Finance for Humans

Ask Lizzie: Can I Personal Finance My Way Out of a Career of Discrimination?

Lizzie got a question from a friend: if you sense you've been the victim of pay discrimination, what do you do? Which begs the question: how do you even know if you're being underpaid, how do you ask for more, and why is it up to you to solve this problem in the first place? Here's what she says.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

”How do I overcome pay gaps based on race and gender?“ – Karen K. Ho

Dear Karen,

Oof. Oy. Oh my goodness, Karen. This is a blisteringly simple question with answers that are anything but. So, I’m going to step outside my “Ask Lizzie” persona for a second.

So, hello, everyone.

I wanted to know more about Karen’s question, and to ask her a few of my own, so we spoke on the phone. Karen, who is from Toronto and lives in New York, is a reporter at Quartz (and, full disclosure, has done freelance work for Wealthsimple). Because she’s covered business, Karen already knows a lot of the things that people are supposed to do to get ahead. She networks, goes to journalism conferences, and keeps up a social media profile. She also knows, because she has covered economic inequality, that as a woman of colour, she’s still likely to be paid less than a white man doing the same job. And all of this is exhausting, she said. “It was just constantly feeling like that Ali Wong line, ‘I don’t want to lean in, I want to lie down.’”

And then Karen said something that will stay with me for a long time. “The thing that is difficult about personal finance,” she explained, “is that you can’t personal finance your way out of systemic discrimination.”

You can’t personal finance your way out of systemic discrimination.

I don’t know if I’ve ever heard something so succinct, painful and true.

But! This is the point where I’m going to put my columnist hat back on. Because while there are a lot of things you can’t fix, I think we might be able to come up with some things you can do to affect some change. Some mitigation strategies. Roadmaps for navigating the unexploded ordnance field that is getting paid what you should when you’re a woman, person of colour, or both.

That the onus to fix this should fall on the people who are being discriminated against is, well, deeply unfair and depressing.

First things first, because I want to be clear about this. Pay gaps are real. Even in Canada, where it is illegal to pay women less than men, the data shows that Indigenous women earn an average of 35% less than non-Indigenous men—about 65 cents to the dollar. Women of colour earn an average of 33% less than white men—about 67 cents to the dollar.

Often, when writing about pay gaps, I encounter the claim that women choose less lucrative careers, and that explains the differences in salaries between genders. That. Is. Not. The. Case. While choice plays a role at the margins, when you use median earnings or control for hours worked and education, the gaps persist. Education and opportunities play a large role, but even then, a significant body of research shows that discrimination itself causes real economic loss.

Canada has actually seen the gender wage gap narrow in recent years, while in the U.S., progress on closing wage gaps has been slowing in the past decade.

With that out of the way, let’s talk about what to do. I want to note the problem with the very nature of this column: that the onus to fix this should fall on the people who are being discriminated against is, well, deeply unfair and depressing. Many women and people of colour are already tap-dancing backwards over a moat filled with alligators in their professional lives without adding one more semi-impossible thing to juggle.

And yet, this is the world we live in and we can’t abide by the status quo. Hence: column.

I suspect many of our colleagues might run away screaming if we asked them what they make. Yet salary transparency is one of the best ways to begin to change things.

