Money Diaries

Mark Duplass Will Fund Your Movie (and Maybe Buy You a House)

In an entertainment world increasingly ruled by a small cadre of companies, Mark Duplass believes in ownership – whether he’s financing a movie or buying his babysitter a house.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

Money plays a huge role in my creative process. I tried to make some studio movies with studio money and it was very difficult to do exactly what I wanted to do; when there is more money involved the studio gets more concerned about whether it’s going to be commercial. So it’s a fear-based process. I didn’t like it. I can’t function creatively in that environment. Now, I am only making things that can be made so cheaply that I can pay for it myself and even if it stinks I know I can still make my money back, but also has tremendous upside if I happen to hit it out of the park. So, when I step up to the plate all I have to do is bunt and I’ve won. Creatively, it has freed me up wildly. It’s that sense of play I’m constantly looking for, that sense of my brother and I when we were kids and picked up our dad’s video camera. As opposed to, Oh my God, I got all the money and if I don’t execute this I’m going to be a failure. My fuck you to the industry is: I’m going to make something myself for 1/100 of the price that the studio would have had to pay for it but I’m going to sell it back to them for what they would normally spend.

My therapist says, “You were lucky to be raised in a household where you were told you can do anything you want.”

My grandfather was a guy who dropped out of high school in ninth grade, would steal tires off of cars and sell them. He eventually bought a truck and started a laundry business, and he built it from the ground up and raised his family from the lower class to the middle class. My dad was able to get into college and became a lawyer — took us from middle to middle upper class. My brother Jay and I have that traditionally American value that: you make the buck and save your buck.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I was a musician for a long time. I was in a moderately successful band with a small record deal. We would tour around the country 180 days out of the year and share $160 a night amongst three guys. It was just brutal. And I remember I had this moment where I was sleeping on someone’s dorm room floor in Michigan, and I was reading the biography of Che Guevara, and there is a moment where Che and Raul and Fidel Castro all get on a raft and go to Cuba to start the revolution and they were 27, 27, and 31 years old. And me and the other two guys in my band were 27, 27, and 31. I just said, “There has to be more than this.” And I gave it up.

And at the same time our first movie The Puffy Chair had gotten into Sundance. We made it for like $10,000. It was an easy way for me to just put the music aside and jump into the movies. I didn’t look back.

As a musician I came around at the wrong time. Everyone could make records cheaply on their home computers in the early ‘90s and the people who were there in that time when the technology arrived thrived. I was too late. I was in that flood of cheap records. It was overloaded, too much content, and no one cared. Also, I wasn’t that great. But I came around movies at the perfect time. I was 27 years-old when the first $3,000 dollar Mini DV camera came out that shot 24 frames and allowed you to make something dirt cheap that looked like a real movie. If I made The Puffy Chair today, I don’t think it would get into Sundance and do what it did for me.

I just happened to be there. It makes you feel that it’s that fragility of life. The feeling that, “Oh my God, if I had not been at the subway at this right moment in time I wouldn’t have met my wife.” I feel that way about my career. I am so lucky.

I have really seen firsthand the whole rich-get-richer thing.

We sold The Puffy Chair to Netflix and Roadside Attractions and when all was said and done made about $150,000. That was a nice profit. Since everybody on the film mostly worked for free, we shared about 50 percent of our profits with the cast and crew.

