Money Diaries

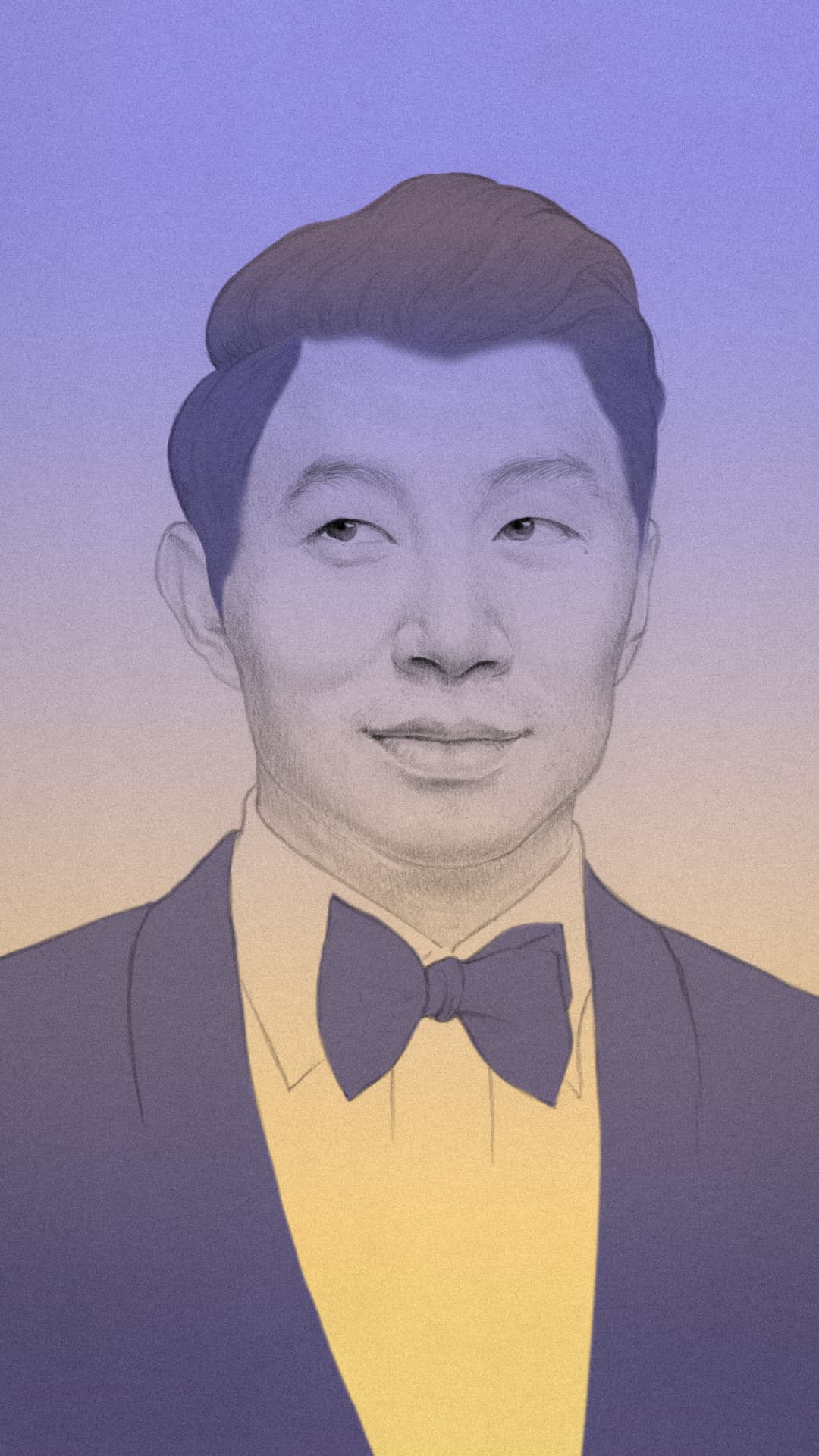

Simu Liu Doesn’t Own the Raptors. Yet.

