Money Diaries

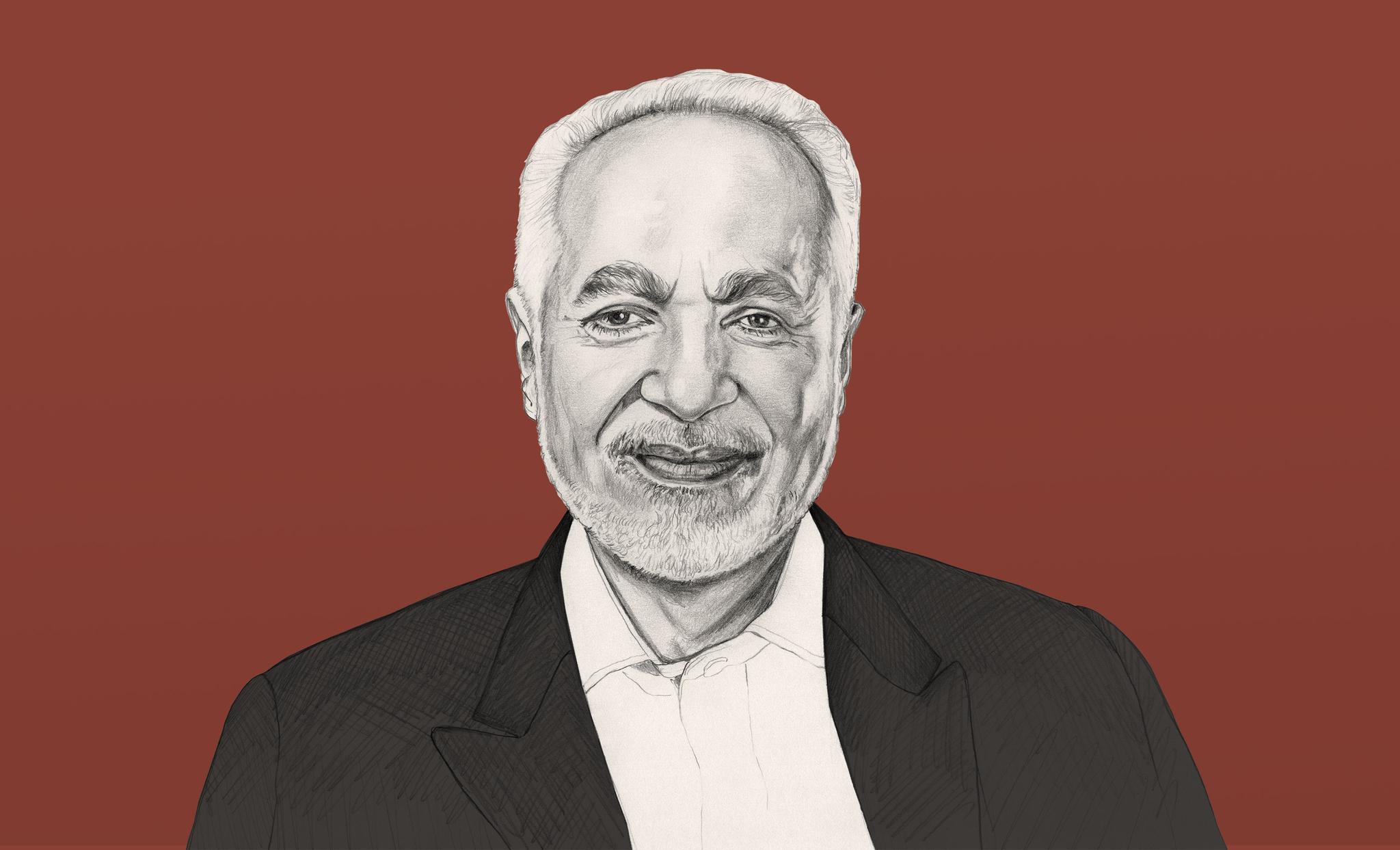

An American Imam Talks Islam and Money

Imam Feisal Abdul Rauf came to America as a child, and learned that prosperity presented its own religious riddles.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Feisal Abdul Rauf is a longtime Imam, public intellectual and the author of numerous books about Islam’s place in the West, including What’s Right With Islam is What’s Right with America.

There's a passage in the Bible that says it is more difficult for a rich man to enter heaven than for a camel to pass through the eye of a needle. Moderation is valued in Islam, but in Islam we also regard wealth as part of what God has granted us. Islam never denies us the desire to be wealthy. Instead, it is our excessive attachment, our preoccupation with wealth that blinds us.

I believe a lot of the religious statements about poverty and wealth — the idea that a rich man will have a harder time entering heaven, for instance — apply more to previous eras than ours, because we are living in a time of prosperity the likes of which has never existed before in human history. And America is a great example of this prosperity.

There’s a famous Catholic theologian Michael Novak who wrote a wonderful essay in which he said that America has disproved the Marxist axiom that religion is the opiate of the masses, that only the weak and the oppressed need religion. America has proved that even the rich and the powerful need religion. The human soul is not fulfilled unless it witnesses the vision of God, and not even riches can obviate the need for that fulfillment. Americans of all walks of life, of all levels of prosperity have sought to witness that vision of God.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I, myself, began my life in America more than fifty years ago. On a cold, wintry morning in December of 1965, I sailed into New York City on an Italian vessel named SS Michelangelo. I was seventeen. I remember that as I sailed over, I had a vision that my role in life would be to help translate Islam into the American vernacular — it was an idea that seemed to just come into me.