Recommended for you

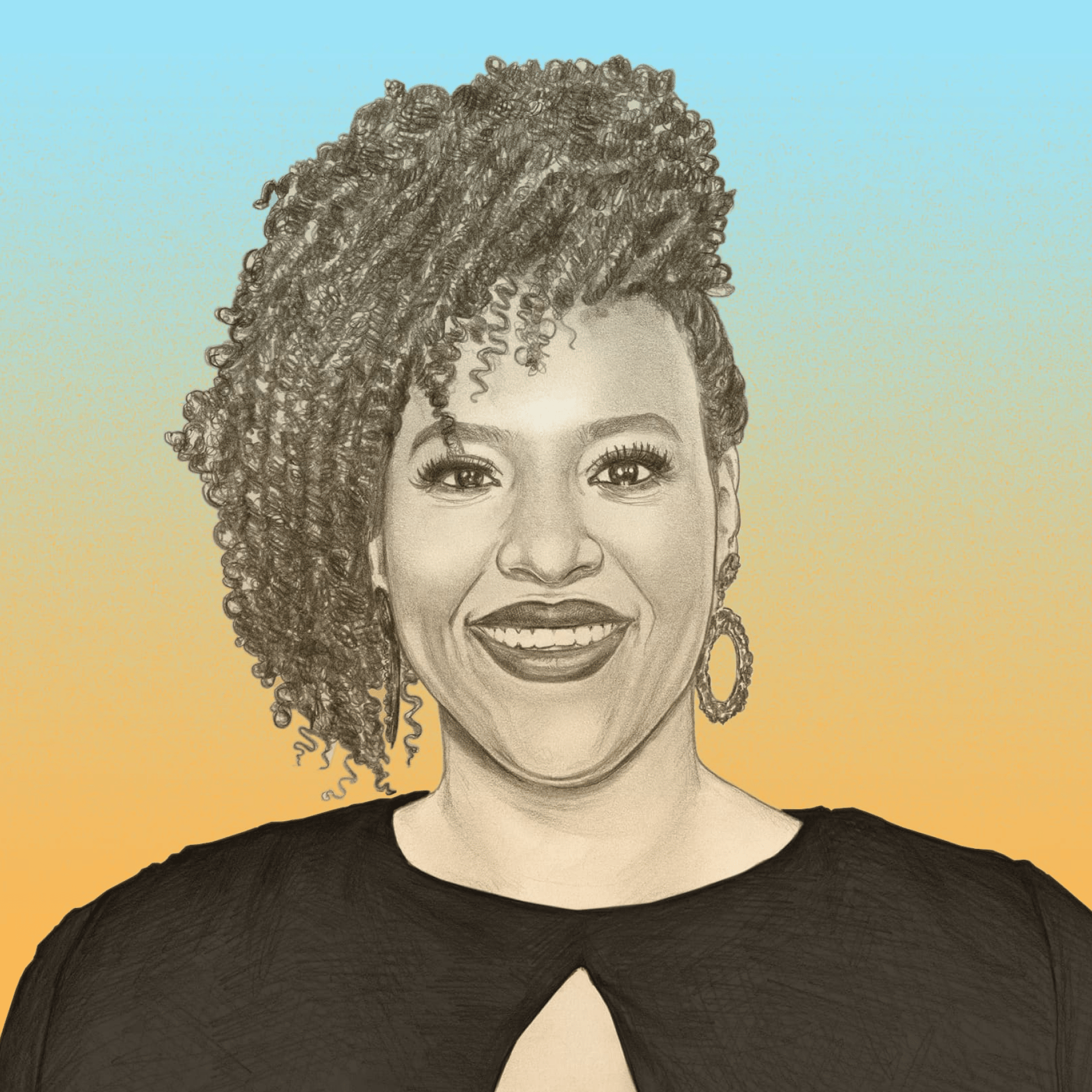

Natasha Rothwell's Character in “The White Lotus” Finds an Angel Investor. Her Real Life Didn't Quite Work That Way.

