Money Diaries

Friends With Money: Steve Aoki

The EDM superstar (and Benihana heir) talks about starting out with zero capital, investing in people, not ideas, and why society ought to do more to embrace failure.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Tori Sampson: Hi, Steve. You’re a Sagittarius, right?

Steve Aoki: Yeah.

Me too. What’s your proudest Sag trait?

We’ve got that spontaneous energy, like just get up and go. I was always like, get up and go and just tip my seat and head out. I kind of miss that feeling of spontaneity. My life has become so structured. It toned my wild roots in a way.

I remember, in another interview you were doing, you were talking about how your dad was like that.

100%. You have to kind of run with the wind, in a way. It’s interesting how much I’ve taken on my father’s energy trait without even realizing it. It’s just something that I love to do is just, I like to move.

Your dad started Benihana, right?

Yeah.

But he was also a wrestler before that.

He came to America as a wrestler and ended up staying. I don’t know if he got injured or something happened where he ended up not being able to do the Olympics. He took, I think, a business course in college, a community college, and decided, “Okay. I’m going to stay here. I’m going to figure this out.”

He was an ice cream man for some time and then made enough money to open up the first Benihana restaurant. His story, just on the basis of being a Japanese American in the early ’60s, only two decades after Japanese people were in internment camps — there was a different level of Asian hate crimes that were happening. The Asian hate crimes happening now versus the Asian hate crimes that were going on in the ’60s, and Asian resentment, Asian hate in general was on a high, a major high.

You’re from Miami, but you grew up in Newport Beach, right?

Yeah. I was born in Miami, but we left Miami when I was 1.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Did you enjoy growing up in Newport?

“Enjoy” is the wrong word. Newport Beach is 96% white. It’s very conservative-thinking. When you grow up in a homogenized culture, lots of things go unchecked. I think, as kids, all we care about is belonging, belonging to something. How do we do it traditionally? Through sports, through these social circles.

Music, when I found it — in my tweens era — was a saving grace, in a way. It was this huge, massive moment for me, where it’s like finding God, literally finding God.

You said “enjoy” was the wrong word. Was there a moment from growing up there that sticks out to you the most, that — I don’t know if it fed you, if it’s something that you held on to — anything like that?

I got into two fights, two physical fights in my life, and they were both because the guy was straight up racist, saying crazy sh*t.

How old were you?

Fifth grade or fourth grade. He was my friend. I would come to his house. And then one day, they’re throwing sh*t at me and saying some really, really racist stuff, really bad stuff. These bad, Asian-insulting words? I just did not understand it at all. The next day, we got into a fight. I’m like, “Why would you say that?” His friend was right there, and I found out his friend’s older brother’s a Nazi skinhead. I’m like, “Okay, now it makes sense.” He was like, “Don’t hang out with him. He is Asian.” Yeah. I didn’t expect this interview to go into detail like that, but ...

Oh, welcome to my interview style. What was your first job ever?

I worked at a flea market selling hats. Definitely child labour, for sure. I was probably 10 or something. When I was 15, I started working at Benihana’s.

What was the first album you ever bought?

First album? My first seven-inch was DJ Jazzy Jeff & the Fresh Prince. “A Nightmare On My Street” was the first 45 I ever bought.

What was it about DJing that really captured you, that got you entranced by the art form?

I had to learn how to DJ because I was playing in these bars and no bands could play there. The bands would have to DJ. But we’d do this every week, build a little scene, then the bar owner would let me in a couple hours before and I would start learning how to DJ in the bar.