The star of Marvel’s Shang Chi on his immigrant experience, buying his friends a Disney experience, and his old job crunching numbers at Deloitte.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Growing up in Ontario, I would say that we worshipped money as a family. My parents treated their bank accounts like a canteen of water in the middle of the desert — everything about the environment was designed to take that water from you, so you had to ration well and not waste a single drop. And when you’re thirsty in the middle of a desert, in the beating sun, you’re not worried about abstract concepts like happiness, or fulfillment. Your one and only concern is finding enough water to stay alive.

My family comes from extremely humble beginnings in Harbin, China. We lived with my grandparents in a small ramshackle apartment with no hot water. In order to take a bath, we had to boil pots of water to mix into the bathtub. We re-used everything, re-purposed whatever we could, and stretched every penny.

When I was eight months old, my parents moved to Canada to study at Queen’s University, and I lived with my grandparents for a few years until I joined them in 1994. When I arrived, they were living near the poverty line. They hadn’t completed their post-graduate degrees yet, so we were living off of their very modest scholarships. We rarely ate out, and we trolled the discount aisle for deals at the supermarket. I learned early on that if something wasn’t on sale, we weren’t getting it. My parents never spent a penny they didn’t have to. And so I, in turn, was never exposed to anything close to the high life.

I got my first job at a Country Style — think Dunkin' Donuts — when I was sixteen, and I made $7.50 per hour. It wasn’t much, but it was the only way for me to have a little bit of spending money. My parents didn’t believe in giving an allowance, and within my group of friends I’d become the panhandler who was always asking to be spotted a dollar so that I could buy a drink or a snack. Getting a job changed that. I saved up every dollar and bought myself a Playstation Portable (PSP), which I cherished every single day. And my last job, before I got fired and pursued acting full time, was at Deloitte, the global accounting firm. It didn’t last long. If I remember correctly, my severance was one month’s pay — about $3,000 — and I spent $1,200 of it on a professional photo shoot, which, if we’re honest, was a bit of a scam.

