Money Diaries

Money Diaries: Government Shutdown Edition

Through the stories of three furloughed workers, we take the human measure of the shuttering of the U.S. government.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

Liz, Transportation Safety Administration, 37 Years Old

Salary: $50,000+

It’s not really a sexy topic for people; it’s not even on a lot of people’s radar.

I work for the Transportation Security Administration. I’m in an administrative office, not at a checkpoint. I’m 37 years old, and it’s going on seven years that I’ve worked there.

I make a little over $50,000 a year. Rent is $1,500 a month plus utilities. I cancelled cable last year; I’m only running internet. My dog just had surgery in December, and I had some health issues. Unexpected expenses can really take a toll. You do your best to squirrel things away, but once it's gone, it’s gone, and you have to start again.

I didn’t have a nest egg. I moved from out of state for the job, and probably wasn’t very well informed about the cost of living in the D.C. area. It’s one of the most expensive places in the country to live. When people say “living paycheque to paycheque” ... it’s one of those things I find myself doing seven years later because it’s very hard to get ahead. Somebody that I know on Twitter made a comment like, “Oh, you won’t be able to pay your nanny anymore.” I had to laugh at that. But there are those of us who really do believe in the work we’re doing as opposed to the financial windfall.

The hardest part is not knowing. It would be different if we knew it was ending in a week, or two weeks. There’s no guarantee we’ll even get back pay.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I deferred my student loans. I’ve got some credit card debt, but it is not too high. But depending on how long this lasts, we’re getting into “Am I going to be able to pay my rent?” territory. You start to think about where you can save. I turned my heat way down, little things like that — buying nonperishables, walking everywhere that I can because I don’t know the next time I can fill up the tank in my car.

I pay my bills on time. I always feel that my head is above water. But now, when it seems like government workers are being used as political pawns, the uncertainty is higher. I had just started with the TSA during the 2013 shutdown and the same thing happened. Most TSA officers start out part-time — it’s a probationary thing, and that 2013 shutdown hit me when I was part-time. I had no opportunity to save. I was living paycheque to paycheque. After three weeks, I sent my landlord’s management company at the time a letter explaining what was happening, and very shortly after that they sent me a note saying that the sheriff’s department would begin eviction proceedings if I couldn’t pay. When you have conversations with your creditors who say, “If you can’t pay me now, then when are you going to pay me?”… saying “I don’t really know” is not sufficient. After 2013 it became my goal: “I’m going to advance my career so this won’t happen again.” I didn’t ever want to be put in that situation again. I did everything I could, volunteering for overtime, so that if it did happen I would be better suited.

The tip letter from the government about how to cope with not getting paid was laughable. Barter chores? Even landlords have bills that they have to pay. There’s very little mercy out there. There’s a sense of humility that comes along with it. Being in my 30s and having to ask for financial assistance from people is really sobering.

The hardest part is not knowing. It would be different if we knew it was ending in a week, or two weeks. There’s no guarantee we’ll even get back pay. There’s too much uncertainty. I don’t know what my breaking point will be.

Len, Healthcare Policy Contractor, 44 Years Old

Hourly wage: $65, 20–30 hours a week

I’ve lived in D.C. for most of my life. I work in healthcare policy, and I was doing it for an organization here before I lost my job in August. Since then I’ve been doing work for the National Institutes of Health, the Centers for Disease Control and Prevention, the Department of Health and Human Services. I’m supposed to be working right now. I haven’t had any income since December 15. I’ve got hours billed for November and December that I haven’t been paid for yet. I’m owed $5,100!

I’ve gone through all of my savings. I’m lucky that my daughter is out of the house and I have an understanding landlord. It’s stressful having $17 in my bank account. But at least I don’t have to worry about feeding a child. At least for today, I don’t have to worry about eviction. I’m asking for little donations here and there. My brother helped me out and is making sure I can keep my cell phone on, making sure I have groceries. I help people for a living — helping to connect them with agencies that provide services. So for me, it’s really hard needing help and it’s hard knowing I can’t help people either.