Recommended for you

Cult Animator Carson Mell Decided Making Stuff Was More Important than College

Money Diaries

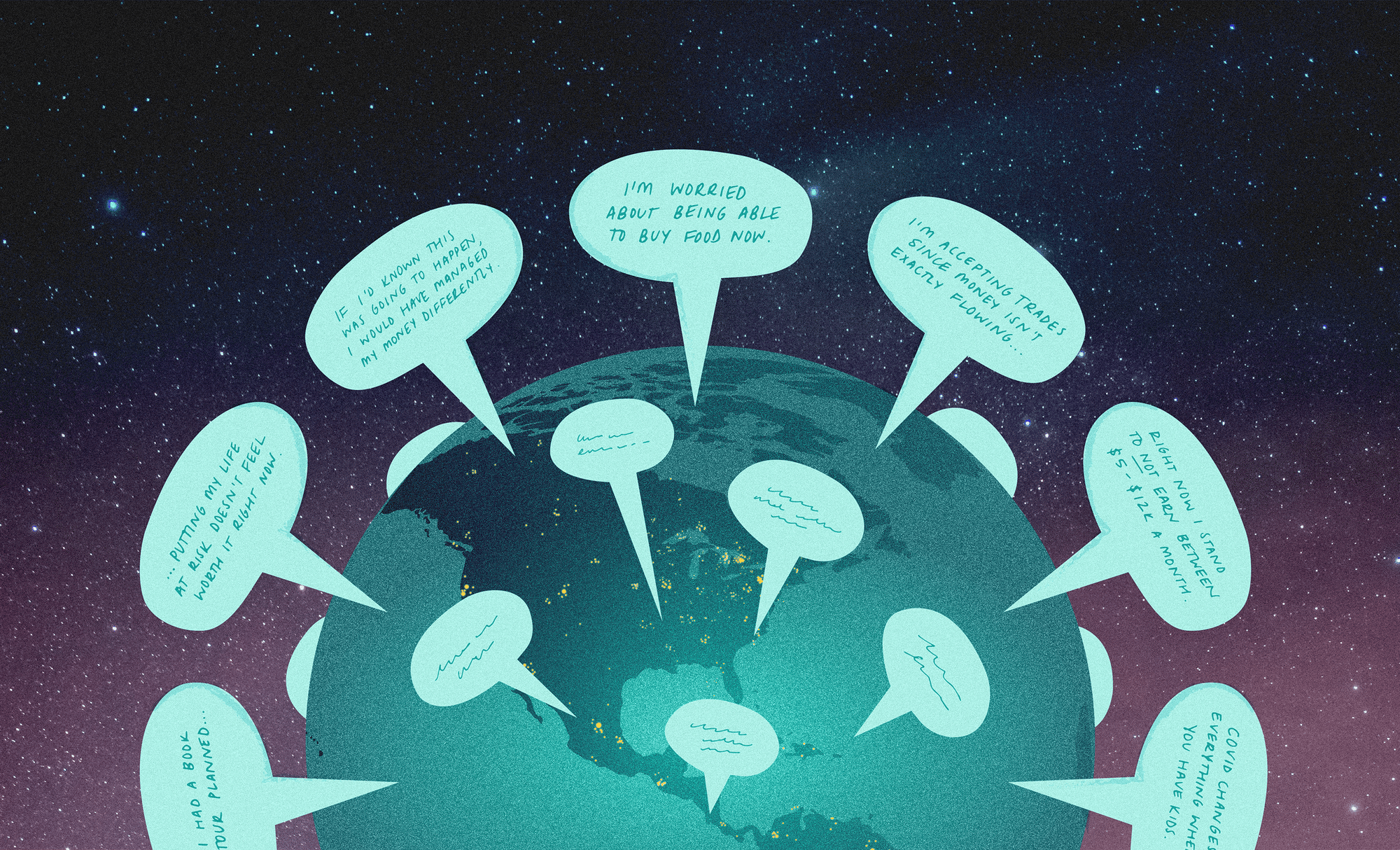

Pandemic Money Diaries — Panic at Trader Joe’s Edition

Money Diaries

Natasha Rothwell's Character in “The White Lotus” Finds an Angel Investor. Her Real Life Didn't Quite Work That Way.

Money Diaries

Money Diaries: Pride Edition

Money Diaries

When did you start your record label? How old were you?

’96. I was 19. The first band was my friend’s band and we gave them $100.

Wow.

