Money Diaries

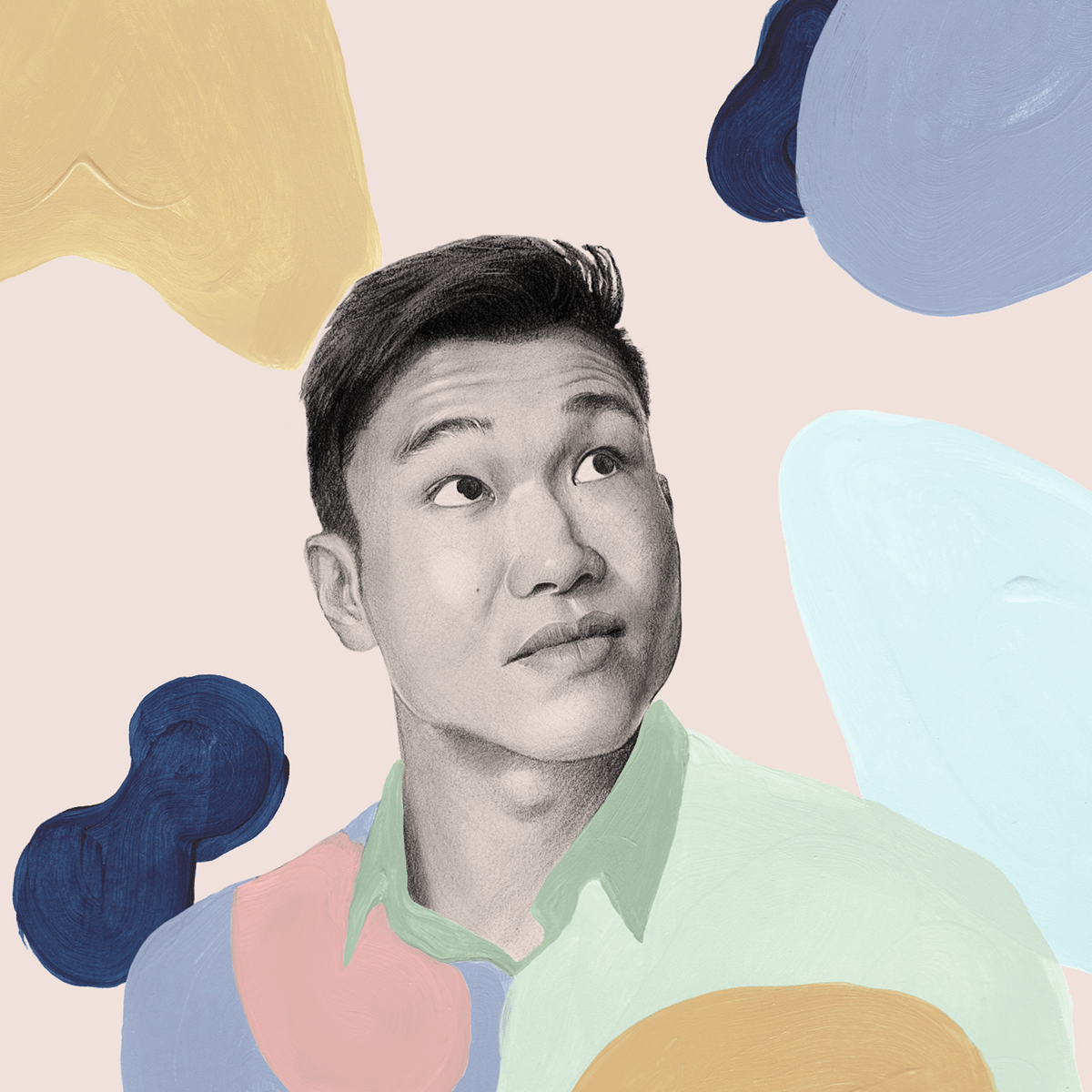

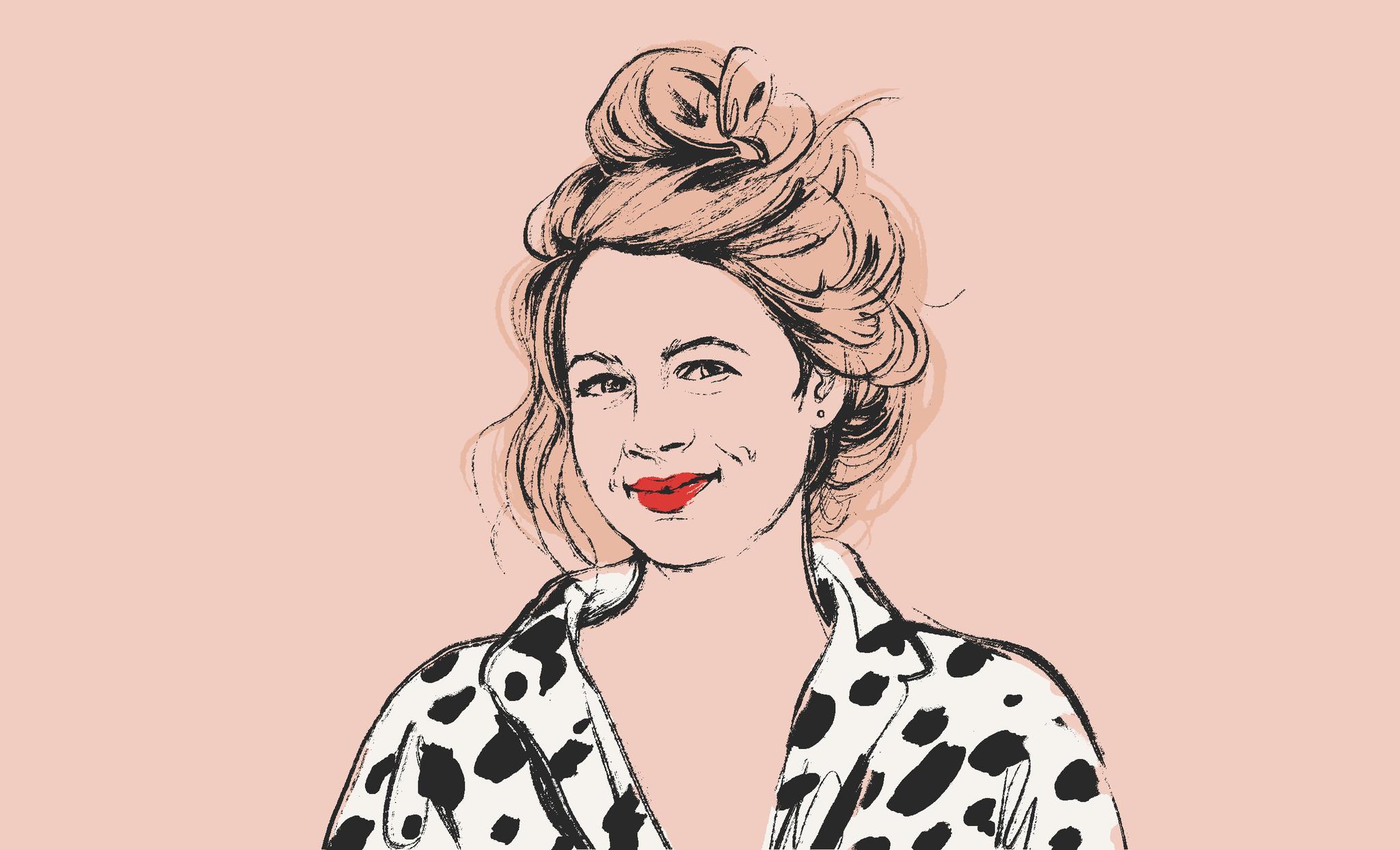

Why Design World Legend Tina Roth Eisenberg Would Rather Build Four of Her Own Businesses Than Work for Someone Else

The founder of CreativeMornings explains why it's easier to run lots of companies and never know how it's going to shake out financially than it is to work for a bunch of clients.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

I think I instinctively always knew that I wanted to run my own company. I was one of those kids who never stopped drawing, then I realised at one point that there is a profession behind it. I had this super eccentric, creative aunt who has always been my role model, and she had at the time a life partner who was a graphic designer. I was probably seven or eight and I watched him draw a poster. I looked at him and said, “What are you doing?” And he’s like,” I’m working.” “Working, as in making money?” He said, “Yeah, this is a job for me.” That's when I started realising that you can be creative and make a living.

I grew up in the countryside in the Swiss mountains with cows in front of my door and farms next to me, sort of the Sedona of Switzerland. My dad did past-life regressions in the living room while I was growing up and stuff like that. While it was a very country-farmland kind of environment, I had two entrepreneurial parents, which is interesting now that I'm a mom myself. You don’t realise how much that actually rubs off on you as a kid, because it's just your normal.

