Money Diaries

Nnamdi Asomugha Figured the NFL Out Early: It Doesn't Provide a Future

The star of the new movie "Crown Heights" — and Mr. Kerry Washington — explains how to transition from shut-down corner for the Oakland Raiders to having three films at Sundance at the same time.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries” where we ask interesting people to open up about the role money has played in their lives.

I still drive the car I had in high school. It was passed down from my brother to me, a ’97 Nissan Maxima, the car I drove to prom. I was never a big spender. We didn’t have much growing up, so I guess I got used it. Even when I was a Pro Bowl player in the NFL, I lived the same way because that’s what I knew. But that car is the one thing that everyone makes fun of me for. Even after I started earning good money, I was still in the mentality of “I know this is all I need so I’m doing fine.”

Bad grades landed me my first job. My mom was a pharmacist at a small mom-and-pop drug store in Los Angeles. In high school I was an athlete, of course, but it was basketball that was my favorite sport. When I started bringing home bad grades in my junior year, particularly in math, my mom pulled me off the team. Instead of going to basketball practice after school, I had to go work in the pharmacy where my mom worked. That was my punishment. Every day after school I had to stack shelves and sweep floors and do things like that. My teammates would go to practice, and I’d go to work and stay there until closing, then come home and do homework. I had to do that for the whole season. It was actually a really tough time for me! I was heartbroken. I mean, this was basketball. The coach would call my mom every week, saying, “Please. Come on!” Finally, with two games left in the season, he called and she said, “OK, he can play these last couple of games.”

It’s not always “Look at this idiot who got paid all these millions of dollars and lost it all.” It may be more like, “This naive kid put his faith in the wrong people.”

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I majored in finance at the University of California at Berkeley, but even that didn’t prepare me for protecting my money as a professional athlete. For athletes, it’s extremely tough to trust people with your finances. It’s so easy to be victimized. It’s crazy. It’s happened to me as an NFL player, to be honest. I think it’s happened to 99% of players in the league. When I hear about a player losing his money, I’ll rarely, if ever, point a finger at the player because I know how difficult it is. It’s not always “Look at this idiot who got paid all these millions of dollars and lost it all.” It may be more like, “This naive kid with a million things going on in his life put his faith in the wrong people.” I know because I was that person. Almost every one of my closest friends in the league has gone through it.

I learned early in my career that I had to be prepared for life after football because you never knew when it would end. I had a buddy who played with me on the Raiders, and he needed to go to his brother’s wedding, which was on a Thursday for some reason. It was during the off-season when the workouts are officially voluntary, but our coach told him, “If you go to your brother’s wedding and miss our workouts, you’ll be off this team.” So my buddy didn’t go to the wedding. In the second week of training camp, he was cut. He missed his brother’s wedding because he was so afraid of leaving, and he got cut anyway.

It was a clear message that as a player, you’re not really in control of your destiny and the way you make a living. It’s always weird when people say, “It was that exact moment…” but for me that was that moment! Something clicked, and I was like, “I gotta be prepared. This could end at any time.” That was my second year in the league. From that point on I started doing broadcasting and things like that in an attempt to find my passion — something I could do after football. I remember walking back to the trailer after shooting a Nike commercial, and the director was like, “Hey, I want to talk to you. You were really great! We get guys coming in all the time, and they just kind of phone it in. You actually went for it.”

Recommended for you

Then he asked, “Have you ever thought about acting?” I said, “Yeah, a little bit but not really.” Two months later I got a call from a guy saying, “I want you to start taking acting lessons so I can put you in my TV show. The show was Friday Night Lights. The director was Peter Berg. I had no clue who Peter Berg was at the time, but I was like, “Yeah, OK, cool. I’ll do your show!” It was one of those moments. He was saying, “You have something here. Start to nurture it a little bit.” So I did.

After 11 seasons, I retired from football; four months later I was in Ghana shooting Beasts of No Nation as an executive producer. I looked around, like “This is what I’m doing now. This is a very different world from four months ago!”

Daniela Lundberg was another producer on Beasts of No Nation. One of the first things she ever said to me was, “You have great taste in films.” I don't know if that's true. But I like what I like and there’s no compromising. Over the past few years Daniela and I have worked on a few films together, and I’ve had a really good time with her. All of the films I’ve been involved with have worked out, so I guess I do have great taste in films!

Very early in our relationship Daniela told me about a project. She said, “There’s this film that I’m going to do. Would you be interested in it?” She sent me the script for Patti Cake$, and I loved it. She asked, “Would you help me to finance it?” I went along with her—I had no idea where it was going to go. With anything I’m involved with, my goal is always to make something great and then see where the chips fall. I knew Patti Cake$ was a crowd-pleaser when I read it. As I started to see the cast involved and their work, it felt like one of those films that could do well regardless of the outlet. It just had that feeling.