I was born in Kuwait of Egyptian parents and my father was a religious teacher who started a Muslim college in Malaysia, so I was surrounded by Muslim scholars. I grew up in that atmosphere. It’s in my genes.

I went to Columbia University where I got a degree in physics. I graduated in 1969 — that was the year we landed a man on the moon, and suddenly NASA laid off thousands of engineers and physicists and scientists and there were no jobs. So I taught in public schools for a while and then I worked as a salesman. The idea of selling was interesting for someone like me. If you’re a slightly shy person, it’s a difficult thing to do. I wasn’t very extroverted as a child. I was raised in Southeast Asia — in Malaysia. In America, people take pride in being aggressive, but in that part of the world aggressive doesn’t mean pro-active, it means you’re rude and brutal. So being a salesman changed me a bit. It forced me to become more courageous. More outspoken.

I don't think it's inconsistent with Islamic religious philosophy to desire things, or wealth. It's the nature of that desire that matters.

As a salesman, I didn’t really have a pension plan, so I decided to invest in real estate. I did well enough in real estate that when I was appointed as imam at the Sufi al-Farah mosque in downtown Manhattan in 1983, I was a pro bono imam. And I volunteered my services for the next twenty-six years. The average annual salary for imams in America is only about $30,000, far less than the salaries of rabbis or priests. So most imams find themselves having to work a second full-time job to support themselves and their families. And that’s true even though in the US imams have even more expansive jobs than they do in other places.

Overseas an imam is a prayer leader and he writes sermons. That’s it. Here we’re required to be marriage counselors, premarital counselors; we give religious classes and run youth programs; we're interlocutors between our faith and the other faith communities; we address the media when something that's considered an Islamic issue becomes newsworthy. Being an imam in America is a full-time job, but the compensation is most often part time.

Recommended for you

When I was a young boy, I was looking for God. To me the experience of God is fundamental to every religion and if you haven’t had that, your religion hasn’t begun yet — it's essentially a mechanical performance. I believe that every human being who is sincere in his or her religiosity wants to see God. That’s why I always quote the old George Harrison song: “I really want to see you, Lord.” That very act of seeing God is the declaration of the faith of Islam: I testify that there is God, I witnessed that there is God.

When I was about fourteen, fifteen years of age, I was sitting on a bus and I had one of those moments. I just felt I was in the presence of God. I've never taken LSD, but my friends say that was like an LSD trip. The only way I can describe it is that if your ego had a boundary like a sphere, imagine that boundary just dissolved for a whole minute. I felt one with everything. I felt one with the bus, with the empty seat to my left, with a tear in its false leather. It was late afternoon — you know, that rich yellow light of late afternoon? I was one with that sunlight and with the greenness of the trees. And I just knew that everything was as it should be and God existed and God was there and He completely enveloped everything, like water envelopes everything in the sea.

It was just such a lovely experience and I said, okay, now I have borne witness to God.

Many people find me “a breath of fresh air” because I’m a spiritual man with an appreciation for the fine things in life. Fine clothing, fine suits. I love Persian carpets. I’m a connoisseur of food. I love to cook. I love well-engineered cars. In every field of human endeavor — art, architecture, music — there are those who have excelled. I believe that those who excel do something that’s worth appreciating. As long as I can comfortably afford them. As I said, I don't think it's inconsistent with Islamic religious philosophy to desire things, or wealth. It's the nature of that desire that matters.

A lot of people know about Islam's particular philosophies when it comes to the financial world. In Islam, there’s a prohibition against something called usury — money lending. That prohibition historically exists in Judaism and Christianity as well. It wasn’t until the 16th century when John Calvin pushed aside the religious opposition to all interest, saying in effect that changing a little bit of interest is non-usurious. And that's when you saw the creation of the whole phenomenon of banking, double-entry bookkeeping and financial markets. This actually is what led to the rise of northern Europe as a world power and essentially led to them colonizing the rest of the world. In Islam that prohibition against usury has been a bit of a challenge.

But the challenge is now being met by an increasing number of Islamic countries, which are developing Islamic financial instruments and Islamic banks that are sharia-compliant. That means that some Islamic financial instruments are different. For instance, the consumption of alcohol is forbidden in Islam, so to invest in a bar would be considered a sinful investment. But you can still participate in the financial world and its advantages even if you take those principles into account.

There's also confusion about a concept call zakat. Outsiders sometimes think of zakat as charity, but more specifically it's obligatory almsgiving — essentially, it’s a tax. So it has a code — you typically give two and half percent of your wealth. In some Muslim countries it’s mandatory and collected by the state. In others, it’s voluntary. But here’s the thing, when zakat was instituted there was no income tax or property tax.

Here in America we’re taxed fifteen different ways. We have property taxes, we have income taxes, we have sales taxes, we have estate taxes, we have all kinds of taxes here. So some scholars say that the tax that we pay is way more than that two and half percent, so that exempts us from the need to pay zakat. But Muslims in America still like to contribute to their religious institutions. So they might budget two and a half percent of their net wealth after their US taxes are paid and donate that to their various charities, their local mosques.

But the Quran promotes moderation, in every aspect of your life. The Prophet said the Believer should be moderate in their food intake, filling one’s stomach one third with food, one third with drink and leave a third for air. There are many, many hadiths, sayings of the Prophet, which promote moderation — moderation in behavior, in worship. And of course in spending as well. Even in charity. You’re not meant to give all your wealth away. First, you must take care of your needs and the needs of your family. As the Quran tells us, “Seek through that which Allah has given you the home of the Hereafter, but do not forget your portion of lawful enjoyment in this world.”

As told to Kathy Doby exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.