Money Diaries

Maye Musk Taught Her Highly Successful Children By Letting Them Go Their Own Way

Raised in Apartheid South Africa, she took an unlikely course to becoming a famous septuagenarian model. And she supported her family the whole way.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

My modelling career is at an all-time high now. Who would have thought? When I was younger, if I’d said that I was going to be really busy modelling at 70, everyone would have said, “Okay, we can’t work with that crazy lady!”

I had my first taste of financial independence growing up in South Africa. My family had moved there from Canada when I was two. I have a twin sister and when we were 12 she and I worked as receptionists for my dad’s clinic — he was a chiropractor. We’d take turns with the morning shift — quarter to seven to seven-thirty — and then we’d go to school. Then we'd do the afternoon shift from 4 to 6 pm. We earned very well, 25 cents an hour — and we really saved our money.

We had great parents. They lived through the depression. They were very frugal because they had lost everything. My mom taught dancing and people would pay her in whatever they were growing on their farm. My mom showed me how to do bank statements, balance the books, accounting. So that really helped me a lot all my life. And she also sent me to a typing course when I was about 15. And I said, “Why would I need to learn to type?” So what happens — now everyone needs to learn to type!

At 17 I didn’t know what I wanted to do. I knew I wanted to study science, but when I told my dad I thought I wanted to be a microbiologist or a biochemist, he said, “You should have a profession so that you can have a career.” So that’s why I studied dietetics. But we were living in Johannesburg, and I had to go to an Afrikaans university and study in Afrikaans. Physics and math in Afrikaans was pretty difficult!

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

We were a very happy family. We always had savings. I could have spent my money on anything I wanted – they didn’t put restrictions on me. When I went to university I did spend my savings on vacations with the adventurer club. We would go to Mozambique and the different islands. So that’s how I spent it. My sister is more frugal than me and didn’t want to spend her money at all. So she just saved it up and she’s doing better than me. She doesn’t spend anything and she invests a lot.

My mom’s friend had a modelling agency. She just asked if I would model for her, and I did, and they paid me, and I thought, “Oh that’s nice — wear pretty clothes and they pay me.” I didn’t take it seriously. I mean, I was a science nerd and I just wanted to get science degrees. So it never occurred to me that it would continue — but it did. My nutrition work was always my stable income and I’d call my modelling the cream on top.

Now I can buy a really good jacket if I want to. It still freaks me out – the price still freaks me out.

I started my practice as a dietician after I got divorced. To me, health is wealth. I’ve worked with very wealthy people, but if you don’t have your health, your money means nothing. The thing is, when you take your portfolio to a city, you can immediately start modelling; whereas as a dietician, it takes a while for your practice to pick up. So I’d book modelling jobs — but they had to book me way ahead so that I didn’t have to move my nutrition clients. I also used to teach nutritional science here in L.A., where I live now. But I had to stop being a teacher because modelling took over. I thought, “You’re on a wave; you might as well go with this until they don’t want you!” I have never been on a wave before; I’ve always been pounding the pavement.

I didn’t tell my children that they should all work for themselves and be independent. They just automatically worked for themselves. The funny thing is that I didn’t know about all of my children’s entrepreneurial activity because I was working all the time. They would do things on their own. At home they had to behave well, they had to play outside quietly, do their homework — or be entrepreneurial, and that’s what they were doing! When I read articles about them, I say, “Oh! That’s why they were all so busy!”

You know how hard it is to become successful; you have to work your butt off. My kids are all doing work that they love to do – Tosca's got Passionflix. She loves to make movies from best-selling romance novels, so she started her own platform. And then Kimbal, he’s always loved food. He studied at the French Culinary Institute to be a chef and a restaurateur — that’s the entrepreneurial side, the restaurants — but he also builds vegetable gardens in underserved schools. And then there’s Elon…What can I say? Never stops, you know? If there’s a problem on this planet or on another planet, he’ll figure it out. He didn’t start an electric car company and a rocket company to make money — otherwise everyone would be doing that.