I was eleven when my dad brought home the very first Macintosh SE — he was a nerd already. He had a DOS computer and was coding. He was a real estate agent, representing a brand new building, and Apple had just come into Europe and they said, “Mr. Roth if you give us the space, we'll give you a Macintosh SE.” He dropped everything and for a year prepared to start a computer school on how to use Apple computers. Then he published the first Apple magazine in Switzerland. Now in hindsight I realise, oh my God, the money he must have been putting in, the risk he was taking.

For me money is literally just the energy to keep doing the things I want to do.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

When I graduated secondary school, I wanted to go to New York to go to art school. My parents swiftly shut that down. They said, “If you want to go to art school, it has to be in Switzerland.” I went to Geneva and then I went to Munich and I studied graphic design.

When I was 26, in 1999, I basically declared to my parents: I'm going. I walked into this tiny design studio and I was like the jack-of-all-trades. I eventually became sort of the web specialist. My dad was always worried I wouldn't make enough money. I lived in New York and I made a horrible salary but I was so proud that I was on my own feet.

Unfortunately our office was downtown in 2001 during 9/11. They shut the studio down. I freelanced, basically. It was really hard. That was, financially, the hardest year of my life. Some days I lived on ten dollars a day — you can't be social anymore.

There was this pivotal point in my life when I got pregnant with my daughter. I kind of had this wake-up moment of, what the heck are you doing? What are you waiting for? I started taking inventory of my life. I started my first company in 2006. The very first client I landed was MoMA, doing their intranet. The universe was clearly there waving some pom-poms at me going, You go, Tina.

Soon I had more clients than I could actually handle. By the time I got pregnant with my son three years later, I was really not happy. I hated it so much that I stopped. You really have to be a certain type of personality to be okay with the client-service model. I like to build something, I like to figure something out. I don't like just to dip in and shake it up and then hand it back.

I had a blog, and it created so much passive income. I could blog maybe one or two hours a day and it paid for my share of expenses. In February 2010 I sat down with my husband at the time and I said, “Hey, would you be okay if I take a one-year client sabbatical and just basically have a year of magical thinking and see what happens if I have some brain space for my own stuff?”

The success of all the things I've started is because I didn't look at it as a company, just something I wanted to see in the world. A few years in with CreativeMornings, I got a teeny, tiny seed investment. But I'm not really the investor type. Again, it goes back to the service model. I have a very hard time when I feel like I’m under-delivering or I'm not living up to someone's expectations. Stuff I have worked on, like Tattly is fully boot-strapped; Friends Work Here is boot-strapped. I do much better at just reporting to myself and holding myself accountable and disappointing myself. It took me so long to understand that there's not a right way to run a company.

And there is not a right way to think about money, other than just finding the way that is right for you. I'm actually really funny with money. Like, I think in buckets. I pay myself with CreativeMornings and I pay myself with Tattly and I make a little savings on TeuxDeux every year. That's my savings for retirement. These buckets are much smaller than anyone would think but I make them work. For me money is literally just the energy to keep doing the things I want to. Everybody always tells me, you are such a risk taker. And I'm like, no, I'm not. I run four companies at the same time so that if this one fails I feel like I still have three legs. The table is not gonna fall.

If I were a real risk taker, I would just go for one company and dive in and put everything in it. I love the word “anxcited” — I'm anxious and excited. Sometimes I wake up at three in the morning and it's like, oh my god I'm gonna burn it all down and I'm gonna burn all of my savings. Don't show me all the spreadsheets because I really don’t care. They just drive me crazy and they actually make me nervous. I look at the bank account, I know what the monthly burn is and I have an intuitive sense of whether it's working or not. I know that sounds really scary to every finance person.

Now that I have children, not that I put my P&L in front of them, but I kind of try to sometimes explain things I have to figure out. Money is something you can talk about. The biggest thing to me is that they feel comfortable to talk about it with me.

I just went through a big life transition because I separated from their dad. And that was a moment where I had to adjust financially to being on my own again. I was quite transparent with my kids, saying, listen, it's not that we don't have a roof over our head, but mommy has to budget a bit right now. I underestimated the feeling of completely being on my own again. I forgot that I did that before I met him — I was living on my own, there was nobody there to catch me if I couldn't pay rent. Now it's been two-and-a-half years, almost three years, and I can’t even imagine somebody else paying my rent.

I actually don’t spend that much money. I would say I spend too much money on Lyft cars. That's something I really need to curb, to be honest. I spend it on nice dinners with my friends and experiences with my kids. My biggest goal is that they will look back at their childhood and say, “Man, I did some really fun stuff with my mom.”

As told to Kyle Chayka exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.