Money Diaries

“We live in a culture where it’s not OK to ask about money. That’s a problem.”

Michele Romanow helped cofound Buytopia and SnapSaves and is a judge on Dragon’s Den. But her real financial education started when she was six.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives.

My parents grew up with very little, but they did an extraordinary job teaching us about money. I started getting an allowance in grade 1. And even then, we had a book that was effectively a ledger of everything I spent money on. It eventually went from grade 1 to grade 12. There was a weekly rate that I would earn—it was, like, two dollars a week I started out with—and I would record that. And then every time I wanted to buy something, I would subtract it from the book. So I learned how to basically make a general ledger in grade 2 or 3. Every once in a while, we would go back and say, “OK, how much did you spend on clothes this year? How much did you spend on going to the movies with your friends?”

"The first thing I learned about money was that talking about money is OK."

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I got to see where my money was going, and I got to see a balance grow. I remember when I was in my second year or third year at university, I had a conversation with my parents, and they said, “Look, you need to look into investing some of your money. You can do research on stocks, and you can pick things, but what probably works the best is for you to buy an index fund because it’s a representation of the whole market.” You know, even if you’re extremely good at picking stocks, most people are not good over a hundred years of their lifetime or whatever it is. That’s a good lesson.

In a way, then, the first thing I learned about money was that talking about money is OK. And the second was that understanding where your money is going is important. I think that is a huge thing that so many kids are not taught because, oftentimes, we live in a culture where it’s not OK to ask about money. That’s a problem. It’s seen as rude or intrusive. In a similar way, I believe that for young people, money should be a factor in making decisions about your career. Because you should be really happy in all the elements of your career. And that includes satisfaction with the work you do and how challenging the work is, but also your compensation. You should not be afraid of money.

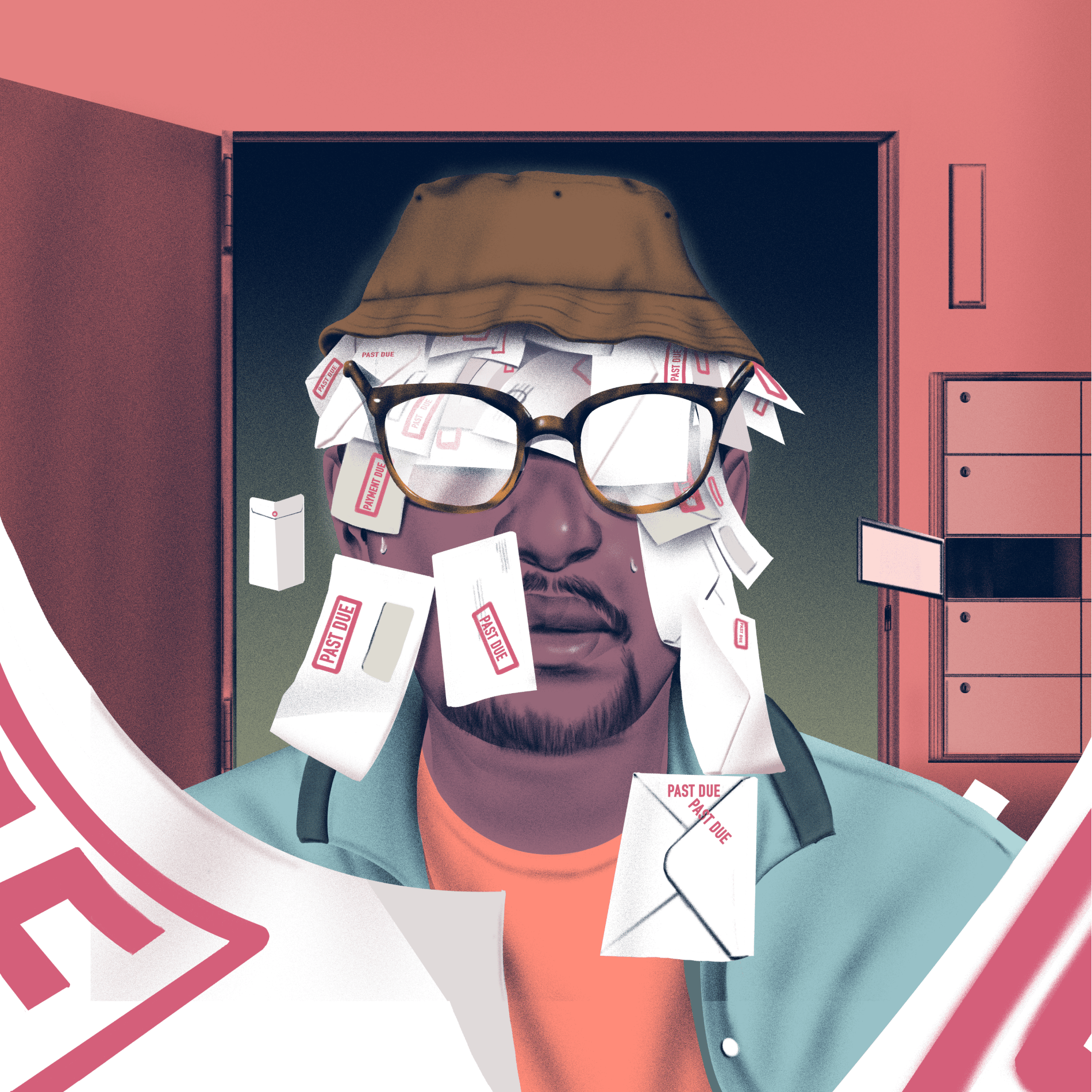

"I find that for a lot of people who get themselves into bad financial habits, it’s often because they’re scared."

Recommended for you

It’ll Work Itself Out (It Actually Won’t)

Money Diaries

Joel Kim Booster Was in Massive Student Debt Until Two Years Ago

Money Diaries

Roxane Gay on Financial Independence: 'The Most Important Thing a Woman Can Do for Herself'

Money Diaries

How to Quit Your Job and Bike Around the World for $17,000

Money Diaries

Kids are very perceptive. Saying to them, “This is how much things cost; this is why we thought that was fair,” that’s important because they pick up on things anyway—it shouldn’t be a mystery. Answer their questions. I find that for a lot of people who get themselves into bad financial habits, it’s often because they’re scared. They’re scared to even know what’s in there. They’re scared to do the digging. Money can be scary. But it should be made clear, and then that makes everything so much happier. There should be no shame, on either side—when you spend money it shouldn’t be guilty. It should be, “Oh yeah! I chose to make that decision; that was the right decision to make.”

I’ve given a lot of advice to young entrepreneurs. But the biggest thing is: You have to get started now. There is no perfect time to start a business. It is always messy, it is always inconvenient, and it is always very scary. And so you can’t limit yourself; you can’t avoid risk by just planning forever. You figure out if it’s a good business by testing things and seeing if things actually work—there’s no other way to do it.

And the second piece is that you have to understand your revenue model and your unit economics. The line in Silicon Valley is often “You can give out one-dollar bills for eighty-five cents forever.” That’s not a business. That’s a gift. And as much as that sounds silly, there really is this mentality of “We’ll just give it away until the business is big enough.” I think it has always been my preference to say, “We’re offering a real service here, so what’s a fair and competitive and awesome price for this?” If I charge $100 for something and it cost me $50, am I making enough money after I take in all my costs of marketing to find that consumer and everything else? Have a clear revenue model, and then make sure you’re understanding your unit economics. Make sure those are positive so you’re not handing out one-dollar bills for eighty-five cents.

As told to Sarah Goldstein exclusively for Wealthsimple. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.