Money Diaries

One Indie Musician on Why Indie Musicians Should Stop Worrying So Much about Selling Out

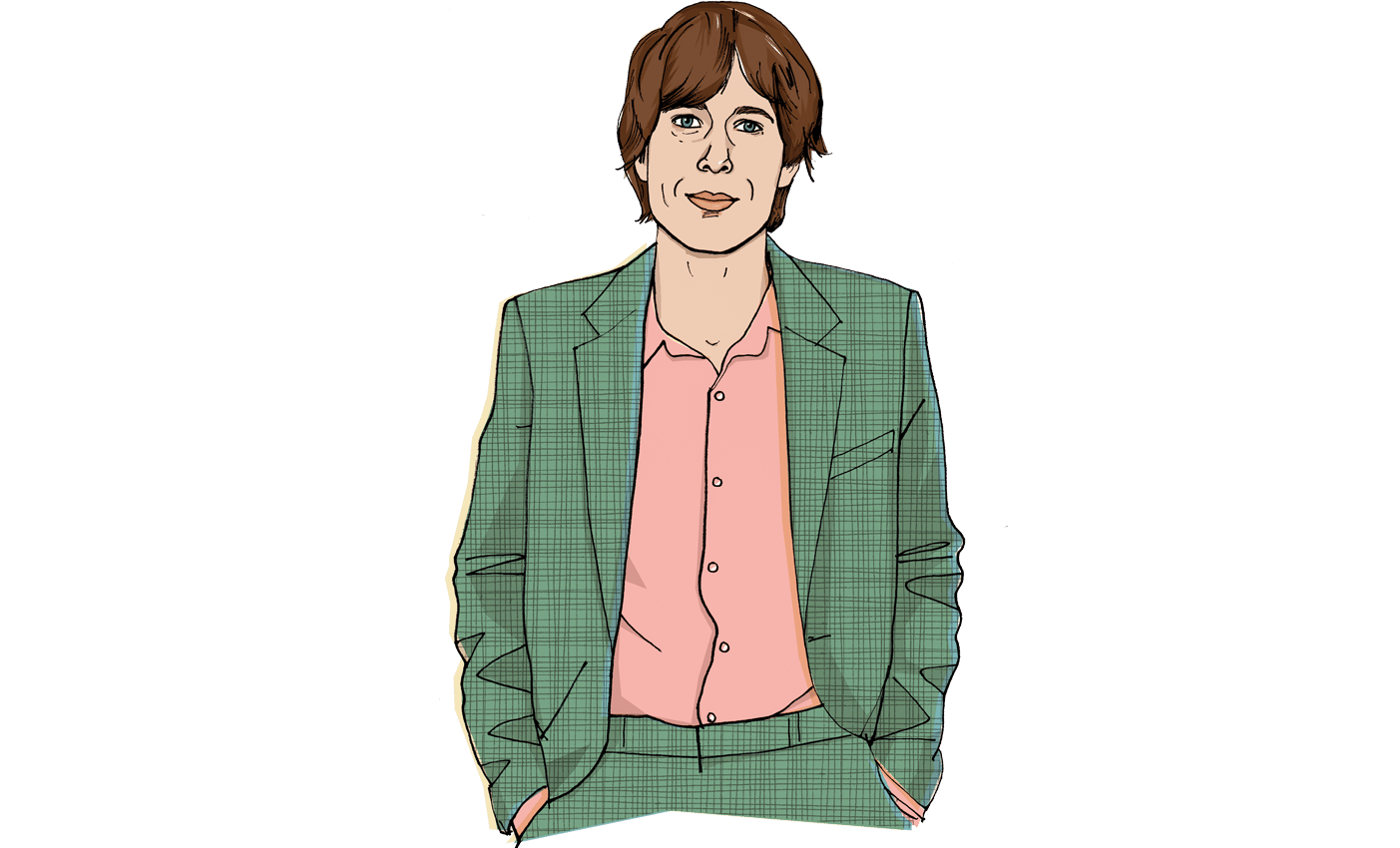

Nick Thorburn—the lead of the indie bands The Unicorns and Islands and the composer of the theme to the Serial podcast — reflects on what it should and shouldn’t mean to have integrity in music

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives.

In college, I started a band called The Unicorns with a few of my closest friends. We released some albums, and we began to make a name for ourselves. That’s when we came to our first big fork in the road. We were offered a lot of money to license our songs for commercials. Honda, Adidas, a TV show called The O.C. But we turned them all down.

We were stubborn. I think the concern was that it would diminish the song’s meaning if someone really loved it and then heard it in a car commercial. We didn’t want to be accused of “selling out” or letting our fans down. And our music heroes—folks like Ian MacKaye, Fugazi, and Minor Threat—were principled about making music for the right reasons. Making music for creative fulfillment and to put good things into the world, not to reap financial rewards. But the music industry has changed. Money has never been a motivating factor for me. But looking back, I might make some of those decisions differently now.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I was raised on the north end of Vancouver Island in a small town called Campbell River, less than 20,000 people. It had once been a fishing, logging, and mill town, but after the industries dried up, it became kind of a sad tourist town with very few tourists. My mom was a nurse, and my dad was a fisheries officer. Growing up, we called ourselves middle class, though that might have been aspirational.

