Money Diaries

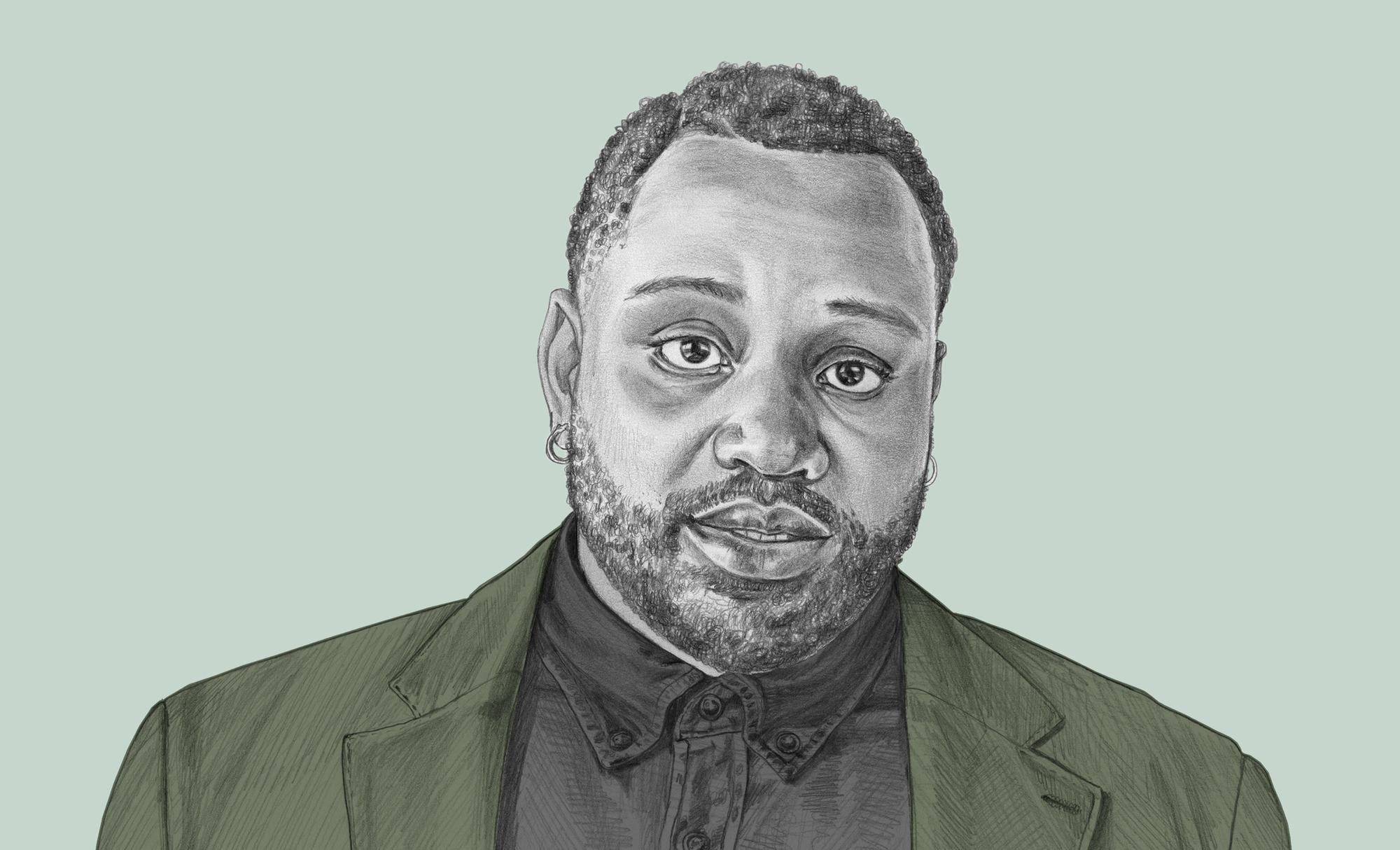

Brian Tyree Henry Tells His Money Story, From Yale to Food Stamps to Oscars

Before he was Paper Boi — and way, way before he was acting opposite JLaw in “Causeway” — Brian Tyree Henry was just a kid from North Carolina living off bologna sandwiches in NYC.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

I remember growing up with food stamps, on welfare as a child. But you don’t know who you are until you’ve gotten degrees from Morehouse and Yale School of Drama, and as soon as you move to New York you have to get food stamps. Mind you, my mother was in tow, telling these people, “He has a degree from Yale!” I definitely remember that feeling, looking at my Yale degree, at my Morehouse degree, and then that EBT card, and I was like, “Are you really going to do this?” But we did it. And I ate like a king for the year that I had it. Bologna and cheese sandwiches.