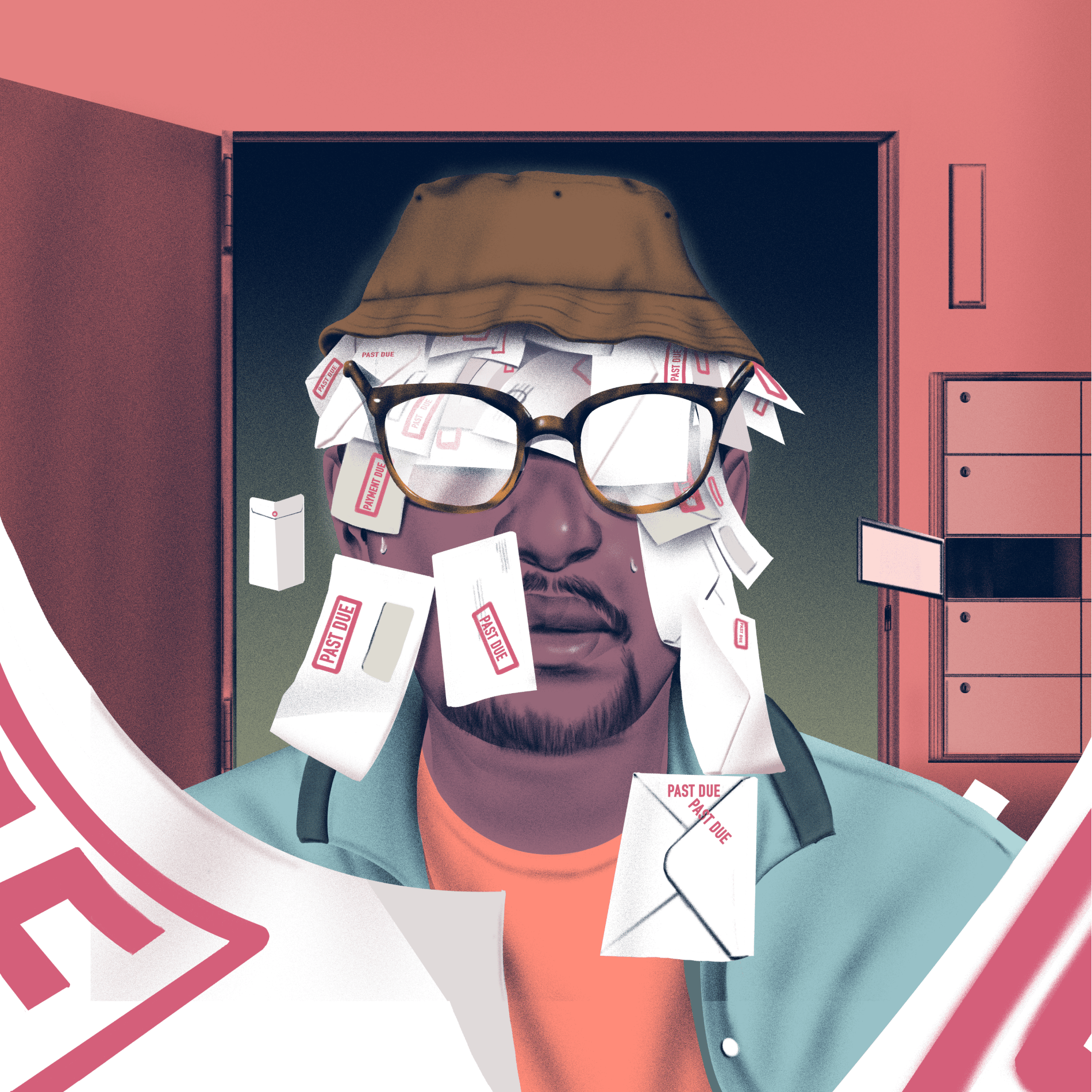

Growing up, my parents avoided credit cards like the plague. During the depths of my struggle, I was thousands of dollars in credit card debt.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

This was a dark, dark time for me financially. Growing up, my parents avoided credit card debt like the plague. They paid off their mortgage in something like four years because they absolutely hated the idea of paying interest. During the depths of my struggle, meanwhile, I was thousands of dollars in credit card debt and could only afford to pay the minimum balance each month.

I could blame this on the fact that I was an Asian actor in the business, but the reality is that it’s hard for everyone. According to ACTRA, the Canadian actors’ union, the average performer can expect to make under $15,000 a year. I consistently made more than that, and I still couldn’t make ends meet. Without a joe job to supplement that income, it just wasn’t possible to survive.

Getting cast in Kim’s Convenience changed my life. It was a Canadian TV sitcom about a Korean-American family that runs a convenience store in Toronto — I played the son — but the role did not make me rich by any stretch of the imagination. Canada had no real star system, and our local actors were treated more like human props than artists. We had no leverage whatsoever. I was paid $80,000 for my first season, which was already more money than I had ever seen before. It was enough to finally pay off all my debts. It was enough to make me into a middle-class immigrant with a relatively steady nine-to-five job who was still struggling to make ends meet.

From the moment I was cast in Kim’s Convenience, I started to plot my path to Los Angeles. As grateful as I was to have a job finally as a working actor, I knew that my career would be dead in the water if I stayed put. We had no idea how long the show would last, or if there would be anything else waiting for me in Canada when it eventually ended. And considering how opportunities for Asian actors didn’t grow in trees, I knew I needed to get to the heart of the television industry for pilot season. And that cost lots of money. I spent tens of thousands of dollars moving to Hollywood — on legal fees for a work visa, multiple round-trip flights, car rentals, accommodations. Three pilot seasons later, I’d gotten enough small roles and earned enough money to settle into LA for good. But I had barely a penny more to show for it.

Recommended for you

To Win Four Oscars, Sean Baker Had to Go Broke Again and Again

Money Diaries

Roxane Gay on Financial Independence: 'The Most Important Thing a Woman Can Do for Herself'

Money Diaries

She Was Living in a Shelter Six Years Ago. Now She’s the CEO of Her Own Beauty Company

Money Diaries

It’ll Work Itself Out (It Actually Won’t)

Money Diaries

Getting cast as the lead in a Marvel franchise changed all that, obviously. But whatever you’ve read out there about how much actors get paid for these types of films, I guarantee you that I make less. This idea that getting a TV show or a movie means you have “made it” just simply isn’t true anymore. Sure, I live comfortably. But my net worth is very much in the red. There are the very real costs associated with managing the level of fame that comes with a role of this size and duration, whether it’s hiring private security or buying property somewhere you feel safe and comfortable.

