Money Diaries

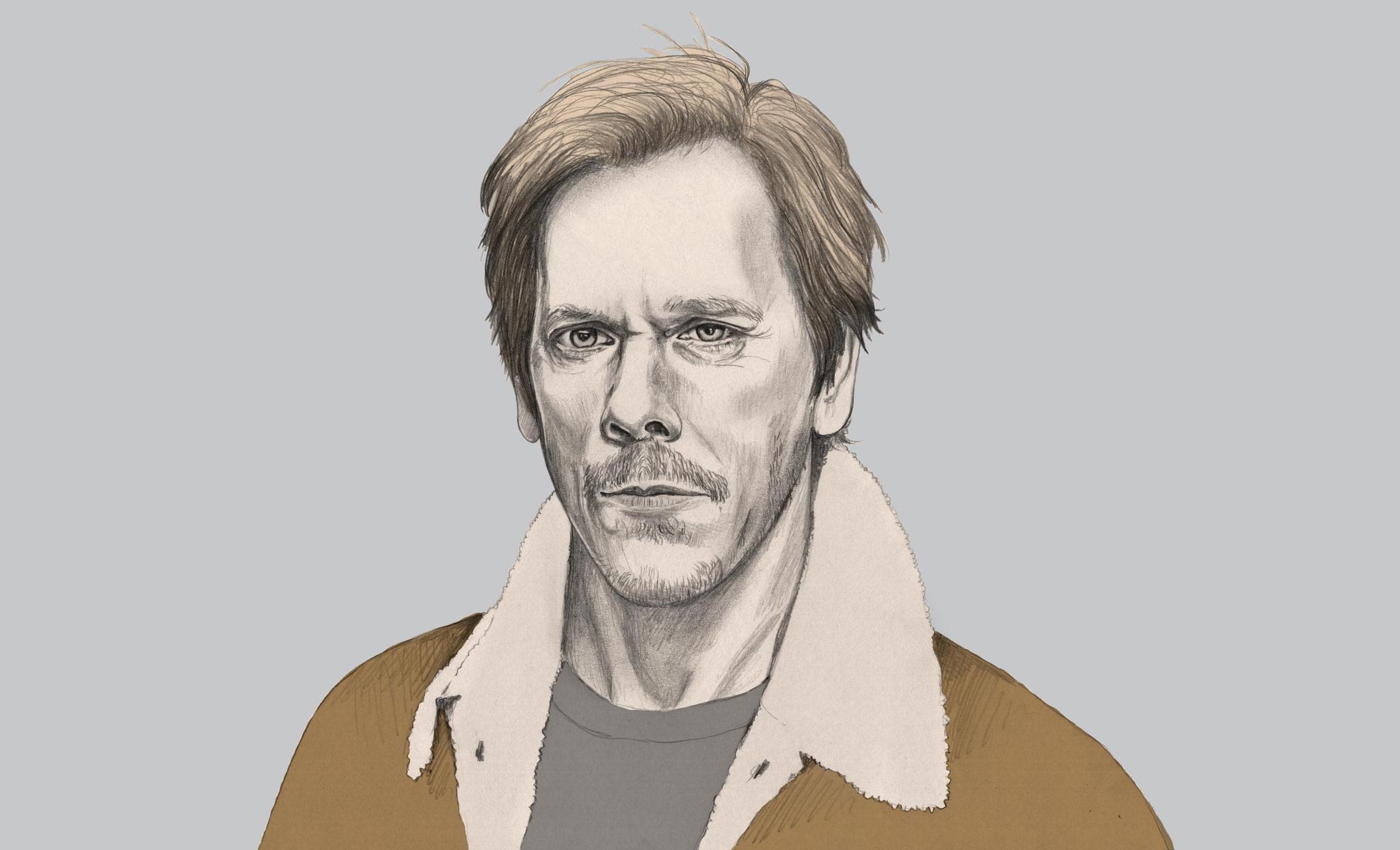

Kevin Bacon: Money is Hard for Creative People

The star of the new show “I Love Dick” on why you should be a grown-up about money (know your financial details) but still have some fun (keep enough cash in your pocket to buy a fancy guitar).