Recommended for you

She Was Living in a Shelter Six Years Ago. Now She’s the CEO of Her Own Beauty Company

Money Diaries

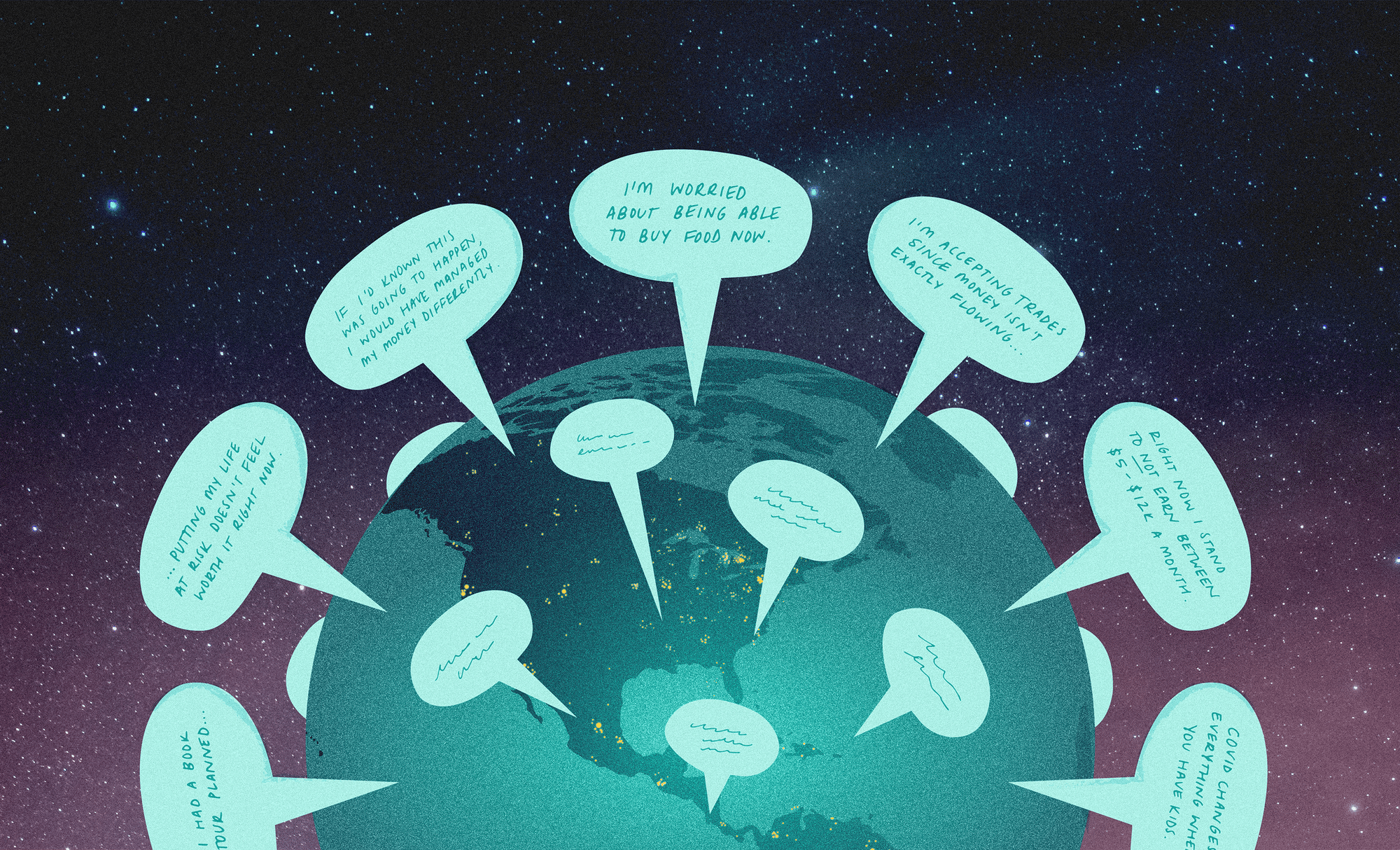

Pandemic Money Diaries — Panic at Trader Joe’s Edition

Money Diaries

Karen Russell: A Brutally Honest Accounting of Writing, Money, and Motherhood

Money Diaries

Joel Kim Booster Was in Massive Student Debt Until Two Years Ago

Money Diaries

The children all worked their way through college. They had to. I moved back to Canada when I was 42, and became a research officer at the University of Toronto so that my kids could go to university for free if they studied medicine or law. But they didn’t want to do that. They decided what they wanted to study – the boys, business, and Tosca, film. I worked such long hours so it was all up to them. If they wanted to do it, they had to fill out all the paperwork, get the loans, get the scholarships… and off they went. They did it.

They didn’t consider it the harder path. It was the path they wanted to take.

Walking in the Dolce & Gabbana runway show this spring was the most fabulous, extravagant fashion show I’ve ever done. And then, of course, the Cover Girl campaign I just did is the biggest I’ve ever done – you don’t do beauty campaigns at 70! Then my Swarovski campaign — there were billboards all over the world. People were sending me DMs on Instagram showing me, it’s in Australia, it’s in Dubai it’s in Brazil! It’s everywhere. That was really cool. People are starting to recognise me on the street. I do get a bit of that. It’s the white hair! So I’ve started to wear a hat and sunglasses.

My parents were entrepreneurs and then my brother and sisters were entrepreneurs, and then there's me. I was in charge of my family, of course. After I divorced my husband, I didn’t get child support, so I was very careful with my finances. We couldn’t afford red meat but I could make a bean soup!

We never had “Why can’t we have this, why can’t we have that” in my family. I wouldn’t tolerate that. They never asked why they could not have something. They figured out a way to get it behind my back. If I couldn’t afford something or it was something they didn’t need to have I would just say no or I would ignore them. You don’t get the spoiled brat syndrome around me.