Financially it’s draining, but also you just get bored. After a while there’s nothing to do but think about how screwed you are.

Recommended for you

Natasha Rothwell's Character in “The White Lotus” Finds an Angel Investor. Her Real Life Didn't Quite Work That Way.

Money Diaries

She’s a Toronto Legend, Model, and Style Icon. And She Was Nearly Homeless

Money Diaries

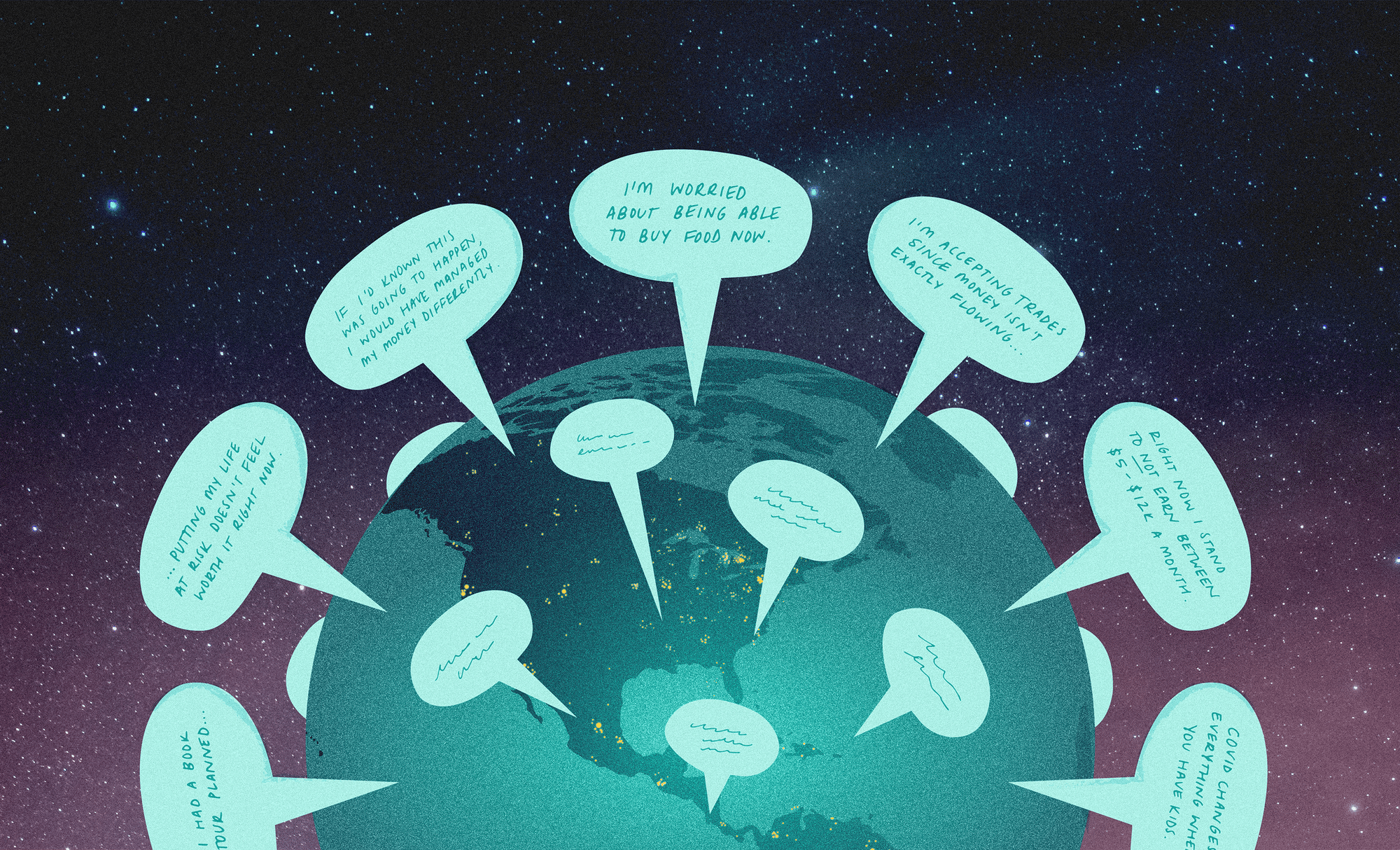

Pandemic Money Diaries — Panic at Trader Joe’s Edition

Money Diaries

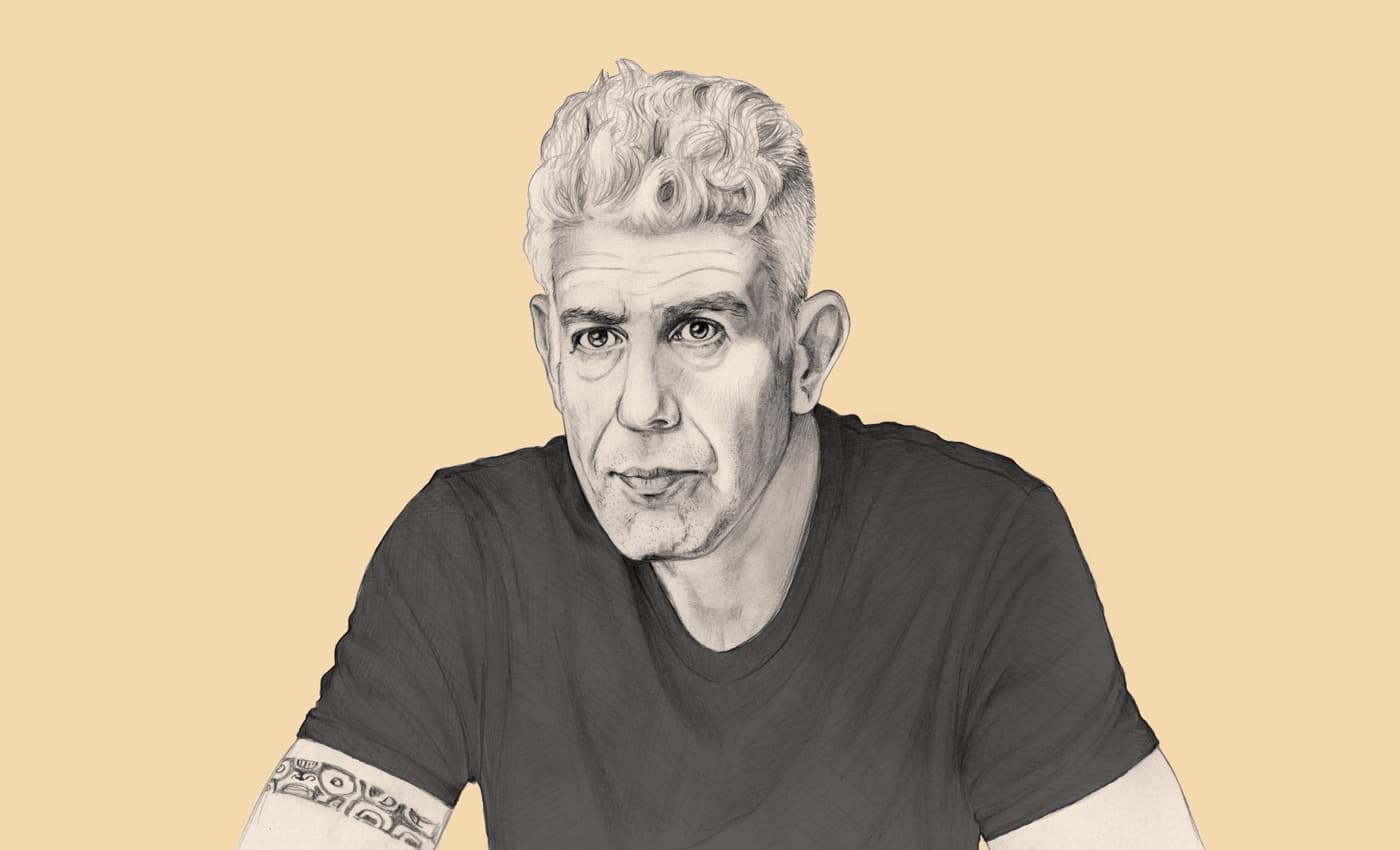

Anthony Bourdain Does Not Want to Owe Anybody Even a Single Dollar

Money Diaries

I’ve got student loans, credit card bills … there’s not much more I can say to them than “when I get it, you’ll get it.” I’m just trying to get through the day-to-day stuff and wondering how the hell I’m ever going to catch up. And from my experience working in government for a long time, I don’t see any end in sight. I don’t know what’s going to happen to us. I’ve been told that if the government is open by February 15, I should get a cheque by March 1, but March 1 is like a million years away. I have no idea about the work that I was going to have in January. I really have no idea.

One of my 2019 goals was to improve my credit, and by 2020 look into buying a house. If I wasn’t able to buy a house, I wanted to at least enjoy my life, travel, have a credit score that allows me some freedom. Now it’ll be good if I am caught up by the end of the year instead of being ahead like I was hoping.

