Finance for Humans

How To Be the Michael Jordan of Selling Air Jordans

Sneakers are art, fashion, objects of widespread and intense obsession. And, yes, some people treat them like stocks.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

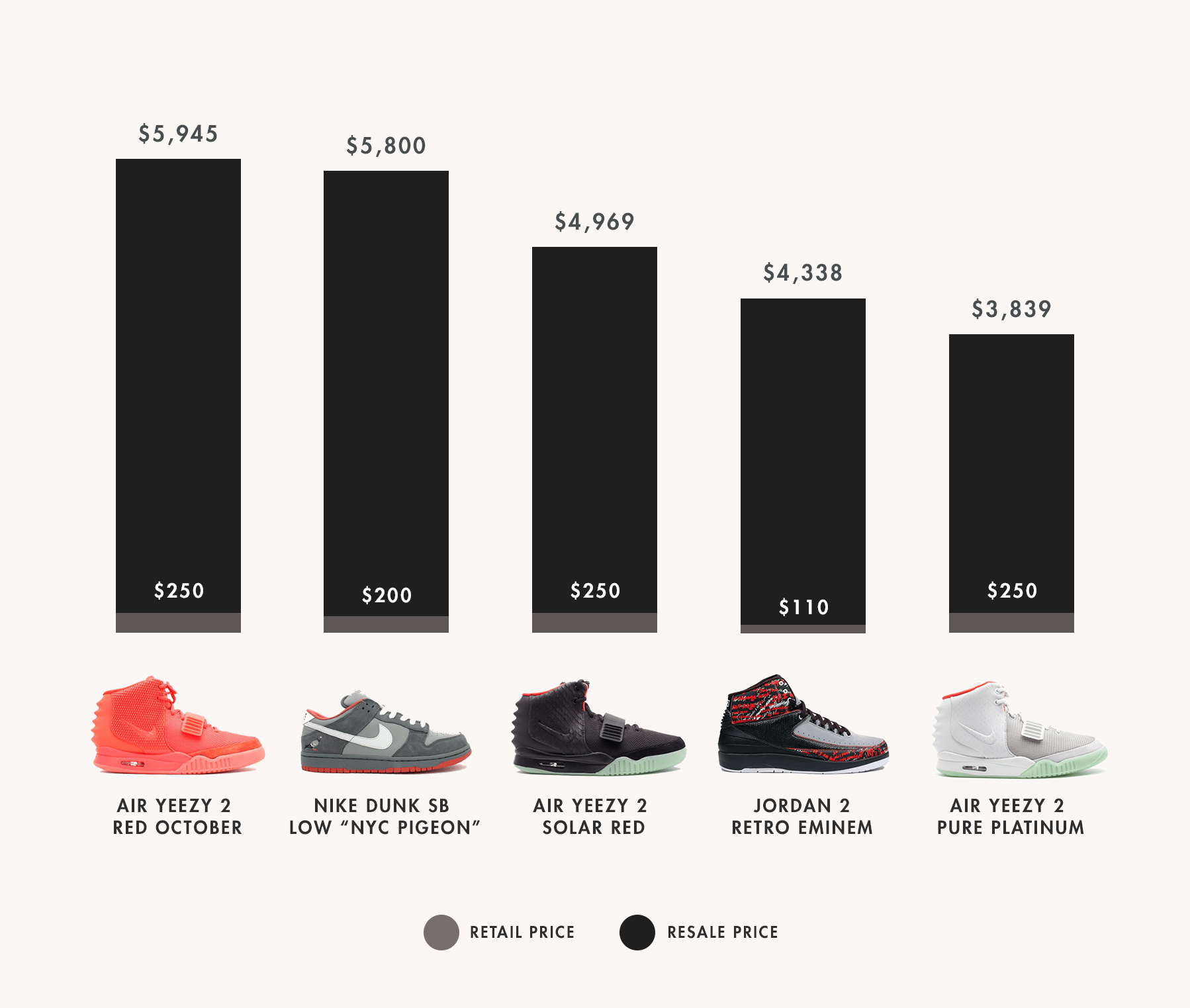

If you don’t know anything about how freaking expensive sneakers can be, or that you can make money buying and selling them, you should check out the most-expensive list on StockX (the sneaker industry tracking site). Or just look at this list of the site’s five best investments in recent years—assuming you were able to get your hands on an unused pair at the retail price:

So yes. There is a world out there where people buy and sell sneakers to make money. To help us understand this world, we talked to Josh Luber, who not only can break down in alarming detail Mark Wahlberg’s $100,000 shoe collection but also is the founder of StockX.

Here’s what smart sneaker people know.

They Know That Sneakers Are a Huge Business

We live in Sneaker World. Sneakers are without question the single most obsessed-about article of clothing there is. They’re probably the most obsessed-about thing-people-buy there is. There are books, exhibits, experts, and websites for and by people who are obsessed with sneakers. And there is no shortage of ways to quantify how ginormous the sneakerverse is. For instance, the fact that Nike has a market capitalization of more than $106 billion (USD).Or that the sneaker business will do more than $55 billion (USD) in sales this year. Or that in 2014, Michael Jordan made more from being part of the Jordan Brand ($100 million USD) than he did as a player during the entirety of his career ($94 million USD).