Growing up, we didn’t like apartheid and we didn’t adhere to it as much as they (the government) would have had us do. My dad would see people of all colours at his clinic. And later, as a dietician in South Africa, so would I. I could work with people of all colours and all races because it was my own home and it was a private practice. My dad had a separate office because there were some very staunch apartheid supporters who would be very angry if they knew he was seeing people of other races. So he had a separate office next to his consulting room. We had to be careful about that. The only problem was when someone came to see me who was from a different tribe than my receptionist. She would walk out and scream at me and say I was being disloyal to her tribe. She was hungover every Monday so I told her not to come in on Mondays. And then anytime anyone with an African accent made an appointment, I would book them Monday so she wouldn’t really know about it.

But as a model, there were models of all races and we partied together even though it was illegal. The point was that we worked together and they got equal pay, always — and often more work than us.

Now I can buy a really good jacket if I want to. It still freaks me out – the price still freaks me out. I can afford it, and it’s important that I dress like a successful model. I don’t know if you’ve seen my Instagram but I wear some fantastic clothes. Some are sent to me by designers and others I buy. My stylist is Julia Perry, she’s been my best friend for 26 years when we were both in rent-controlled apartments in Toronto. So when she started with me she was very careful with what she would buy for me. But now she’s not so careful!

I must say when you are financially strapped you have this pain in your gut the whole time because you’re scared. You have to earn enough to pay the rent, to feed your kids, to dress them, you have to have a roof over your head. You can’t afford a car but that’s okay because there are buses and subways and all that. You get to know the bus system very well. The thing is, after that pain is gone, it’s a really nice feeling. I can go out now, and I can order a lobster dish if I want to. But in the past I couldn’t. It’s nice that I can go out and order anything I like – but unfortunately I have to watch my weight. I can have the most extravagant desserts except I can’t! If I want to keep on I have to stay in good health.

As told to Alix Browne exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.