Finance for Humans

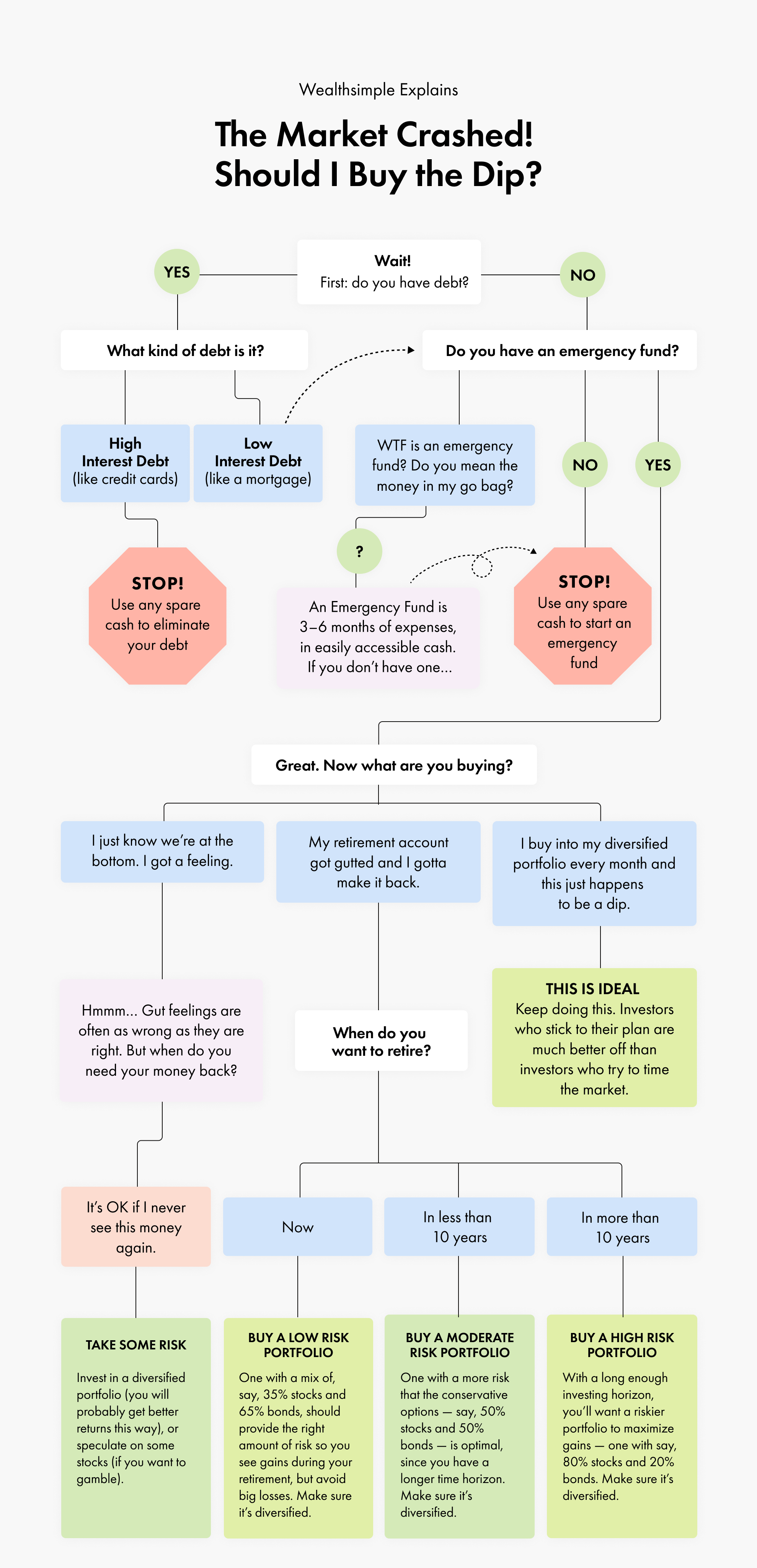

Wealthsimple Explains: The Market Crashed! Should I Buy the Dip?

When the market dips, people start to wonder: is now the time to buy? Here's our answer.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Markets are down, which might make you wonder if you should do that trendy thing: buy the dip. Buying at a low point is, of course, a brilliant idea. But it can be harder than it sounds. For one thing, you actually have to know where the bottom of that dip is. One of our ironclad pieces of advice is: timing the market usually doesn’t work. But that doesn’t mean you shouldn’t try to do it, it just means that there are some rules to getting it right. Here’s how to figure that out (hint, the answer lies within.)

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.