Yeah. I mean, when I say I started my record label, it’s an idea. The cost to record the first record was a hundred bucks each. It was $300 to record because there’s three of us. It was a split label release, so it was my label — Dim Mak — and then their label, called Bastille. It was my friend’s band and we went to the pressing plants. We got the vinyl made. We did the covers at Kinko’s copy centre and we made 600 of them. Hand numbered them. We sold them at all the shows. And that was our first release.

That’s a hustle.

It’s a hustle, yeah. It costs $2 to make and we sell them for $3, so we make a dollar profit and then we split that dollar. I didn’t have a single investment in my label until 2003, when two brothers, the Good Charlotte brothers, actually pulled my business out of my apartment. I had 13 interns and one employee at that time. They paid for this office, put me into this unit where I could work out of an office. That was the first investment I had, seven years after. For the first seven years, we’re running and gunning with zero capital.

I Googled your net worth last night. It’s $120 million. Did you know that?

No, it’s not around that. Though it’s a nice thought.

Okay, that’s fine. But I just want to say you are by far the wealthiest person I’ve ever spoken to in my life, and it’s not even close. It’s an honour.

I’m doing well. I’m not doing that well, but I’m doing well.

What’s the most expensive thing you’ve ever purchased?

Probably my house.

How much is that?

I bought my house for 2.7. But I also just put in a lot into the house, like all the crazy sh*t. A foam pit costs a lot of money. My pool is six feet deep.

How do you invest your money?

I invest a lot in different things. A lot in private equity. I trust my money managers to put it in very safe bonds and things that are just boring. I don’t really touch that kind of stuff. I let them handle that. When it’s fun, it’s a little bit more risky. Whether it’s crypto or NFTs, startups, a lot of tech, I definitely dabbled into all that space quite a lot. I was very early with Spotify, StockX, Uber, Pinterest.

For the audience of people who are like, “I don’t have the money that Steve has, but I am interested in building my wealth,” do you have a recommendation for a good investment?

I’ll start with something that’s not a good investment. Nine out of 10 restaurants and clubs fail. So, the advice is, Don’t invest in the idea, but invest in the person. Whoever is leading the operations, if you feel like they got their sh*t together, they’re organized, they can manage and delegate well, they know how to build a team, that’s who you want to invest in. And don’t get married — don’t get too excited about the idea. Because the ideas, they are everywhere. There’s always a really brilliant idea. Everyone’s got a brilliant idea. The execution of the idea is far more important.

Who’s been your favourite artist to work with thus far?

I always shout out BTS, and rightfully so. They’re just really kind, beautiful, compassionate people. I have a great relationship with them. It’s just proud for me to see Asian faces that are dominating in music, that are singing in a non-dominant language and have taken the entire world with joy and happiness. They’ve united the world in so much happiness. It’s just amazing to see. And they represent the Asian demo. For me, it’s a really big proud moment. I love BTS.

I have friends who are millennials who get so much joy from listening to BTS. I don’t know why — I know I’m not their target demographic — but they bring me so much joy. And I was like, wow, that has to be a huge reach, if you’re reaching black girls in their 30s. That’s a big deal.

Here’s another topic switch: Did your dad leave you any piece of Benihana?

I never expected to receive anything from my dad. He never put it out there like that, which I think — one of the best lessons that he ever gave me is that there is no lifeline. Because everyone’s going to fail. The problem about the way society is right now is that we don’t embrace failure so much. We need to embrace failure in a way where it’s okay to fail.

No successful person has never not failed.

Yeah. For my kids, if I have kids — I don’t have kids yet, but if I have kids — that’s one thing I’ve been thinking about. I don’t want to spoil them and then they just don’t want to fail. I’m like, “Fuck. You have to fail. You have to fail. You have to pick yourself up.”

That’s so smart. Thank you so much, Steve. This has been such a great opportunity and conversation. I really appreciate you just chatting with me.

Absolutely.

Tori Sampson is an award-winning playwright (her recent play “If Pretty Hurts, Ugly Must Be a Muhfucka” was a New York Times critic’s pick) and currently writes for “Hunters” on Amazon Prime. She is a proud Bostonian and lover of all things Julia Roberts and AJ1 sneakers.