Money Diaries

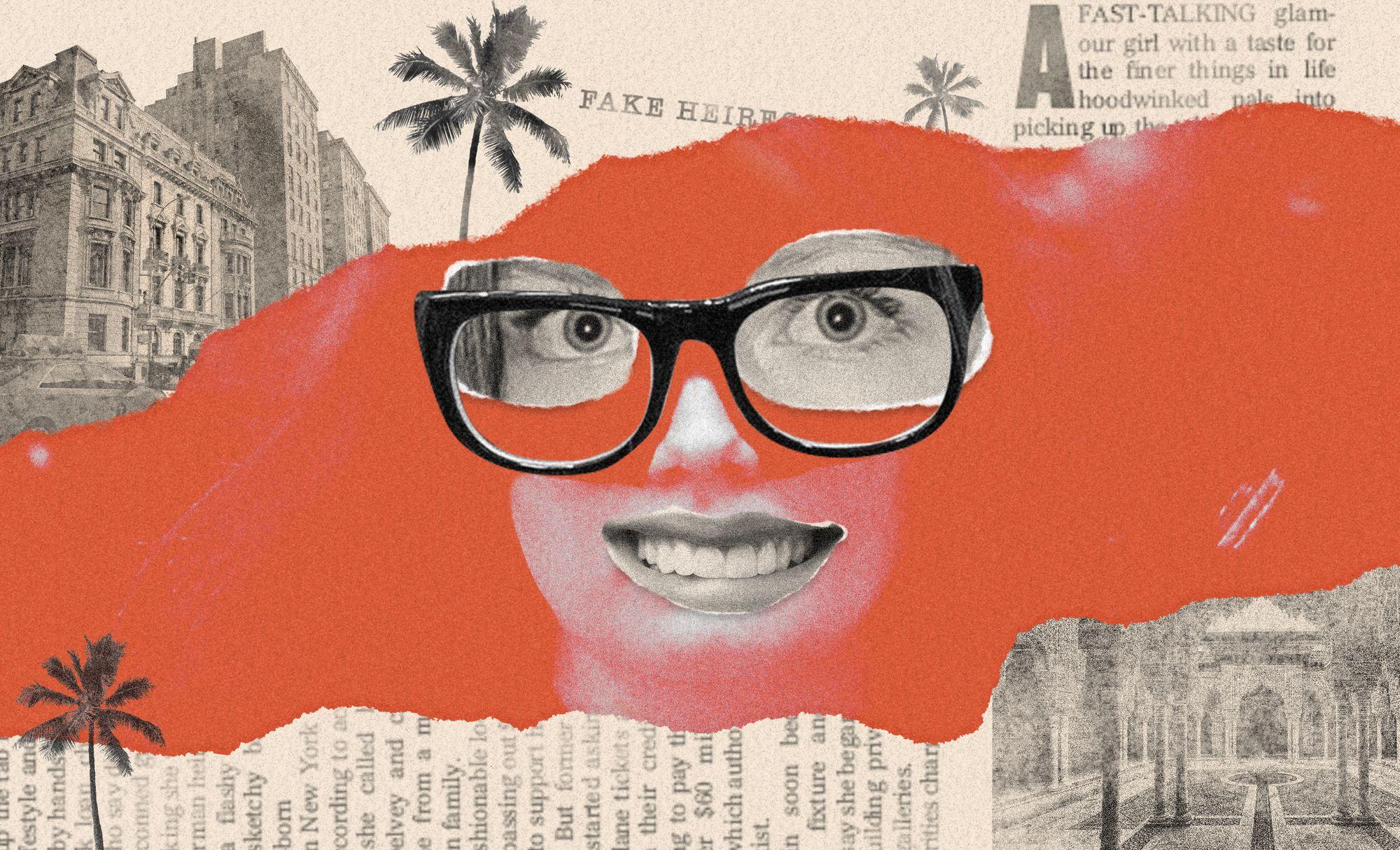

How I was Conned by the “Fake German Heiress”

Money Diaries

Roxane Gay on Financial Independence: 'The Most Important Thing a Woman Can Do for Herself'

Money Diaries

Stories From Our New Economy: Bullish on Bidets Edition

Money Diaries

We have kept that little creative and fiscal communism model going on.

