Finance for Humans

How & Why to Break Up with Your Financial Advisor

They might be nice and have a cool business card and wear comfy sweater vests, but they are probably charging you four times more than they need to for things you don’t use. Here’s how to know if you really need your friendly neighbourhood financial advisor.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

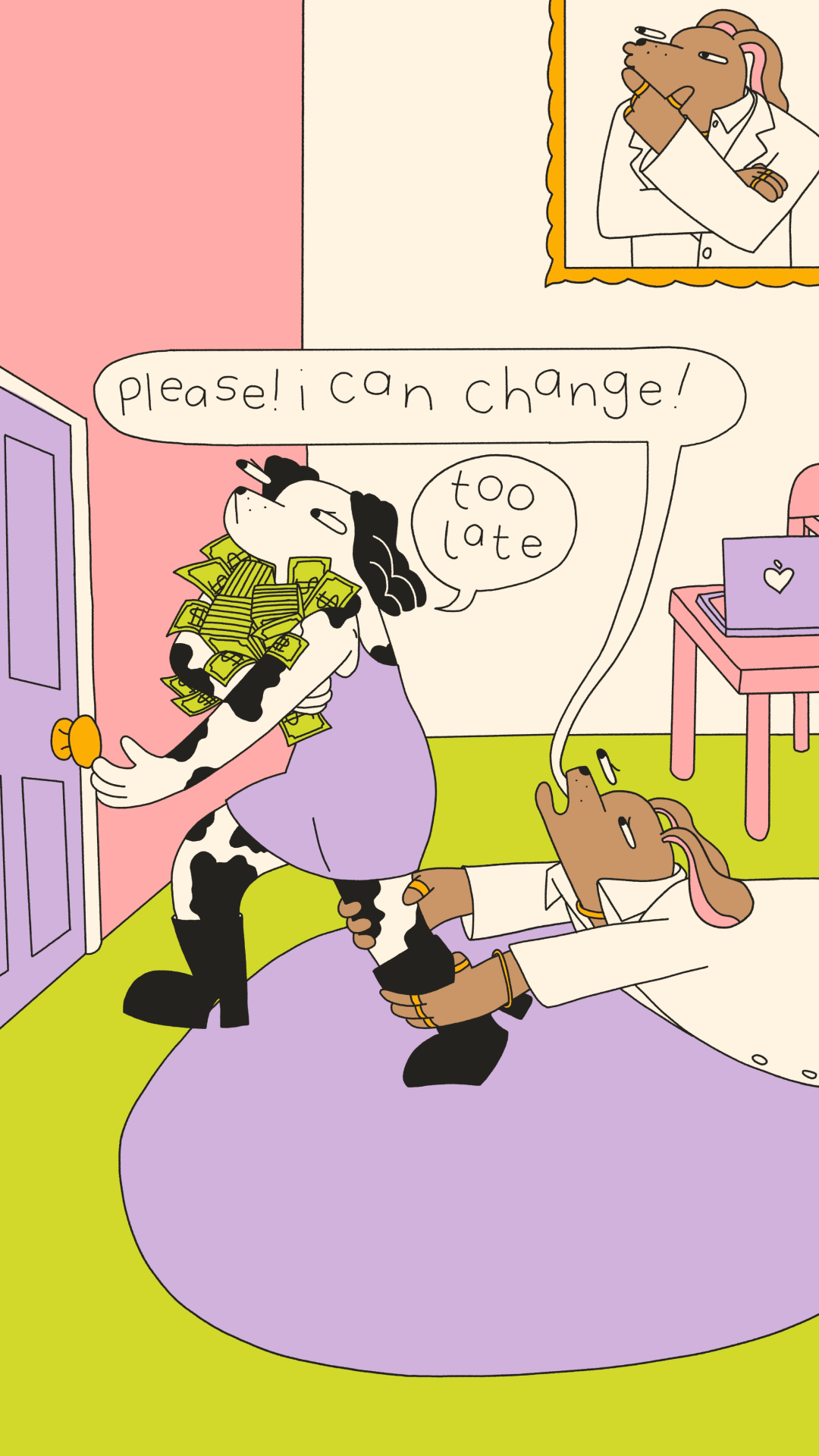

Breaking up is so hard. Right? You have to say, “It’s not me, it’s you,” in a way that seems totally convincing. You have to sit and hold hands all night crying and get back together again three point five times before it really works. Unless the person you are breaking up with is a financial advisor. Then all you need to do is send a short well-worded email. She, or he, will be cool with that. This is a non-emotional person by trade! And they probably have 847 more clients anyway.

