Money Diaries

Kylie Jenner Tells Wealthsimple Why She Buys Cheap Makeup and Expensive Rolls Royces

At 19 years old, Kylie understands what it means to be a frugal Jenner. Like: Say no to the $40,000 watch.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives. Kylie Jenner is known not only as a star of the reality TV show Keeping Up With the Kardashians, but also for her blockbuster cosmetics line, her 22 million Twitter followers and nearly 95 million Instagram followers.

I never had an allowance. If I wanted to go to the mall with my friends, I’d negotiate with my mom about how much I was allowed to spend. She wanted me to have good money sense. I knew I couldn’t ask her for anything crazy.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

By the time I turned 16, I was making my own money [through endorsements and TV] — enough to buy my own car. It felt so good to know I’d never have to say, “Mom, can you please just pay for this?” again. But I’m glad I wasn’t raised with the mentality that I could just buy anything I wanted whenever I wanted it. You have to have some restraint.

For example, I don’t like to spend money on jewelry. I’ve only really gotten jewelry as gifts from my mom or a boyfriend. I mean, there have been plenty of times when I spot a necklace or a ring or a bracelet and I’m like, “Wow, that thing is amazing.” But I find a way to hold myself back. No matter how much I fall in love with it, I’m not going to pay $40,000 for a watch. I’m just not going to do it.

"One day, I’ll step out of the spotlight, I think, and just live a normal life. And just because I have money now, doesn’t mean I’ll always have money."

Some of my favorite belongings are actually the things that cost me the very least. I use a lot of cheap makeup. Mascaras. Blushes. Just regular drugstore makeup. It doesn’t have to be fancy or expensive to be effective.

Recommended for you

Roxane Gay on Financial Independence: 'The Most Important Thing a Woman Can Do for Herself'

Money Diaries

To Win Four Oscars, Sean Baker Had to Go Broke Again and Again

Money Diaries

How to Quit Your Job and Bike Around the World for $17,000

Money Diaries

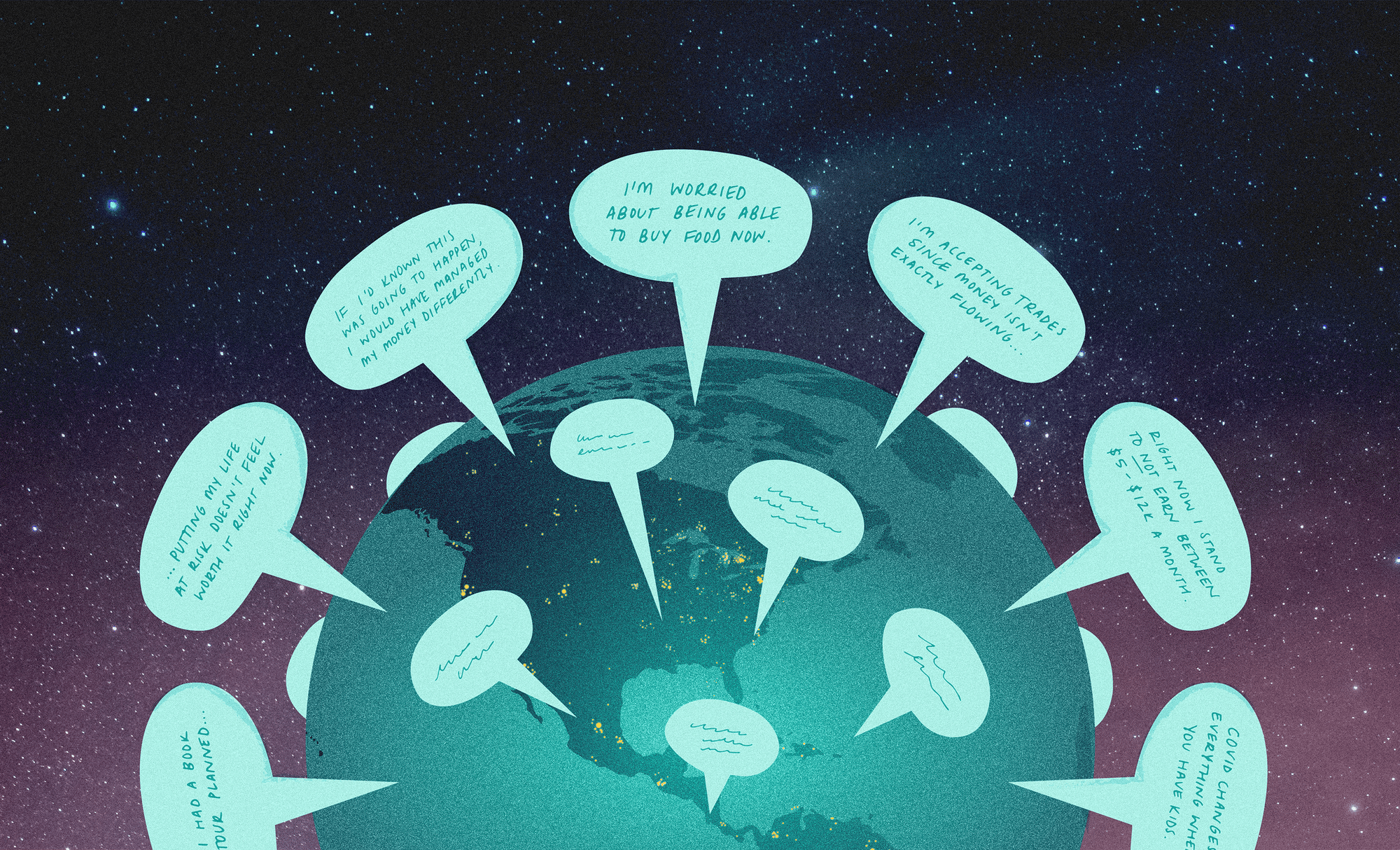

Pandemic Money Diaries — Panic at Trader Joe’s Edition

Money Diaries

That’s not to say I don’t splurge from time to time. The money I spend is mostly on cars. I have six of them right now. Six is probably too many, I know. But my number one jam this summer is this cherry red Rolls Royce Wraith that I’ve been driving all over the place. What can I say? I love it.

The more money I have, the more I look to my mom for financial advice. Right now, I’ve been investing a lot of my money into buying homes. I don’t know if I’ll rent them all out or just keep some as investment properties. It’s been one of the hottest times for real estate that I can really remember. Stocks can fluctuate, but people always need a place to live.

Over the years, even as I’ve had more money available to me, my relationship with money hasn’t dramatically changed. I’ve never been the type to say, “Oh, look, I just made all this money. Now I can go spend it.”

One day, I’ll step out of the spotlight, I think, and just live a normal life. And just because I have money now, doesn’t mean I’ll always have money. It’s not a forever thing. I could lose it at any point.

These days, there’s been a lot of talk in California about raising the minimum wage, and it’s scheduled to go up soon to $15 an hour. I think that’s really important. Minimum wage workers deserve a living wage — you shouldn’t work all the time and end up broke. I work hard, and I’m really fortunate for all the success I’ve had. But everyone who works hard deserves to be rewarded.

As told to Davy Rothbart exclusively for Wealthsimple. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.