Money Diaries

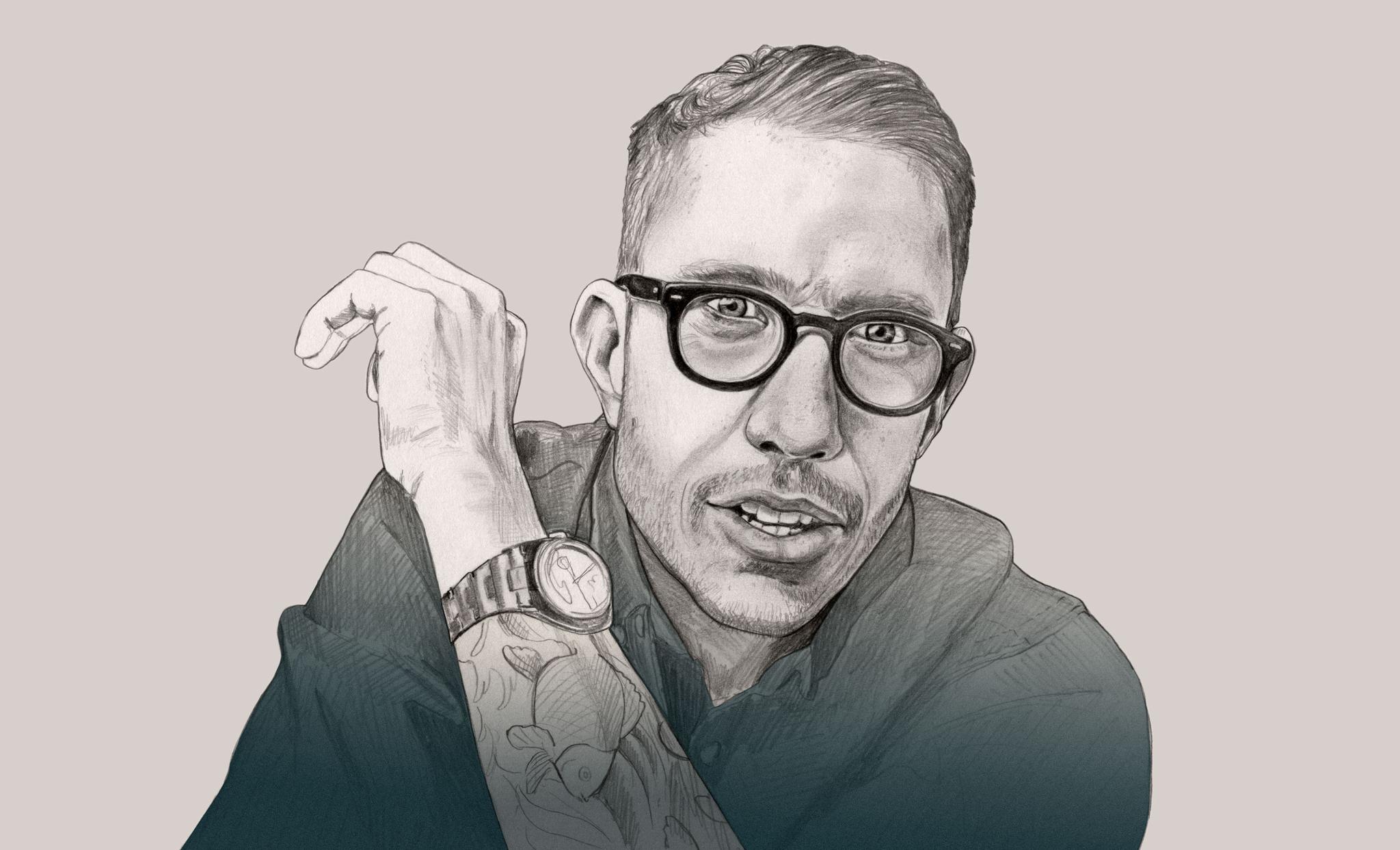

“I Created the Most Famous Hairstyle Ever, but I Couldn’t Even Pay My Electric Bill”

The most important things Chris McMillan —the hairstylist who makes people like Jennifer Aniston and Kim Kardashian look good— learned about money, he learned when he was a crack addict.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives.

I was bad with money. If you want to know how bad, let me tell you about Oscars night, 1998. I’m a hairstylist, and that night I did Helen Hunt’s hair for the awards show. Afterward, I went home to watch the show, but my electricity had been turned off. Yes, I was making hundreds of thousands of dollars a year, but I couldn’t pay my electric bill. So I went out into the hallway of my apartment building, snaked a power cord back up to my door, and sat on my shitty Salvation Army couch—at this point, I owned almost no furniture—to watch the show. I remember lighting up my crack pipe, watching Helen Hunt’s acceptance speech, and thinking, Her hair looks great.

The lesson here might be an obvious one, but it’s one I had to learn: It’s not easy for a crackhead to save money. No matter how much money I made when I was an addict, I never had anything.