Know Why You’re Breaking Up

Now that you know it’s easy, it’s time to get to the reasons why you should break up with your advisor. Because while advisors are definitely a good call for people in certain financial situations, for a whole lot more of them the reasons to move on are more than compelling.

1. They took your retirement savings and flew to Aruba with your spouse.

Ok we’re kidding. This is probably not the reason. Unless they really did, in which case: it’s for sure the number one reason.

2. The fees are out of control.

Financial advisors tend to charge flat fees based on “assets under management,” which can be anywhere between 1%-2%. That means if you have $100,000 invested with an advisor, they might charge between $1,000 and $2,000 per year. That’s a lot. If you don’t think it’s a lot, consider this: over the course of your lifetime, an extra half a percent will likely cost you upwards of $120,000*. High fees are simply the enemy of smart investing, and it’s one thing (unlike the fluctuations of the market, for instance) you can control.

And advisors aren’t the only game in town. Wealthsimple Invest charges a fee of 0.5% for accounts with less than $100,000 and 0.4% for accounts with more than $100,000.

3. You don’t even know if the fees are out of control.

It’s hard to even know what you’re paying in fees. Banks, investment companies, advisors and most other entities that manage your money all seem to have different fee structures and they’re all confusing. That’s often by design. Because when you do the math (once you’ve finished your degree in math) you’ll see they’re pretty high. See rule number two.

That’s why we at Wealthsimple aim to be as transparent about fees as possible.

We asked Wealthsimple advisor Michael Allen what to look for to see if you’re being taken for a ride. “If, after your introductory session with your financial advisor, you’re coming across fees they didn’t tell you about, that’s not a good sign,” he said. “The advisor is supposed to be protecting your money; you shouldn’t have to feel you need to protect your money from your advisor.”

4. You’re not getting any value for those extra fees.

There are basically two reasons you might want to pay higher fees in order to have a financial advisor. The first is because they’re providing services that you can’t or don’t want to do yourself. The second is that they’re there to hold your hand on demand, any time, for any emotion.

Let’s tackle the first one. The biggest reason a lot of people think a financial advisor is worth it is that they are providing superior returns. This is a fallacy. Reams of data across the history of markets prove that investors who follow a strategy of tracking the broader market (like Wealthsimple Invest portfolios do) have better results than investors who have someone picking and choosing stocks and other investments. (There are other, better reasons you might need a financial advisor — like that you need someone to actively ensure you’re properly covered when it comes to estate planning, insurance needs, budgeting, debt management, charitable giving and tax planning. You just need to be sure you actually need that stuff, and you’re getting it.)

If the main reason you want a financial advisor is the second reason — to always be there, on the other end of the line, to be reassuring and calming and answer every question you have when you have it, because over time you’ve actually become good friends — it might be good to have one. You just have to decide how much you’re willing to pay for that, and how much hand-holding your advisor actually does.

Wealthsimple Invest, we hasten to note, is basically the same as a financial advisor. We design portfolios tailored to your goals and financial situation, our advisors all have years of experience managing high net worth clients, you can call us to answer questions whenever you want, and we often wear nice sweater vests. We’re just a lot more efficient.