I was born in Fayetteville, North Carolina. It’s home. Fort Bragg was our little claim to fame. 'Fayettenam' — Fayetteville’s so dangerous we call it ‘Fayettenam,’ like Vietnam. When I went to visit my father it was like, “Oh okay, we’re going to run and get groceries. There’s a gun on your car seat though. Can we figure out how to shift that?” My father was in the army but by the time I was born, he had been retired for about 15 years. He served in Vietnam three tours — not exactly by choice, but he was there. In high school my father was like, “If you join the military I will shoot you.” And I believed him. There used to be recruiters that would come to the door when I was in high school and he would literally just sit on the porch with his shotgun, just like, “Yeah keep moving.” I grew up with the benefits of the military — great insurance, great hospitals. Much respect to it, but no military for me.

I was the baby of the house. My sisters were 15, 16, and 18 years older than me. By then, my parents didn’t have time to entertain me. I always had a really big problem watching my parents be embarrassed. This black man and this black woman who were constantly dealing with a lot of things that were kind of humiliating to them when they left the house. So I would do a lot of pretending to make sure that they didn’t feel embarrassed when they got home. So, for example, I never was able to believe in the Tooth Fairy or the Easter Bunny or Santa Claus. I would pretend so hard and be like, “Oh my god, the Tooth Fairy left me like a quarter. That’s so amazing!” knowing that my mother with the money that she had would leave like a dollar or 50 cents. I think I wanted them to be able to experience some kind of like glee and joy that their child still had this wonderment about things that had come from their blood and sweat. I would just pretend for them as long as I could.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Acting for me was just a way to escape and not have to spend a lot of money on therapy. When I would go out of the house I would imitate these insane giants that I lived around. I just kept doing it. I never thought that I would make a living off of it. In school, I really got into plays. I was like, “Oh they’re called ‘plays,’ so you get to literally go and play all day.” I really liked it and I kept meeting people who saw that I had a finesse for it and they just pushed me along to keep doing it. Never once did I think I would make any money. I just did it because it was fun, and I found my fellow freaks. You know, the people who loved iambic pentameter, the people who liked making sets. And it got me out of Fayettenam for Christ’s sake.

Once I made the decision to be an artist, there were three things that I decided I was never going to go without: lights, a roof, and food. Because once you tell your family that you’re going to be an actor they’re already waiting for how long you’re going to be on unemployment. They’re never like, “Oh my god, I can’t wait to see your name in lights.” They’re like, “You about to be poor as hell.”

So it’s all about proving my family wrong, having the last word. If you’ve got lights, food, and a roof, who can tell you anything? I still don’t know how this adult shit works like at all but I’m really good at pretending to be an adult. I mean I know how to do taxes and I’ve got bank account, but until a week ago I didn’t even know credit scores were three digits. But no lights have been shut off or anything.

And I’ve never been threatened with eviction. Because if you get threatened with eviction, in my mind, that means that you’re probably not that good of an actor. Before the eviction could happen I’ve made up several different tales. Like, “Oh yeah, you didn’t get that check? Oh man I could have swore I sent it. Oh the stamp must have fallen off.” But if you get to the eviction that means that you stopped being creative.

What does making money mean if the person I wanted to spend it on the most is no longer here?

I was happier when I didn’t know where my money was going to come from. I was in New York pursuing the thing I really loved, using my EBT card and eating these dope bologna, cheese, and mustard sandwiches. I remember not having a printer to print scripts out on, walking 20 minutes to the train. But when I started making money my circle of friends changed. I started being surrounded by people who know how to make money and making money was all we did. I stopped walking to the train as much, I stopped eating bologna and cheese, which I actually really loved.

I realized I don’t want to be around people who are just about making money. The making money part is fun, the having money part is not what makes me happy.

