Money Diaries

Comedian Maria Bamford Wants You to Know Exactly How Much She Makes

The stand-up comic and creator of Netflix’s Lady Dynamite has had lots of jobs — like dressing up like a Star Trek alien. But she was always terrible with money. Now, she’s finally learning.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives.

There’s so much shame attached to discussing finances. I don’t totally understand it. Why can’t we all know what everybody’s earning? When I get booked to do a stand-up show, I can gross $20,000 or more in a night. That’s my current market rate. Two years ago, it would have been maybe a quarter of that amount. A year from now, it could be more or it could be a lot less. It’s impossible to predict. My finances have definitely changed from one year to the next.

In my early 20s, I lived in an “intentional community” in Minneapolis for a while. It was kind of like a commune, a place called the Hieronymus Bosch House. Some intentional communities are big and elaborate, but this one was small—just six or seven artsy people sharing an old Victorian. You were supposed to pay your share of the rent and do whatever job came up on the communal chore wheel. I was good on the chores but bad on the rent. It was $140 a month, and I just never paid it. For like a year, I didn’t pay. Eventually, they were like, “Hey, man, what’s going on?” And I had to call my parents in Duluth to bail me out.

In my experience, the Vulcans liked to party and the Klingons tended to sleep around.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I was young and ignorant. I couldn’t imagine that I had anything of value to contribute to the world. I was doing stand-up comedy, but it was in coffee shops and performance-art places and of course that didn’t pay. To make money, I was working part-time waitressing at a pizza restaurant. I also busked on street corners sometimes. I’d been playing the violin since I was three years old. It was the one thing I was slightly good at. I didn’t have much of a repertoire, just a couple of fiddle songs and then stuff I’d learned doing the Suzuki method as a kid—anything covered in Volumes 1 through 8. I really wasn’t that great as a busker. I mean, it seems heartbreaking when people just walk past you, but that’s what busking is. I think the most I ever made out on a day of busking was $40. Maybe $50.

Then it happened. I landed a gig doing Star Trek performances at the Mall of America, dressing up and greeting people. And soon I got hired to do the same thing in California—going to malls and Jack in the Box restaurant openings. I was a Bajoran from Deep Space Nine. I wore platform heels and a padded bra and did my own alien makeup. “Greetings! I am Major Lilanca from the Planet Bajor!” I traveled with a Klingon, a Vulcan, and a boom box, and we’d play improv games with the people we met.

In my experience, the Vulcans liked to party and the Klingons tended to sleep around. They also didn’t always get along with each other. It was a cultural thing, I guess.