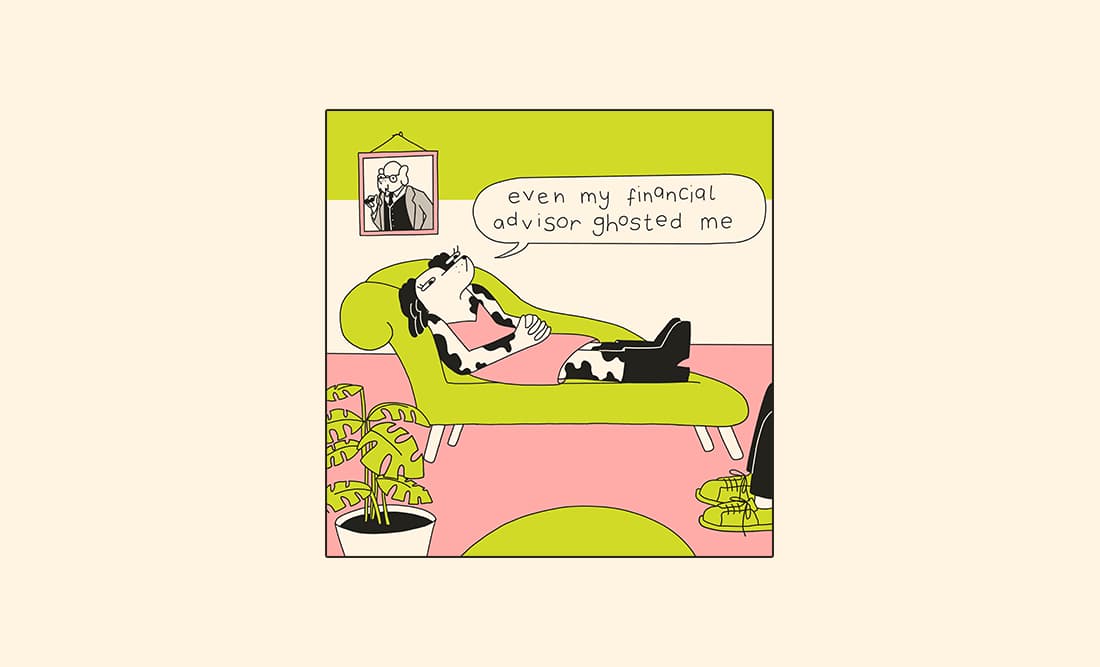

5. They’re ghosting you.

Which brings us to our next point: if you’re paying for hand-holding, but like, no one’s holding your hand, is that a good value proposition? The fact that advisors are often way harder to reach than they say they will be is one of the most common reasons people do stuff like Googling “how to break up with your financial advisor.” So welcome, Googlers! If you’re googling that, it’s a pretty bad sign. And if you’re sensing you’re not getting their full attention, it’s always a good idea to ask how many clients your advisor has — the answer may be surprising.

“It’s usually a bragging right for a financial advisor to say, ‘I have 2,000 clients that I manage,’” says Allen. “Titles like Director, Vice President, Executive Vice President, Managing Director, Chairman usually have nothing to do with how many people work for you. It’s about how much revenue they earn each year. And I can tell you that if the size of your portfolio isn’t in the top 10% of their clients, you’re not going to be getting much service.”

6. You realize the advice you need isn’t actually personal.

The trick to most financial advisors is to offer cookie cutter advice in a human wrapper. Ask yourself, does the advisor with 2,000 clients have time to painstakingly create and manage your portfolio? The truth is, for 99% of us, our financial situation is like an algebra equation based on income, expenses, and goals. A well-programmed digital investment service can use that equation the same way to make an investment plan just as tailored to your situation. And as inhuman as a digital advisor seems, that very fact about it means you’ll avoid the common pitfalls of human error when it comes to financial advisement — and most have support available around the clock.

7. You realize the personal advice you need is advice you’re not getting.

We think that the smartest investment strategy is mostly the same for everyone (track the broader market, don’t pay someone to pick stocks, keep fees low), with risk dialled up or down depending on how comfortable you are with fluctuations and your time horizon. But there are some good reasons to have an advisor in your corner. A complicated tax inheritance situation, for instance, or you want a completely hands-off approach to your financial life, or you need lots and lots of contact for emotional and/or transactional support. Most of us don’t need that stuff, in which case it’s likely you’re wasting your money paying high fees for an advisor. It’s always a good idea to pay for what you need and not for what you don’t.

8. You realize the reason you’ve made money recently is that everyone’s made money in this market.

If your advisor is taking special credit for a market that’s boosted nearly every portfolio considerably, then your advisor is selling you a bill of goods.

What Happens Next

Before ending things with your financial advisor, set up all the accounts with the institution that you’re delivering those assets to. As Allen says: “Have your transfers ready to go. A lot of clients we speak to initiate the transfers first, and then they speak to their financial advisor because it usually takes 48 hours for the advisor to be informed that the assets are transferring out. So the client has a timeframe of about 48 hours to kindly end the relationship. That way, there’s no fumbling of any transfers.” And that means you have an ironclad reply if the financial advisor tries to keep your business. It’s just too late.

*This figure assumes an initial investment of $100,000, a $10,000 annual contribution thereafter, 5% rate of return, and 1.05% management fee over a 25-year period.

Alex Beggs is the senior staff writer at Bon Appétit. She only plays with Monopoly money.