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

But sneaker companies are different from other companies with billion dollar market caps. Sneakers aren’t McDonald’s (another company with similar market capitalization). The sneaker business isn’t the oil business, where the value of the product is both intrinsic and anonymous (who would value one barrel of refined petroleum product over another? No one). Sneakers are personal. Sneakers are the way people express themselves these days. Sneakers are something most of us have the means to actually collect. The vast majority of us will never own an Expressionist or an Old Master or even a new master. But a lot of us can buy Jordans. And a lot of us do. Maybe it’s because it’s cool to wear sneakers to work now. Maybe it’s because Drake (and everybody else) can’t stop letting us know what sneakers he’s wearing on Instagram. Maybe it’s because the sneaker industry figured out how to make a billion different models and colorways so that each pair feels like it’s one of a kind.

They Know Sneakers Aren’t Just an Investment

There's a vibrant market for reselling popular and rare sneakers. One estimate found that secondary sales on eBay netted $60 million profit for the resellers in 2013, and that figure was about one quarter of the total sales. But if you’re just out to make money, sneakers aren’t your play. Some shoes increase in value after you buy them. The vast majority of them do not.

Now, if you’re in it because you are obsessed with sneakers—or even if you just want to impress your friends—you have a better chance of being happy with what you buy.

They Try to Buy Shoes for Their Actual Retail Price

According to Luber, the single biggest factor to consider when buying sneakers for the purpose of reselling is whether you can buy the sneakers that everyone’s freaking out about at the suggested retail price. "There can be a lot of hidden costs that newcomers might not think of that can eat away potential profits—taxes, eBay fees, PayPal fees, shipping fees, buying at post-retail prices," he says. To avoid that stuff, the people who do this for a living wait hours upon hours at their favourite store to acquire pairs of sneakers at as close to the retail price as possible. Boutiques will still markup in-demand drops, but it’s still cheaper than eBay or other auction sites.

Which means you’re going to want to know when the new stuff is going to hit stores. The site Sole Collector is the go-to source for release information.

They Buy Nikes

When it comes to brands, there's Nike, and there's everything else. The company's sneakers accounted for all but $10 million of the $240 million profit in the after-retail sneaker market in 2013, for example. Specifically: Jordans. "Jordans in classic colorways tend to hold their value or increase in value most reliably," Luber says. He thinks that UnderArmour, which reps star-of-the-moment Steph Curry, is making a push into the market, as is Diadora, which has some "great collaborations with sneaker boutiques all over the world."

They Don’t Wear the Damn Shoes

If you're going to try to make a go of it in the sneaker-selling business, don't take your new purchase out of the box. After just one wear, a pair loses its "deadstock" status, and its value drops considerably.

Except When They Do

But if you're the type of person who wants to wear some sweet sneaks but doesn't want to go through the hassle and the expense of getting retail deadstock, consider the secondary market. Sites like Grailed offer person-to-person sales that allow you to pick up a lightly worn pair, kick it for a bit, then resell said pair for about the same amount of money you bought it for as long as you kept it in good condition. You won't get rich, but you won't hemorrhage cash. And you get to wear the cool shoes instead of just looking at them. You can always count ROI in terms of compliments received.

They Are Sometimes Named Drake

Drake is a dude who knows his sneakers. "Drizzy's Shoe Game Is Unstoppable" is an Internet headline you’re as likely to read as any these days. Now Drake probably isn't buying as an investment (he makes his money in other ways), but he does have darn good taste. He rocks Jordan Retro IIIs, Vs, XIs, Jordan Premio "Bin 23" VIIs, the rare Nike Air Yeezys, Kobes, and LeBrons. His Air Jordan collection alone numbers in the hundreds of pairs. And if you’re looking to invest, you could do worse than to buy the shoes Drake has his name on. Pairs from the line he made with Nike, the Air Jordan 10 x OVO, go for $500 or more on eBay. He'll likely partner with Nike again, and waiting in line for the drop is probably as good a bet as any. Besides, it could be worse. You could have stood in the cold to buy his sweatshirt collaboration with the Jordan brand.

They Buy Their Sneakers at One of the Six Best Stores in Canada

Livestock: With three spots in Vancouver and two in Toronto, this growing boutique is the single best place to find rare kicks.

Capsule: The two Toronto locations stock everything you need from Nike, Air Jordan and beyond.

Courtside Sneakers: Check out the Jordans and Nike Women's at their locations in New Brunswick, PEI, and Nova Scotia.

Off The Hook: This Montreal store keeps it fresh and clean with a wide range of Adidas, Nike, and more.

Adrift: Another Toronto staple, Adrift focuses on skate culture but features an impressive selection of sneakers.

NRML: The Ottawa-based boutique is known for getting the drop on the newest releases.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.