1. Be Smart With the Money You Have

Recommended for you

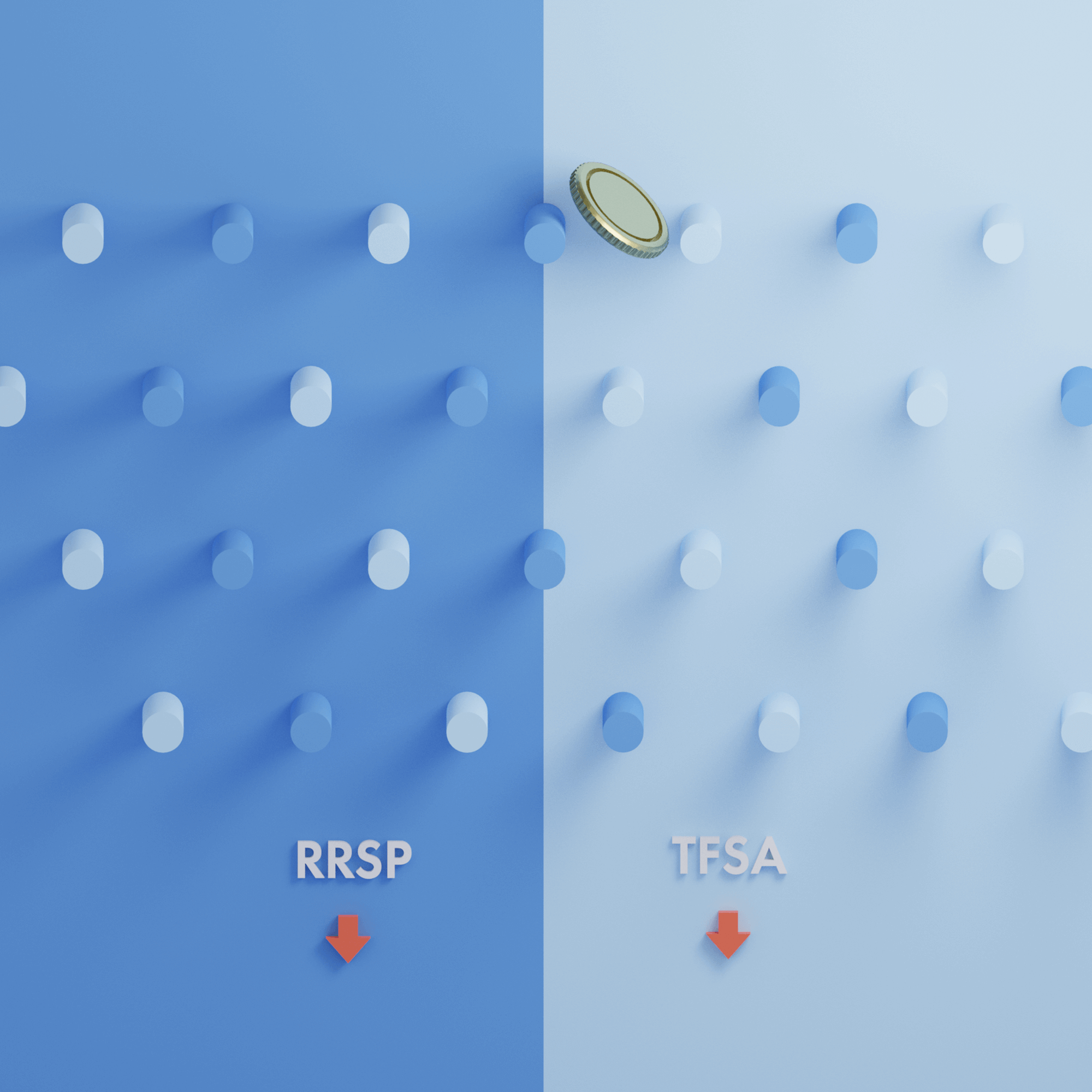

The first piece of advice I have is purely financial: save as much as you can as early as you can. I say this because when you are faced with wage gaps, it’s even more important to set aside as much as you are able, so that you have something to fall back on if needed. Even if it’s the tiniest amount, it matters. And, if you have any sort of employer retirement program match, take it! Free money! It will do nothing to unwind discrimination, but it will allow you to reap the benefits of compound interest (even if you make more money later, the one thing you can never, ever get back is time).

2. Get Some Data

Now, let’s get at the tougher question of how to figure out if you’re being paid fairly (or how to fix it if not). I think many of us have had a scenario where we suspect this isn’t the case. Some years ago, in fact, I discovered that a white male colleague in a similar job at my organization earned more than three times what I did. Did his longer tenure and more senior position entitle him to more money than me? Yes, absolutely. Three times more? In my opinion, nope nope nope.

You can’t change what you cannot measure, of course, so you need data. If you work for a nonprofit organization that must file public tax records, great! You can look it up. If you work for a company that posts its salaries online, awesome! If you have a union that dictates certain pay bands, woohoo! If none of these scenarios apply, the best way of getting this information is to talk about it. Which also, it turns out, helps narrow the pay gaps. So simple and yet so… not. I suspect many of our colleagues might run away screaming if we asked them what they make. Yet, if we are serious about this, then salary transparency is one of the best ways to begin to change things.