Recommended for you

Anthony Bourdain Does Not Want to Owe Anybody Even a Single Dollar

Money Diaries

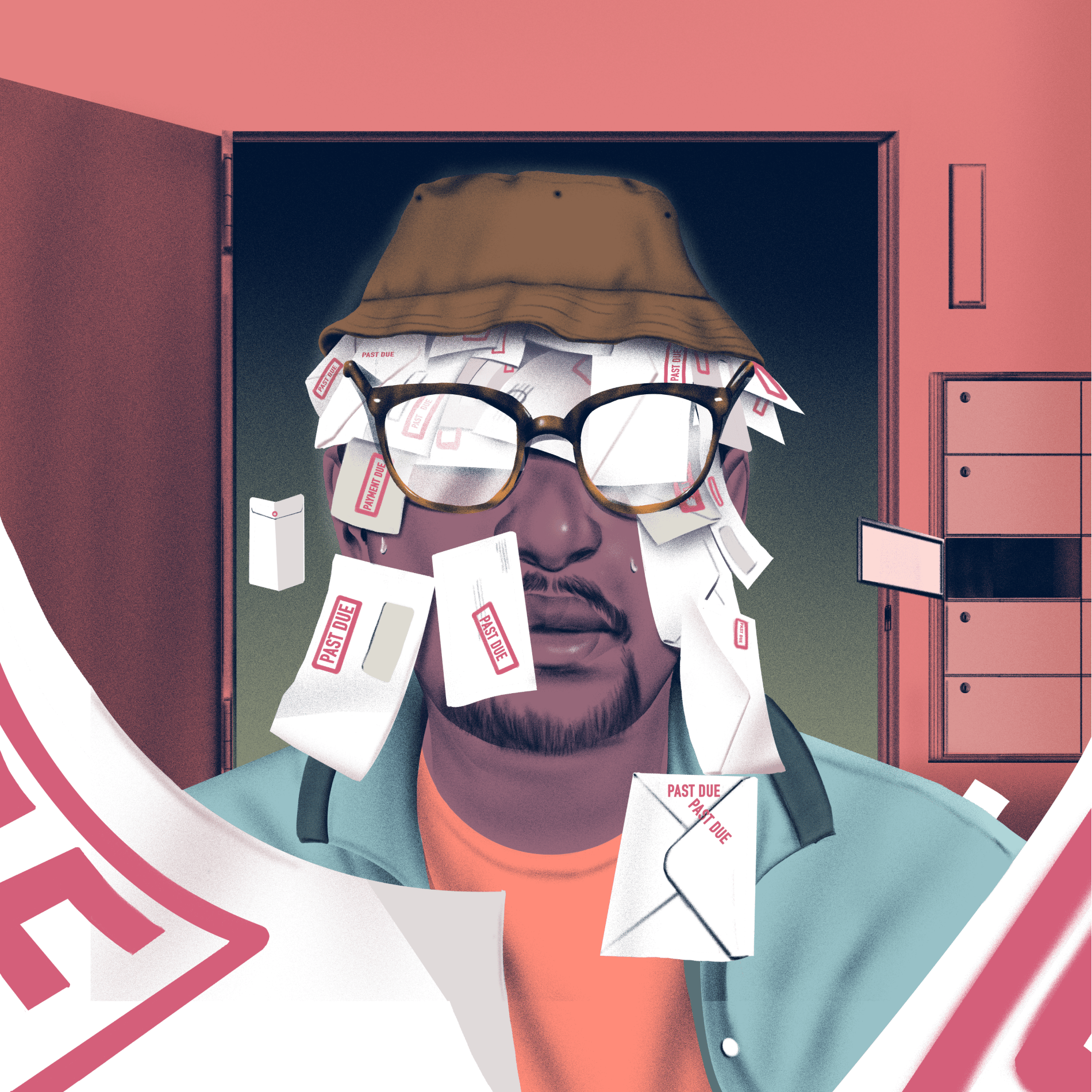

It’ll Work Itself Out (It Actually Won’t)

Money Diaries

She Was Living in a Shelter Six Years Ago. Now She’s the CEO of Her Own Beauty Company

Money Diaries

How to Quit Your Job and Bike Around the World for $17,000

Money Diaries

I was making $600 a week as a Bajoran. It was the most I’d ever been paid in my entire life. And I was living in L.A. I figured everything was going to work out for me. But that was magical thinking. In reality, I just watched my money disappear—I don’t even know how. My parents had cut me off financially at that point, which was the right thing for them to do. But I was suddenly in a pretty desperate place.

That’s when I found a 12-step group dealing with money. L.A. is the 12-step capital of the world, so it wasn’t hard. I love 12-step programs—any kind. I started going to them when I was younger and struggling with eating issues. I think that there’s huge power in a group of humans coming together, getting out of isolation, and helping one another think of new ideas. It’s a weirdly miraculous thing. And there’s always free coffee!

The money 12-step was not unlike going to AA meetings, which I have also done. In this case, it was about finding a way to live a financially sober life and not be living on the edge all the time. People in my program helped me find an affordable place to live. They were like, “What are your skills? What’s something you can earn more money at?” It was all very logical. I signed myself up at like five temp agencies and started calling in available for work every day. It was a simple thing, but it turned everything around.

Now that I make a living as a comedian, I like to show other comics what I’m earning. It feels useful. When I perform, I have an opening act, my dear friend Jackie Kashian. I pay her a third of what I net for every job, since she does a third of the time on stage. There’s often a middle-act comic—usually someone who’s just starting out. I pay them between $600 and $1,000. I also tell them what I’m earning. I show them what a contract looks like, what my manager and agent take out of my fee. I want them to have an idea of what it all looks like—it’s really important not to be ignorant about this stuff. It’s empowerment.

I’m still not perfect with money, but I’m improving. I’ve hired a bookkeeper and an accountant, though I still get unfairly irritated with them. I’m like, “Didn’t I fill out that form last year? Why do I have to do it again?” It can feel as if they’re speaking another language sometimes. I started an accounting course and three bookkeeping courses and haven’t been able to finish any of them. I just can’t bear it, so I drop out. I try, and I fail. But at least I’m paying attention now. I read books about running a business, and I sometimes look at my balance sheet and feel proud of where I am. Even when it feels like I can’t take it all in, I still try. I still try.

As told to Sara Corbett exclusively for Wealthsimple. Illustration by Jenny Mörtsell. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.