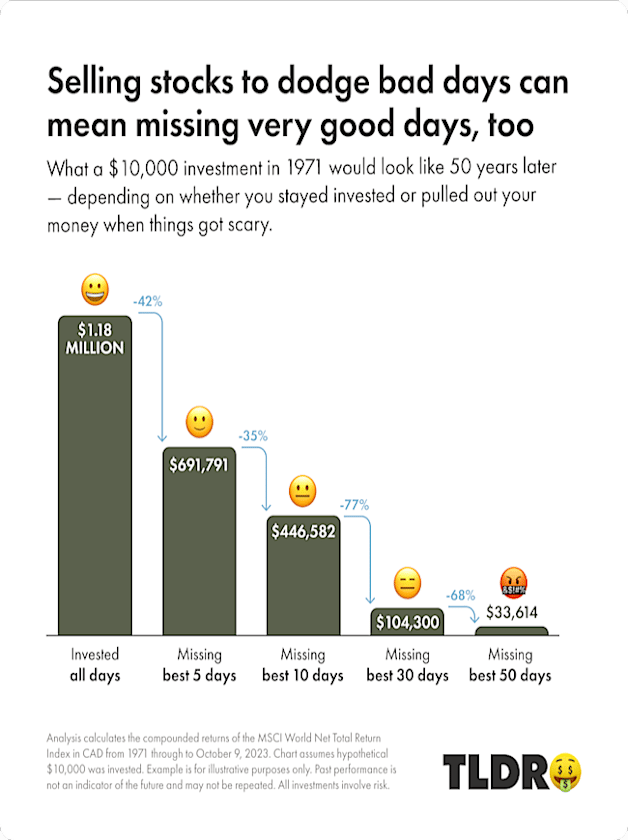

Why? Because stock gains aren’t evenly distributed. There are often a lot of boring, low-action days (or weeks or months) in a row and then — bam! — a great day will come along and stocks will surge. The trouble is that no one really knows when these red-letter days will appear, but history suggests that you really don’t want to miss them. If you do, your returns will likely be far worse than if you had held your shares through market turbulence. Check out this chart:

THE UPSHOT: We live in a scary world with a lot of unknowns, and markets, now as ever, are volatile. Of course, it would be super if you could accurately predict the future, exit the market right before a big downturn, and then savvily reinvest right as stocks hit their nadir and begin to recover. But that’s really hard to do. Studies have shown that individual investors who panic sell during downturns tend to jump back in after the market has already recovered and risen a bunch, which is a good way to miss out on banner days. That’s why many personal-finance pros suggest doing the most boring thing possible: accept that timing markets is hard, make sure you have enough cash in the bank so you don’t need to sell if markets take a dive, and stick with your plan — even if that means refusing to open your brokerage app for a while.

Jared Sullivan is an editor for Wealthsimple Magazine and author of the book "Valley So Low: One Lawyer's Fight for Justice in the Wake of America's Great Coal Catastrophe".