3. Figure Out How to Have the Conversation

So, how do you do it? Here is a good prompt from Allison Green, who writes the website Ask A Manager. She suggests starting with something like, “I have the sense my salary is below-market, and I’m trying to test that with real data.” Perhaps your colleagues are open to sharing their salaries. If you sense they’re not, it might be better to look for a range, which some people are more comfortable with. She also reminds us that it’s just as important to be open about your own compensation to someone who might be a few rungs below you on the ladder. It’s not always a smooth conversation, but such is the nature of change. An important thing for American readers: your boss might not like you discussing your salary, but doing so is protected by federal law.

(A note here to white men: YOU should really volunteer your salaries to the rest of us. It’s one of the best things you can do to help level the playing field. So if that’s you, I’m asking you to commit to sharing what you make with at least two co-workers this year. Take them out to lunch (when it’s safe) and ask them what they want to accomplish, what their goals are, and where they want to be in five years. And actually listen, then help.

Professor Morela Hernandez found that when Black candidates [tried to negotiate their salaries] with an evaluator who was racially biased, they were often falsely perceived to be negotiating too much, and then penalized with lower salaries.

4. Know How to Ask for More the Right Way

Now that you know you’re being underpaid, let’s talk about what to do. Conventional wisdom says we must ask for the raise we want, but that can actually backfire. A groundbreaking study, Bargaining While Black, by Professor Morela Hernandez at the University of Virginia, showed the potential dangers of negotiating. Hernandez found that both white and Black employees were equally likely to try to negotiate their salaries, but when Black candidates were faced with an evaluator who was racially biased, they were often falsely perceived to be negotiating too much, and were then penalized with lower salaries. I reached out to Professor Hernandez to ask her if she had any advice. Not surprisingly, she gets these questions a lot.

Her first piece of advice is to think about the duties you're performing as part of your job—and maybe on top of those as well. “Women and people of colour get asked to take on the lion’s share of 'service activities' that are extra/outside the normal parameters of their work responsibilities,” Hernandez wrote me in an email. This is probably not a surprise to anyone who has been asked to be on a diversity committee or recommend other employees for jobs without being compensated for their time.

People tend to get rewarded financially for things that help the company's bottom line, and these other duties often get undervalued (though, of course, they should not be!). It’s a terrible trap. You probably want your organization or company to do better. But if the work you're doing isn’t tied directly to profitability, it can suck your energy and marginalize you further. Hernandez adds, “the insidious effect of doing too much unrecognized ‘service’ is that it depletes a person’s time and energy above and beyond what they are already doing to do their actual work, and do it well.”

So, in a nutshell, it’s okay to care and want to contribute to the institution while also expecting the institution to properly recognize and compensate your efforts. If that’s not what’s happening, you might want to refocus your energy so you can take care of yourself.

Women and people of colour get asked to take on the lion’s share of “service activities” that are outside the normal parameters of their work responsibilities.

Second, Hernandez says that if you’re not getting respect and remuneration inside your organization, you may have to look outside. “You might leave your current position, or if you get a job offer you might receive a worthwhile counteroffer from your current workplace. Either way, you will obtain a more level playing field.”

She says women, in particular, are hesitant to do this, because they see it as risky. “Men have typically embraced it,” she explains, adding, “Instead of seeing it as a risk or as a political maneuver, I encourage women and people of colour to consider their own growth and development. It’s important to embrace new opportunities, challenges, people, and places.”

One thing that struck me about Professor Hernandez’s work and her way of thinking is how much taking care of yourself can benefit the whole. If you are able to narrow gaps just a little bit, that benefits everyone. It’s very much a financial way of putting on your own oxygen mask first that then enables you to help someone else.

I think you and I both know that you probably can’t overcome pay gaps based on race and gender. At least, not you alone. But maybe if you do a little, and I do a little, and most importantly, our employers do a little, and we all talk about it, we can make some progress. So that whoever is writing this kind of column in 50 years doesn’t have to answer this question, and whoever is writing in doesn’t have to ask it.

All best,

Lizzie

Lizzie O'Leary is a longtime economic and policy journalist. She hosts the podcast “What Next: TBD” at Slate.