When it comes time for me to make a movie, I write a script that would normally get made for $2 to $5 million dollars in the studio system. But I cut all the expensive things out of the script while keeping the beating heart of it. Instead, we make it for $100,000of my own money. I pay everybody $100a day, whether you’re the director, an actor or a PA. But everybody is going to have a piece of the movie, and when we sell it at Sundance or another festival we all share the profits. Sometimes those movies only sell for $300,000. But sometimes they will sell for $5 million and everybody scores. The thing that is tricky about that model is you’ve got to be willing to hang lights. And I know a lot of directors who are done with that, who don’t want to get their hands dirty or feel like they’re in film school again. I get excited by it because it makes me feel like I’m still young, and I miss that feeling of scraping around with my friends. That process still genuinely excites me.

Now young filmmakers come to us and say, “I have a movie idea. I can make it for $10,000.” I just tell them candidly, I can’t be your producer. I can’t give you the time and attention that you need, because I’m already a workaholic and I need to spend time with my kids. But I will give you $10,000 and if you shit the bed then it’s just a write-off for me and I only lost $5,000. But if you sell it for $100,000 at Sundance just pay me my $10,000 back, no interest, because you worked so hard, it’s yours, and congratulations. Because that’s what our parents did for us. They basically lent us $10,000 dollars to make The Puffy Chair and it’s why I am standing here. If I didn’t have that, I wouldn’t be where I am.

I am very conservative with my money. I fly coach and I drive a Toyota and I don’t like spending money on anything that goes away. So, I live in a big expensive house, because I know that that will appreciate in value. When I’m buying furniture I don’t want to go to Restoration Hardware where you’re going to buy a $6,000 table that loses its value. I’d rather spend $10,000 on the vintage piece that will hold its value. So I’m a very traditional kind of 1940s guy who is going to invest and let it appreciate. I’m just built that way.

I do have an unhealthy relationship with money in that I do ridiculous things like spend an extra hour on my computer trying to get a flight that is $240 instead of $273. I need to put my time elsewhere. And I did make one large silly purchase. I spent $20,000 on an outdoor infrared sauna for my house, but I was able to justify that by saying I’m a workaholic, I need a place that I can relax, and I was really sold on that whole it purges toxins on a cellular level. In my mind I was like, “If cancer is coming, this will help get the cancer out!” I think I succumbed to the advertising on that one; I don’t understand it, but it sounded great. I use it all the time.

I like to invest in the stock market, in things I feel I know well. I got into Netflix really early on and got lucky on that. And then I bought into Twitter, because I was sure that was going to score, and then I lost a bunch of money on that. Friends of mine who have been in this financial class for a while that I find myself in now like to give me advice. They say, “Oh you should go to these people who invest your money, and because you have a lot of it now they’ll give you really premium investments.” And now I have some investment people. I get access because I have enough money to get in there. So I have really seen firsthand the whole rich-get-richer thing.

We’re very close with our nanny. She helped us raise our children, we love her, and she was spending too much money on rent in Los Angeles, and so I couldn’t help thinking that I had this money in the bank and I wanted to help her buy a house. So, we were trying to find all these ways to do it, I thought maybe I’d lend her some money, but that gets yucky, because people feel like they owe you something. So we decided to try an experiment, this zero interest loan idea. We bought her a house for about $500,000 cash, and now she just pays me what she’d normally pay for rent and it goes against the price of her house. It’s like rent to own. The house needed a lot of work and she was excited to fix it up, so over the last four years that $500,000 house is now worth $750,000. So she has this $250,000 of equity that is all hers, and whenever she is ready to refinance she just cuts me the $500,000 to buy me out, and then has a mortgage and owns the house.

The recent regime change has changed in my relationship with money. I don’t like giving Trump my money, so I stick it where he can’t get to it. I give a lot of money away, about 10 percent of what my wife and I make. And lately I am putting even more away in these donor advised funds, which are a lot like foundations but without the headaches. Now the government can’t get 50 percent of my money and do things that I don’t align with spiritually. If I’m making a dollar, I would rather give the whole dollar away to someone who might really need it.

As told to Errol Morris exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.