Finance for Humans

Cubicle Escape Plan: How to Semi-Retire Years Before Most Canadians

Want to quit your day job at 50 and teach pottery or become a fishing guide (or whatever)? Here’s how much you’ll need to save.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

The average 9-to-5 worker spends 80,000 hours on the clock over their career. If you’re 35 and plan to retire at 65 (the standard age Canadians start receiving their pension), you’ve still got a solid 48,000 hours left. Which, even if you love your work, is a long time. In fact, it’s too long in the view of some Canadians. According to a recent study conducted by the pollster Leger and our sponsor, Wealthsimple, 41% of Canadians between the ages of 25 and 44 hope to semi-retire before age 55 in order to chase big dreams — like working for a non-profit, or launching an artisanal-mustard company, or writing the Great Canadian Novel in a remote cabin. “I want to live in the forest, in front of a lake — just waking up and not having to report to anyone,” explained Eric Tai, who’s in his early 40s and lives in Vancouver. “If I want to draw, I’ll draw. If I want to play with my daughter; that kind of stuff. I want to be free.”

Which sounds super dreamy. But how can you actually do something like that? More precisely: how much money would you need to save to soak in the lake life, or whatever your ideal version of semi-retirement is, without burning through your nest egg before you retire for real at age 65? Well, lucky for you, it’s our job to figure out such things. Read on!

First, some assumptions:

[1] You want to switch careers at age 50.

[2] Your household income is currently $140,000 a year (which is the median for a university-educated Canadian couple). You’ll make roughly the same amount in real dollars until you retire, once you account for 2% annual inflation and a 2% annual salary increase.

[3] Once you semi-retire and recruit some pupils for your pottery studio or whatever, your household income will fall by half, to $70,000/year, and will stay there until you fully retire at age 65.

[4] You already have $50,000 saved (pretty typical), and finally…

[5] You’ll spend the inflation-adjusted equivalent of $60,000 a year in retirement until you keel over at age 95 (RIP), so you want your savings to last until then.

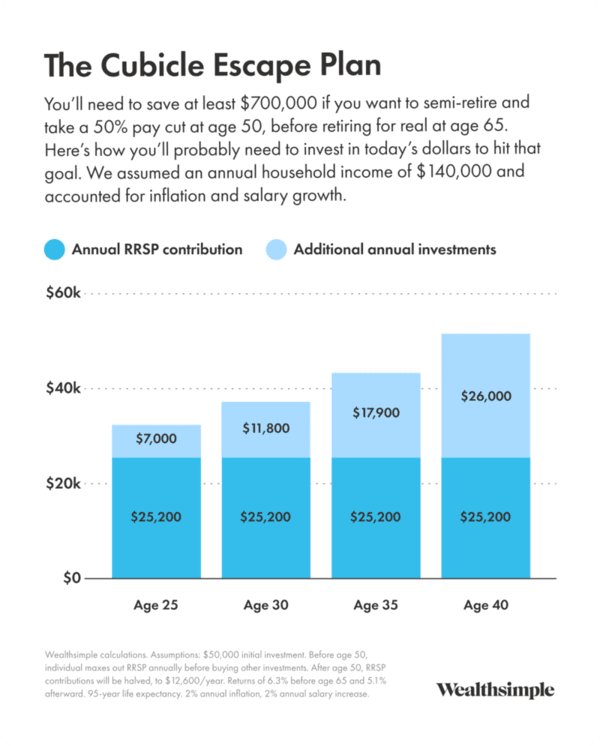

OK, got it? Well, based on our calculations, you’ll need at least $700,000 by the time you turn 50 if you’re hoping to semi-retire by then. That’s a big number. (We sort of explain how we arrived at it below). But you can get there by steadily investing:

Do those annual savings goals seem ambitious? Well, they are! But at least they’re more attainable than the savings targets you’d have to hit if you wanted to retire fully at age 50. (We ran those brutal calcs back in February; scroll toward the bottom.)

Anyway, the chart makes clear that the earlier you start saving, the easier it will be to hit your goal. And if you do save $700,000 by age 50 and keep putting $12,600/year annually into your RRSP (aka half of the limit) until you turn 65, you’ll probably end up with between $970,000 and $1.5 million* by the time you resign yourself fully to the trout stream or backyard garden or whatever else retirees do. And that pile of cash, along with public-pension money, should be enough to cover your living expenses until you sail off into the great beyond.

*Our calculation shows you’d actually end up with more than $970K–$1.5 million, but you’d have the equivalent of that buying power today.

DO THE MATH YOURSELF

We’re betting your annual household income is not exactly $140,000. To figure out how much you’ll need to save to semi-retire at 50, first determine how much money you’ll need once you retire for real at age 65 — 80% of your annual pre-retirement income is a number that personal-finance pros often toss around. And if you expect to live another 30 years after turning 65, you’ll want to save enough to cover that time. Confused? You can use a handy retirement calculator if math isn’t your strong suit. Anyway, once you know your retirement goal — let’s say it’s $1.23 million — then you just need to figure out what 90% of that number is: about $1.12 million in our example. That should give you a pretty good target to try to hit by age 50. In the meantime, good luck!

Sarah Rieger is a senior news writer for Wealthsimple Media, and co-host of the TLDR podcast. She was previously a reporter at CBC News and editor at HuffPost Canada. You can reach her at srieger@wealthsimple.com.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.