I will never forget the first time that I saw this thing in a kitchen — I don’t even know what they call it. Please forgive my ignorance. I was in Connecticut, doing a play in Greenwich or Darien, and I would go to the homes of some of the wealthiest people for dinner parties and in their kitchens there was always this faucet over the stove. And I was like, “What the hell is that? Why are there faucets over the stove?” I realized, oh yeah it’s just customary to have a damned faucet over your stove! And to me I was like, “That’s opulent. That is amazing.” If you get a faucet over your stove then you’re like, “Oh hold on, let me get some really good pots then.” Like I know that if I get a faucet over my stove all my pots are going to have to be copper, or like porcelain pots with countryside etchings and stuff, because that’s what you do once you get a faucet over your stove. But I was like, “I don’t know if I want to be around these people.” I don’t know if these are the people that I want to kick it with because that’s the lifestyle that they know.

I don’t know what sick depraved thing inside of me loves the Bernie Madoff story, but I love it. I could literally watch The Wizard of Lies every day. Watching it, I wonder if you can ever really trust investments. I’m always like, how insane is it for people to really just give all this trust to somebody about their money? Someone could be saying that they’re doing this thing, and you have this account over here, but there is a shithole floor below their business where they’re stealing all your money.

As soon as I get money I just want to give it away — it’s one of my best and worst traits. I guess if it’s not there then I don’t have to worry about the responsibilities of it. It’s just something that I’ve done for a long time. I’ll go out to a restaurant and I’ll ninja the check — be like, “Oh it’s all good.” And I hate to return things, so if I get something that’s the wrong size I would rather just give it away to somebody than return it. I’m ashamed to look at my monthly statements. You know, I just discovered that they make a Pinot Noir Rosé so for an entire week I just bought Pinot Noir Rosé like every day. I don’t want to see that I spent that much money on rosé every day! I’m bad at keeping receipts, too. But I’m a great tipper. Nobody can tell you that I don’t tip. I’m an amazing tipper.

There is nothing worse than when people automatically assume that you have money. Like I remember once I got this television show, if went anywhere, people would automatically be like, “Well he’s got it.” I’m like, “How do you know I got it? Because I’m on a television show? You don’t even know how much I make. And I could be sending money somewhere to people.” But people automatically assume things about you based on the money they think you have, this imaginary money.

My father is a black man from Kentucky born in 1940. His highest level of education was fifth grade. I don’t think he had a bank card until I was like 21. I think he used to stow his money in mattresses. He still has a flip phone from 1997. I was like, “Dad, you don’t know how to text, do you?” And he was like, “I don’t know how to do it, but I get your texts.” I was like, “Well, what is a text if no one responds to it? I need you to respond to the text message. And I want to send you pictures.” So I got him a phone, and it was the most expensive thing I ever bought. I paid $900for a top-of-the-line iPhone 7 Plus — this was before the 8 and X shit came out. I was like, “You’re almost blind but it’s the size of a tablet. There is no way you can’t figure this out.” I sent it to him as a gift so there was no price tag, and the first thing I was expecting him to do was call on that phone or at least text. But I hear nothing from him. So I call like two weeks later and I’m like, “Dad, you’re answering on that damn flip phone aren’t you?” He was like, “Yeah, man. Yeah.” And I was like, “You didn’t take the phone to get programmed?” “No, no, but I looked online and saw that it was $900.” I was like, “So you can look up how much the damn phone was, but you couldn’t get it programmed?” But I knew that the reason he won’t program it is nobody in his entire 77 years has ever spent that much money on something for him. I know it’s the most expensive thing he has ever gotten.

My mother taught in inner city schools. I lost her a year ago.One big reason why I got into acting was because I wanted to spoil her so bad. I wanted to do what I call caking her out. Like I wanted her to get all the Balenciaga she wanted. I wanted her to have the best car. I wanted her to have the house with the dock by the lake. And what I never accounted for was that I wouldn’t have her when I got all those things. So what does making money mean if the person I wanted to spend it on the most is no longer here? I know my mother was proud even when I was eating those bologna sandwiches. I can look at my bank account and be proud, but it’s not the same — she is not here to get that faucet over her damned stove.

As told to Errol Morris exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.