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives.

After high school, I moved to New York City. That’s what I did. I didn’t have anything lined up, and I started working in restaurants, first as a busboy, and then as a waiter. My relationship with money was very loose. I had no budget, no savings, no credit cards, and no bank accounts. I was a cash-only kind of guy. I’d get paid out at the end of the night, spend some of it at the bar, wake up the next day, and check my pockets to see how much money I had left. There was never a budget or any kind of longer-term financial plan. I’d make money, spend it, pay rent, spend more money, and hope that when the end of the month came around, I’d have enough to put up another month’s rent.

You have to have a kind of responsibility with money, and to a certain extent, I still struggle with that.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

That was kind of my first adult work experience. But in a way, the most formative job was my first one. I was sixteen. It was in a warehouse where we packed and shipped medical books. I worked out on the loading dock. When an order came in, we’d locate various boxes of books in the warehouse, pile them on pallets, use the forklift to load them onto a truck, and then do the whole thing over and over again.

I wasn’t the kind of kid who exercised. I was never an athlete. And this was constant heavy lifting. You’d check out the order slip, pack books into boxes, load boxes onto a pallet, load pallets onto a truck. Then another truck pulls up—over and over again. It was a repetitive job. But there was an interesting dynamic with the guys I worked with. They had a hard edge and initially saw kids like me as soft fucks who’d slow things down and get in their way—waste their time and make their jobs harder. They didn’t haze us, but they showed little interest or respect for any of us until we proved ourselves worthy of it.

Here’s the thing, though. I have a really strong work ethic. And the guys there, they figured that out within a couple of weeks. The job itself had no inherent meaning to me—we were just moving pallets of books around—but working hard and earning those guys’ respect meant a lot, so I found a way to make it happen.

There’s a kind of joy in seeing something in a store and pulling out the cash to buy it for yourself.

Decades later, I still think that experience was really meaningful. At the book warehouse, you couldn’t help but watch the clock. An eight-hour day felt interminable. But now when I’m working on a movie, we usually work fourteen-hour days; an eight-hour day goes like wildfire. It’s nice to know that if I could load books for eight hours, I can handle acting for fourteen.

My parents weren’t wealthy, and they didn’t really teach us much about money. We just kind of assumed we’d have enough to get by, and we always had food to eat. My dad was a pretty old guy, and after he retired, I remember him trying to figure out how to make money. He hadn’t planned for retirement. So, without much guidance, it took me a long time to come around to the idea that you have to have a kind of responsibility with money, to keep an eye on it. To a certain extent, I still kind of struggle with it.

You sometimes hear about an actor whose business manager walked away with millions of dollars. I’ve learned to keep a closer eye.

My advice is for people to understand the basics—where their money is and how much is there. It’s tempting to hand off your finances and let someone else do all the work, to say to them, “Hey, you take care of it.” But it’s important to be watchful with investments and stay personally involved. You sometimes hear about an actor or musician whose business manager has walked away with millions of dollars that didn’t belong to them. I’ve learned to keep a closer eye. Understanding money may not be everyone’s idea of a good time, but it’s a necessary evil. If you’re a creative person who doesn’t understand money easily, you may not want to admit how essential it is. But ultimately if you stick your head in the sand, you’ll be sorry.

These days, I still like having cash in my hands—I never walk around with less than $200 or $300. In some ways, I’m still a cash-only guy, like I was in my restaurant days. There’s a kind of joy in seeing something in a store and being able to pull the cash out of your pocket and buy it for yourself.

I was outside of Tulsa, Oklahoma, not too long ago, and I Googled this giant guitar store in a tiny little town. It was closed for the day, but the owner answered the phone and said he’d open back up. I dropped by and found this beautiful old Gibson guitar. I had one already, but this one spoke to me—it was really special. It wasn’t particularly expensive—I was able to pay for it with the cash in my pocket—but it had incredible value to me. It’s important to me to invest in things that have meaning. It’s something I’ve already gotten a lot of use out of and am going to treasure for a long, long time.

As told to Davy Rothbart exclusively for Wealthsimple. Illustration by Jenny Mörtsell. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.