Finance for Humans

Trade Wars! (Should I Be Scared?)

What tension between governments means for your investment decisions.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Trade wars! You've heard a lot about them lately. They seem scary. And maybe you have questions. Like: Will anyone get drafted? Will civilians be hurt? Will they someday make a version of Saving Private Ryan to commemorate the event, except with some Chinese solar panels or Canadian milk playing the part of Matt Damon?

Or maybe you have more practical questions. Like: What is a trade war? Or: Will the economic tensions between the United States and seemingly everyone else blow up the economy? Or that most practical question: Should I sell my investments and hide under my bed?

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Let's take it one step at a time.

What, exactly, is this trade war about?

Let's start with the current situation. The United States government doesn't like the terms on which it's trading with various other nations. So it is trying to change those terms.

Changing the terms of a deal is never easy. And it's especially difficult with really complicated deals hashed out over marathon diplomatic sessions that carry implications across all the countries involved. So the American government is trying to use leverage so other countries will be motivated to change. Among other things, it's increasing tariffs (money charged on a particular product when it crosses the border) on certain goods.

Recommended for you

Is This the Year to Try Wealthsimple Tax? (Um, Probably. Yes)

Finance for Humans

You May (Still) Have to Pay Taxes on COVID-19 Benefits

Finance for Humans

The Bond Market Fell, Hard. An Explainer for Normal Humans

Finance for Humans

The Perfect Guide to Every Little Tax Question You Have

Finance for Humans

As you may have guessed, the United States' trading partners don't really want to be bullied into changes with tariffs. So they're also increasing tariffs to show that they will not back down.

People are scared there will be an all-out trade war, with each nation ratcheting up the economic pressure to try to make its partners back down.

What would happen if there were an all-out trade war?

First, let's get some perspective. The number of tariffs that have been discussed thus far is really small relative to the size of the economies they'd affect. The U.S. economy, for instance, produces about $20 trillion in goods and services, and the current tariffs affect a fraction of a percent of that. In Canada, the tariffs that have been proposed affect a tiny fraction of GDP.

If this stand-off escalated into a full-blown trade war, it would definitely have economic repercussions. Economies would grow more slowly. Consumers would feel poorer because the goods they buy would get more expensive (thanks to those tariffs). The economist Paul Krugman did some math and estimated that the maximum impact would be 2-3% of GDP, which is about the growth rate of a developed economy in a year. That's also about 1/3 the size of the 2008 recession. Beyond the direct costs, there are indirect ones. Like that tariffs and trade restrictions would force some companies to make things in different places. That could be extremely costly and cause significant job losses.

OK. So what should I do? Sell everything?

You're investing for the long term, right? That's what passive investing is all about. So ignore this, and most other, news. In general, trading on the news without special insight (the type of insight that hedge funds have teams of analysts and connected advisors working on constantly), usually results in losing money. In fact, even people who invest in those hedge funds don't reliably make money after fees and costs!

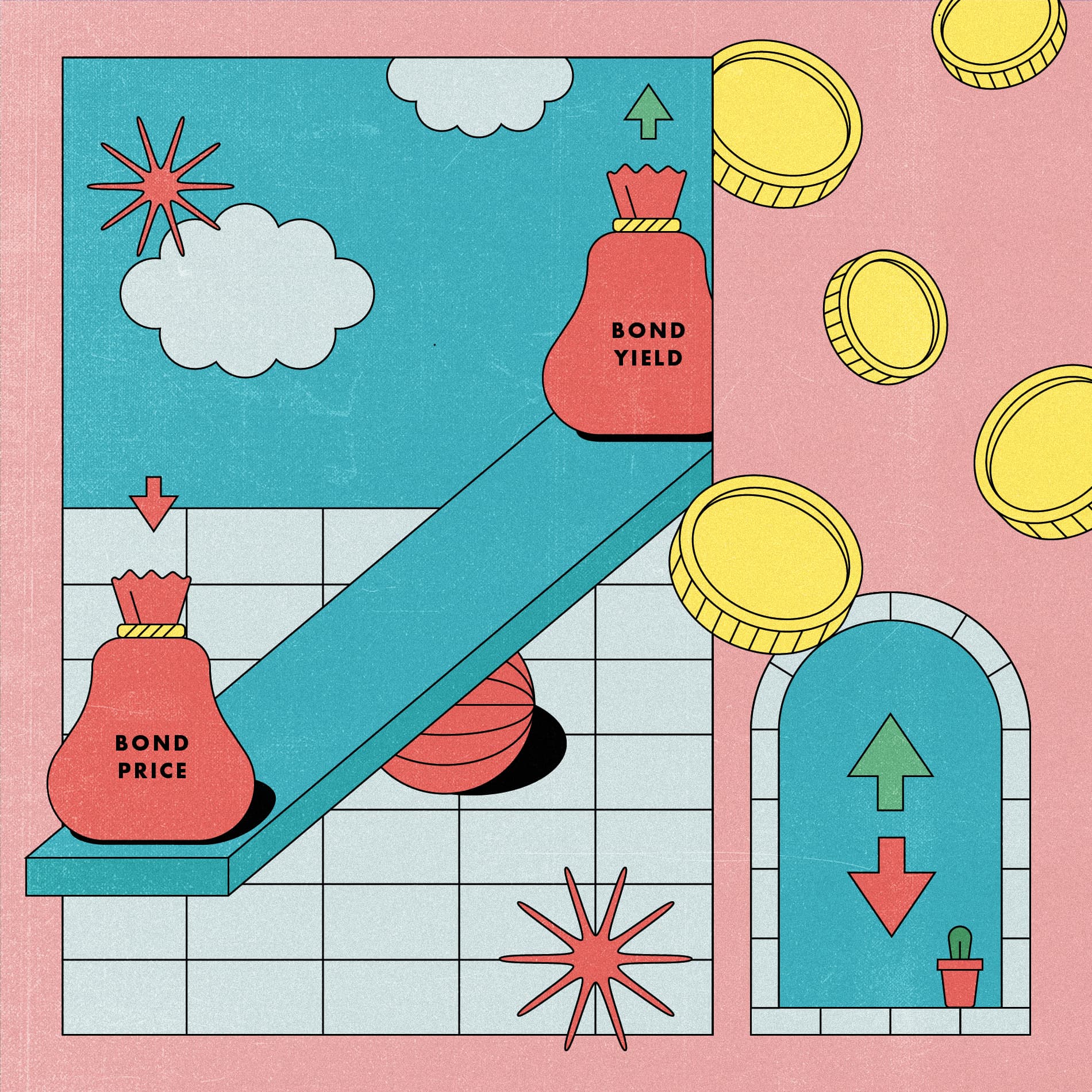

As a long-term investor, we think you should focus instead on the overwhelming historical evidence that, over time, relatively risky assets (like well-balanced portfolios of stocks and bonds) will outperform cash; and that the folks who think they can time the market will end up losing.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.