My first job was as a paper boy. Then, when I turned 15, I got a job working at McDonald’s for minimum wage—$5 or $6 an hour at the time. How it works is there’s one guy who flips the burgers and another guy who puts the fixings on. It was a joy when I got to actually make the burgers—adding the relish, mustard, secret sauce, and spit…just kidding!—because there was actually a creative element to it. God bless the fine people who work at McDonald’s or do any jobs that no one else wants to do. Fast-food workers should be paid way more than they are.

I never longed for expensive things. But that all changed my first semester in college, after I moved to Montréal. My roommate was really into shoplifting, so we would go to the grocery store near our house, brazenly walk in, grab the grocery bags off the checkout counter, walk through the aisles, fill up the bags with all the fanciest stuff—organic eggs, granola, cashew butters, fruits, cheeses—and just walk out. I didn’t shoplift for very long, but it was too late. I’d acquired a taste for the finer things in life. I was hooked on the good stuff.

It comes in little waves—I’ll be frugal for a long stretch, happy with simple, cheap things. I’ll buy clothes only at thrift stores. I’ll drive my humble car, a baby-blue 1974 Mercedes-Benz for which I paid just $3,500. But then, after a stretch of frugality, I’ll get an itch for a beautiful tailored suit, and I’ll go ahead and scratch that itch. Recently, I bought a nice dress shirt for $230 at Barneys. Some nice things are worth the cost.

Recommended for you

When I was in The Unicorns, those offers from places like The O.C. and Honda—that was like $20,000 to $60,000 for a song. And I’ve come to regret that we said no. Artists used to make money by selling CDs. They don’t any more. Spotify and whatever haven’t really replaced that—they pay half a penny every time a song is played, which is pretty shitty. We all have to be looking for what they call “other revenue streams.” It’s become more acceptable to license songs. And looking back, it seems like it would have been harmless. And we could have used the money to keep making more music. My current band, Islands, has been more open-minded about licensing songs. We don’t say yes to every opportunity, but it’s no longer an automatic no. Look, everything’s negotiable. You can’t just have a hard-line stance. Just turning down money doesn’t do anything. Saying no is just a negative, and by itself it doesn’t accomplish anything.

But that’s not to say that I don’t feel the same way still in a lot of respects. You can’t just be into making art for the money; if you are, you should be doing something else. The Unicorns broke up in 2004, and two years ago, we had a couple of ten-year reunion shows at the Forum in Los Angeles, where the L.A. Lakers used to play. Those were fun, big shows, and we were paid handsomely, opening for Arcade Fire. We had plans to keep playing a string of reunion shows that would have paid a lot of money. But we found ourselves at another fork in the road. Creatively, the passion wasn’t there—there were other projects that carried more excitement for us. So we passed on the shows and passed up a lot of money.

And that’s how it is. I do things that make me happy over things that get me paid well, for better or for worse. The truth is, I would love to have a house. I live in Los Angeles; it’s an expensive city. I have extreme house envy. I’m not just on this quest for riches. Every encounter with money is a new conversation you have to have with yourself. And I worry sometimes about sliding down a slippery slope.

And I think there’s something to be said for side gigs, for not remaining so single-minded and pure. A few years ago, my friend Jane, who used to work for the radio show This American Life, recommended me to the producers of a new show called Serial, which hadn’t been released yet. They played me the pilot episode and asked if I’d be down to write some music for it. I took the job and, over the weekend, wrote a bunch of music cues. The liked one of them so much, they decided to make it the show’s main theme. I figured Serial would be some fringe podcast that a few hundred people might hear. So it was a real shock to see the show catch fire and become a phenomenon. You would literally hear the theme I wrote played at NBA games over the P.A. system when there was a contested call. The Portland Trailblazers even offered me courtside seats if I’d tell them who the real killer was. I didn’t tell them—but they still put me courtside. I was like, Wow, this is cool! I brought a girl I’d just met to the game, and for that night at least, I felt like a baller.

And that changes the way people understand me. Serial legitimized me as someone who not only can write indie rock albums but also can compose music for podcasts, radio, film, and TV.

“Selling out” is an antiquated concept to me now, but I have to admit there’s a little kernel of it that still has hold over me—an adolescent kind of punk mentality. Like, I have this fantasy: When I die, I want to die penniless. I know it sounds weird and kind of sick. But I die alone in a rooming house, and after I’m gone, I’m heralded as this unrecognized genius. It’s just a romantic vision I’ve held onto. Generally, I’ve always had this unspoken notion that if you’re making money, you did something wrong. You compromised your principles or your purity. So I think the idea is that if I die penniless, it means I did everything right. I never sold out. On the other hand, I also have a fantasy of having an awesome house in L.A. I guess we’ll see what wins out.

As told to Davy Rothbart exclusively for Wealthsimple. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.