Whatever you’ve read out there about how much actors get paid for these types of films, I guarantee you that I make less. Sure, I live comfortably. But my net worth is in the red.

And then there are the costs you impose on yourself. I’m never not going to pull out my credit card when the bill comes with my friends. I know that I’ve been beyond lucky, and I want to improve the lives of those around me, whether that’s taking my family to see the Great Barrier Reef in Queensland Australia, splurging on a party bus for 11 of my friends to go to Vegas for the weekend or bringing my high school friends on a VIP Disneyland experience with private tour guides. It’s a gift and a burden to know that you are the only one who can do this for them. Also — and I know I’m gonna get no sympathy for this, but I’m just gonna say it — I hate flying coach. Everyone hates flying coach, and now I don’t have to do it anymore, and neither does my family.

The two things that eat up my paycheque the most are food and mortgage. I don’t really cook. I was never that great at any aspect of it. I also bounce around all the time for work, which makes buying groceries nearly impossible. Mostly, though, I just love sitting around a table with friends and enjoying good food. As a consequence, I’m sure I spend way more than I probably should on treating people and eating out. Next is the mortgage. I own property in Toronto and Los Angeles, and ironically, I’m rarely in either city. So, a massive chunk of my paycheque goes to mortgage payments and property taxes for homes that sit empty while I go somewhere else and make more money.

The good news is: I wouldn’t consider myself a frivolous shopper. I graduated from business school, so there’s a floor to just how irresponsible I’m capable of being with my money. I max out my pension contributions, invest a percentage of each dollar that comes in, and deduct everything that I can for tax purposes.

That’s how I try to think of myself—not just an artist collecting a paycheque. I’m the founder of a lean and mean start-up named Simu Liu.

The most valuable thing that I buy with my money, though, is the power to say no. The financial freedom to take creative control of my career. It’s commonly known that the most fearsome negotiator is the one who is ready to walk away. This entire experience has opened my eyes to the difference between new money and generational wealth. When Shang-Chi came along and I started making some real money, I didn’t think of myself as rich. To be honest, I had quite the opposite reaction. I took one look around me and I thought, “Holy crap, I haven’t even begun to scratch the surface of what some of these people make.” This town is full of new money, but building a lasting financial foundation is far more difficult, and far more rare.

Now that I feel like I’ve reached a reasonably secure stage in my finances, I’m ready to pursue some big ambitions. I definitely want to make the Forbes list of the highest paid actors, and I want to produce my own projects from start to finish. I worked with Mark Wahlberg on a movie earlier this year and I got the chance to pick his brain about his businesses. He really impressed upon me the idea that unless you have an ownership stake in a project, you’ll always just be making a paycheque.

That’s how I try to think of myself — not just an artist collecting a paycheque. I’m the founder of a lean and mean start-up named Simu Liu.

That being said, I’ve often thought that my parents represent a cautionary tale of what happens when you let money rule over your life. I’m not a hoarder. I’m not afraid to spend. I view money as a resource that I can use to create unique experiences with the people I love. For instance, the Toronto Raptors. I love the Toronto Raptors. Buying the franchise someday might be a bit too ambitious; the path would probably involve running a successful production company — an insanely successful production company — and then investing the capital in the next Uber. We’ll see. For now I’m satisfied with being a superfan. I did spend thousands of dollars on the playoffs and the Finals in 2019, when we won the title, because I just had this feeling we were going to win it all — and the bill included the massive friends-and-family discount I was able to take advantage thanks to my friend-and-family Jeremy Lin. But if you think they’re anywhere near Drake’s, you are really overestimating my net worth.

Originally published December 2, 2021.

Devin Gordon is contributing writer for a number of publications, including The New York Times Magazine, ESPN the Magazine, GQ, The Atlantic and The Guardian.