This was the 1990s. I’d been doing hair for a number of years at that point, and I had a pretty good reputation. Frankly, I was doing better than I’d dreamed I’d do. I was doing photo shoots for fashion magazines. I was styling hair for awards shows and movies and guest visits on late-night talk shows. I had become kind of famous because I’d created a haircut that became known as The Rachel on the actress Jennifer Aniston when she was on Friends (she ended up becoming one of my closest friends). That had been a shocking thing—to watch it become arguably the most famous haircut in 50 years.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

But in the midst of all that, the dark, ugly secret of my life was that I was also an addict. Crack, weed, cocaine during the day, booze at night so I could sleep or at least come down from the uppers. I would fly all over the world doing famous women’s hair. But when I landed in L.A., I always made sure my dealer was waiting for me so I could get high right away. Because I couldn’t wait. As anyone who’s been through addiction can tell you, my addiction became the bottomless pit I was always feeding. If I had $100, $90 went to crack, a few dollars went to cigarettes and a 40-ounce beer, and I’d spend $.99 for two tacos at Jack in the Box. Occasionally, I would give my brother money to invest for me because I knew enough to know that I couldn’t trust myself.

I continued to work, but things began to change for me. My reputation became, “Yeah, he’s good, but will he show up?”’ I missed plenty of great jobs because I was off getting high somewhere.

Then October 14, 1999, happened. It was a Thursday, around noon. I stopped at a 7-11, got money out of the ATM, and met my dealer on the corner. Normally I would have waited to smoke, but I was particularly edgy this day. I took out the tiny white rock, put it in my pipe, and fired up right there in the driver’s seat of my Porsche. That was the paradox of my life: I was a crackhead with no money in my checking account and no electricity who also drove a Porsche.Cars have always been my weakness.

As I exhaled, I saw two cops walking toward me, one on either side of my car. My mind went blank. I hit the accelerator and took off. I flew through Century City and raced toward downtown Los Angeles at full speed. Suddenly, there were lights everywhere—police cars behind me, more on both sides of me, another pulling ahead of me. I veered onto a sidewalk, and I narrowly missed mowing down pedestrians. By the time I crashed through someone’s fence and into their front yard, there were six police cars trailing me. I jumped out of my car and took off on foot. That’s when I saw the helicopters. Man, did I run. But it’s not that hard to outrun an addict. A few seconds later, two policemen grabbed me and threw me in the backseat of a squad car. I was six feet two inches, and I weighed only 140 pounds.This was rock bottom.

As long as I’m sober, I’ll feel pretty rich.

Recommended for you

I realized that I had nothing. No money, no furniture, no house. Nothing. But I understand now that the problem wasn’t that I didn’t own anything. It was the feeling that I was out of control. That no matter how much success I had, no matter how much money passed through my hands, no matter how many famous people kissed me on the cheek, none of that could save me. I’ve been sober ever since.

And when I became sober, I was starting out from zero financially. I was working in someone else’s salon for a while. I had to spend time rehabilitating my credit so I could find a bank that would give me a credit card. But every week, I saved. It was amazing how much I could save when I wasn’t doing drugs. Eventually I opened a salon. And about ten years ago, I started having the career I could have had a decade earlier—working consistently with magazines and catering to a regular celebrity clientele.

But I also realized that I didn’t understand money at all. I had this mountain of money in the bank, and not only did I have no idea what to do with it, but I realized I was intimidated by it. Every time I looked at the balance, it stressed me out. And if there’s one thing sobriety has taught me, it’s when to ask for help. The best investment I ever made was hiring a business manager. He invested my money, took care of my taxes, started a pension for me, and made sure all my bills were paid. He explained to me that it wouldn’t take long for me to actually own my own home. I bought my first place within a year of hiring him. People probably think my business manager is a rip-off.And he did cost more than my mortgage at the time. But he’s worth it to me. He’s helped me feel like a grown-up.

Once I had money, I started buying art, which has also turned out to be a great investment. Early on, someone gave me two bits of wisdom: Only buy what you like, and only buy what you can afford. It was great advice. I bought a photograph called The Birds by Alex Prager, which I love and which has increased in value. I own a Warhol. I bought paintings by an artist named KAWS, and they have quadrupled in value. Art is tricky because you never know if you’re getting ripped off. But the more you do it, the more you learn and the more you know.

Of course, not all my investments have been wise. As I said, I have a weakness for cars, which are dumb ways to spend money. I once paid over $130,000 for a Mercedes-Benz G Wagon, which could only be driven from gas station to gas station because it was such a guzzler.

Now I am a little addicted to saving. I love taking money out of my paychecks and putting it somewhere and never seeing it again. And then spending the rest with a totally free conscience. If I earn $1,000, I might spend a quarter of it on shoes and a great dinner. But the other 75% I save.

I’m not going to tell you that I don’t love nice things. I do. A lot. I still like cars even though they’re dumb. And I love seeing how much money I have in the bank. But the truth is that I’m not afraid of having nothing anymore. Because I’ve had nothing before. And as long as I’m sober, I’ll feel pretty rich.

As told to Danielle Pergament exclusively for Wealthsimple. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.