Everyone affected is being really helpful to one another. I know a lot of federal contractors, and everyone is really stressed. The contractors are just screwed. But we’ve been a village. There have been times where someone has said, “Let me buy you a drink, just to get you out of the house.” I’ve offered to help out colleagues in difficult situations — I could watch their children if someone needs to drive an Uber. Financially it’s draining, but also you just get bored. After a while there’s nothing to do but think about how screwed you are.

Amy, NASA Employee, 36 Years Old

Salary: $100,000+

I live in Houston and work at the Johnson Space Center. I’ve been with NASA for about 10 years, straight out of grad school. I do mission support function; I’m not a technical engineer or scientist.

I’ve got student loans, revolving debt, a mortgage. I’m the single earner in my household. My husband and I have two kids. One is in elementary school, and one’s almost 3. The 2013 shutdown was tough because our oldest was in day care and that’s expensive. Now they’re in public school. It’s been more challenging from a parental standpoint because my youngest is getting used to me being home, and I can already feel the separation anxiety.

Our credit union is really great. It’s offered 0% interest loans for individuals who are affected. We have savings. After the 2013 shutdown, we started paying more attention to our savings because it was a little nerve-rattling for us. But since we don’t know how long this is going to go on we made a decision to leave our savings alone and went ahead with the loan. I think the 0% interest is only for two or three pay periods, though. Where we live it’s a lot of folks employed by NASA, so the community has really banded together.

It’s frustrating because I keep hearing “enjoy your time off” from people who aren’t familiar with what’s happening and think this is a paid vacation.