Suddenly last year I found myself at Sundance for my first time, and I had three films there: Patti Cake$, which I executive produced; Crown Heights, which is based on the story of an innocent man who was wrongfully convicted; and Waiting for Hassana, a short documentary I executive produced about two Nigerian girls who were kidnapped by Boko Haram. It was a crazy, awesome week. At one point I had to stop doing press for Crown Heights so I could run over to the premiere of Patti Cake$. On the way I kept bumping into people. As we passed, they were like, “I’m going to Crown Heights tonight!” Then I had to leave halfway through the screening of Patti Cake$ to finish press for Crown Heights. As I was walking out with my publicist, we were like, “Yeah, the energy is there. The crowd is loving it.” It had that good feeling. In the end Patti Cake$ sold for more than any Sundance film ever. It was a pretty great week. And a better job than sweeping up at the pharmacy, that’s for sure.

As told to Davy Rothbart exclusively for

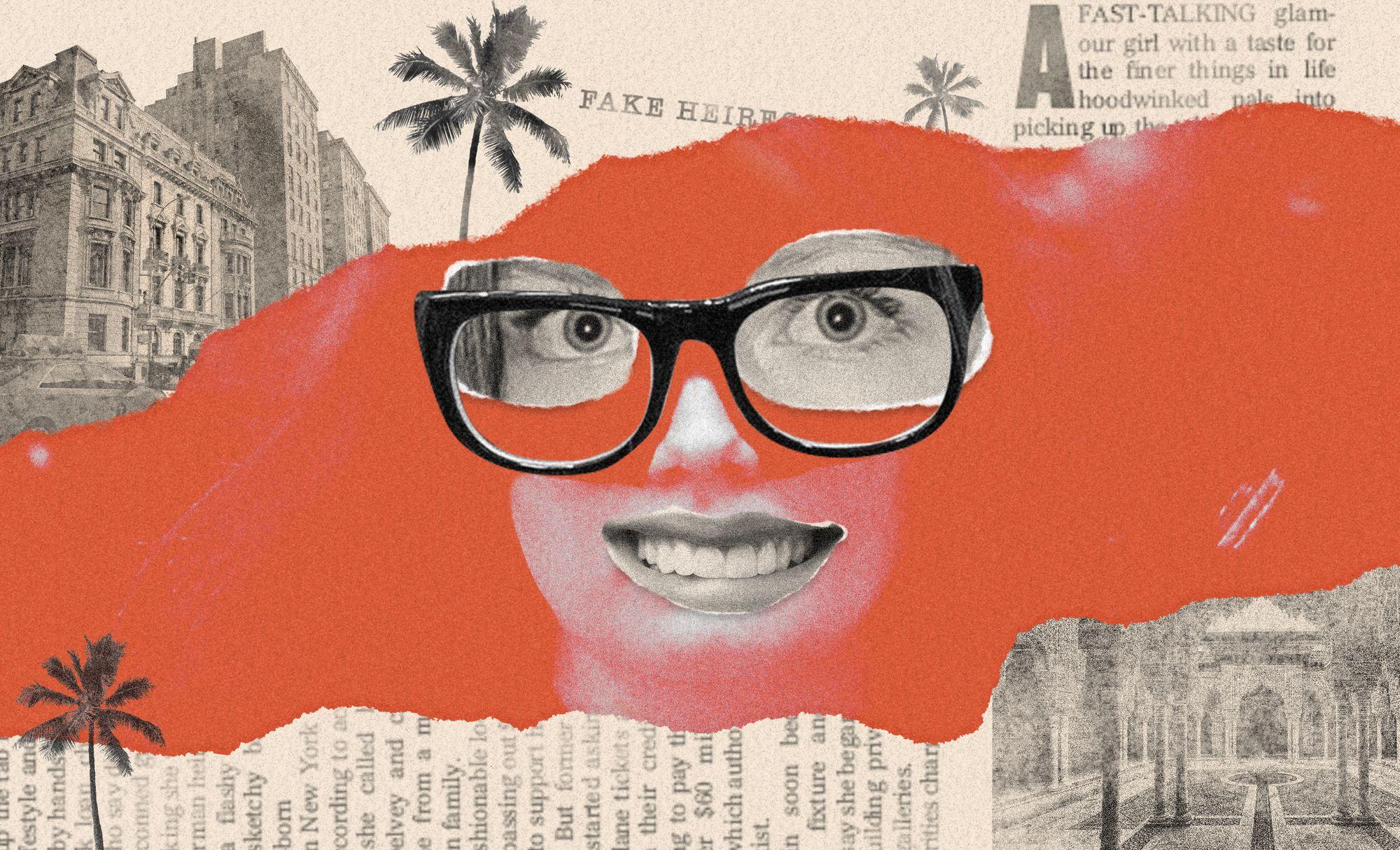

Wealthsimple. Illustration by Jenny Mörtsell. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.