Money & the World

How to Consume and Discern Information in Our Slop-Infested World

AI has unleashed a flood of computer-generated marker commentary. Here’s how to filter the good analysis from the bad.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Note: Brent Donnelly, the author of this piece, is a longtime FX trader. He writes the very good Friday Speedrun newsletter.

The internet is a fun place to learn about money. It’s also a minefield of lousy takes and, increasingly, AI slop packaged as brilliant analysis. This poses a huge problem for traders. Good investing requires you to stay informed without getting emotionally hijacked. And what you read shapes how you think and how you invest. So you need to be a savvy consumer of financial media. Here’s a crash course.

Ignore financial nihilism

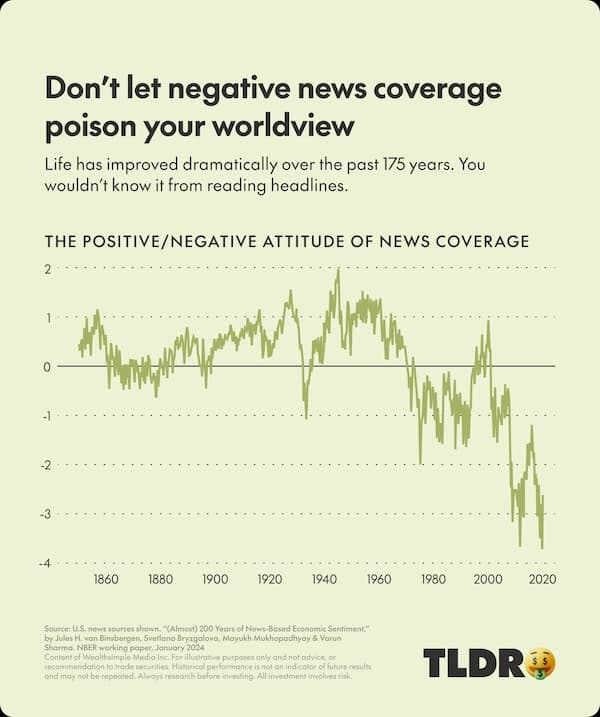

One long-running issue is that financial media has a negative bias. Why? Because negativity drives engagement. People claim to prefer positive news but habitually consume negative coverage. Even infants react more strongly to negative stimuli. Studies agree that humans tend to perceive people who present pessimistic opinions as more intelligent than those who express optimistic ones.

That explains why bearish market analysts are often viewed as having “cut through the noise,” while bulls are dismissed as naive Pollyannas. “For reasons I have never understood, people like to hear that the world is going to hell,” economist Deirdre McCloskey once said. “Yet pessimism has consistently been a poor guide to the modern economic world.” Indeed, over the past 200 years, the global poverty rate has plummeted, and stocks have steadily climbed. Human progress trends upward.

Of course, it’s not always unwise to be bearish. Just remember that if a forecaster is shouting that a crash is imminent, ask yourself whether he or she is preying on our innate fondness for negativity, whether they have a verifiable track record, and whether they’re providing analysis supported by evidence.

Prioritize legitimate gatekeepers

Platforms like X and Substack have removed the traditional guardrails around publishing. Hence any rando can now disseminate objectively wrong information in essay form. And if the essay taps into the right vibes — fear, nihilism, cynicism — it can go viral.

That’s why it’s important to subscribe to Bloomberg, Reuters, Financial Times, The Wall Street Journal, or other outlets of high journalistic quality. Financial media has a negativity bias, yes. But professional editors, reporters, and fact-checkers still have tremendous value in upholding standards around clarity, accuracy, and quality control. Independent thinkers with long track records — like the Marginal Revolution guys, Michael Mauboussin, or Ben Carlson — are also solid bets.

Filter relentlessly

I recently wrote about a market analyst who often pumps out three to four long essays a day on Substack. He was unknown just months ago and now has 13,000 subscribers — and his articles are likely written by a chatbot, at least according to AI-detection program GPTZero. This is hardly an isolated case.

Plenty of smart people are on Substack and X, but you need to curate carefully and mute aggressively. Know the bias of every author you read. Consider deleting social media from your phone. And remember that permabears, permabulls, and clickbait merchants all thrive on attention, not truth. Successful investors are flexible, open-minded, and forward-looking. Don’t be perma-anything.

Donnelly is a longtime FX trader and the president of Spectra Markets. He writes the Friday Speedrun newsletter.