We’re not re-upping our daughter for an extracurricular activity that she is involved in, because you need to pay for six months in advance. Home-improvement things are paused, and we’re hoping the quotes we got will still be honoured. Most of the people I’m talking with are making similar trades. It’s frustrating because I keep hearing “enjoy your time off” from people who aren’t familiar with what’s happening and think this is a paid vacation.

We’re not guaranteed to get back pay. It has to be signed and factored into the final appropriations that come through. And still, it doesn’t happen until we actually go back to work. I’m betting at this point that we are going to miss two more paycheques. That’s what me and my husband are planning for. We probably have about three months’ worth of expenses in savings, but that’s basics, paying the bare minimum on everything.

I’ve been staying in touch with colleagues. We are a pretty tight-knit group, so we are reaching out to everyone, checking on certain people. We’ve got a couple people who headed to their parents’ homes and are eating their food, or have gone to visit family to get a change of scenery and more of a support system.

Everybody is quite bored. To be honest, I’m doing a lot of cleaning up, organizing, and tidying. You’re kind of trying to figure out what you can do with what you have available. We just kind of hang out at home and try not to spend money. I’ve taken the Amazon app off my phone! But with this particular president, I was anticipating this. The writing was on the wall.

As told to Danny Gold exclusively for Wealthsimple; transcripts edited and condensed for clarity. Illustration by Sammy Yi.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.