Money Diaries

Jon Chevreau, One of Canada's Favourite Money Gurus, Tells Us How He Retired at 60 Without Ever Being Rich

He's a columnist, author, and almost pathological saver. And he doesn't want you to call it retirement.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives. Jon Chevreau is a Canadian journalist and author who has written several books on mutual funds, stock markets and investing.

I guess I'm sort of the poster child for saving. I’m a writer, and writing involves taking the sacred oath of poverty—it's not really the most lucrative profession. But my wife and I, we always saved as much as we could. From the moment we got married, which was 27 years ago, we maximized our RSPs, and we maximized our TFSAs. The smartest investment I ever made was buying stock of Apple Computer right after the iPod was launched. It was about $5,000 in my RSP. That $5,000 would be probably worth $1 million today. Unfortunately, if you asked me what was the dumbest thing I ever did? I sold those same shares a year later. I had a great idea, but I didn't have the patience to stick with it. So that's one big brilliant move and one boneheaded mistake. You can't be investing for 40 years without making a lot of mistakes. That’s why there’s evidence that you can make a lot of mistakes picking your own stocks, and maybe this is why you should be in ETFs.

I think we have relatively simple tastes. To me, the best bargain out there is something like Netflix. We like to watch that — it’s like, what, 10 bucks a month. Anybody can afford Netflix. Our idea of a big night out would be Friday night going to a nearby pizza place and having one beer and coming home and watching Netflix. Or the library: We are big readers and there's a library nearby—it's totally free. I integrate it into my routine. I walk to the library and listen to a podcast, like Motley Fool, as I'm doing it. So I’m learning about money, being healthy, and picking up a book that is free. Life doesn't have to be that expensive.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

There are unavoidable expenses, of course, like auto insurance. But we both drive hybrids, and one of them is seven years old, and so our gas costs are low. My Toyota Camry, I only fill up my car once every five or six weeks. For the longest time we drove a Volvo, which we bought as a demo model, so right off the bat it had already depreciated a little bit.

I wrote a book called Findependence Day. “Findependence” is just shorthand for financial independence. I'm 63 years old right now, and I declared my findependence day two years ago, on my sixtieth birthday—I had balloons and fireworks and everything else.

As far as how much I felt I needed to have in order to declare my financial independence, I don't usually reveal these figures. But I'll give you a clue. As a general rule, you only need to replace only 50% to 70% of your working income when you retire, because a lot of your expenses are gone: You’ve paid off your mortgage; the children are educated; you no longer have other expenses. In Canada, the bare-bones version of financial independence is not that hard to pull off—for a couple, their Canada Pension and OAS will probably bring in $30,000 per year. Then there’s middle-class retirement, which is, say, $60,000 or so a year. Part of that is the government pensions, but the rest will have to come from passive income generated by retirement savings. To generate that much income you’ll need $500,000 to $1 million in today’s market with interest rates as low as they are. But if you want the Cadillac retirement, if you want to eat out in fancy restaurants a lot and you want to travel a lot as a lot of us do, then you want $100,000-plus per year. And to do that, you’ll need $2 million. So basically that's it. If you can live on nothing and you're used to living on nothing, you can actually not save a penny. If you want to live in the style to which many of us want to be accustomed, you need a million or two.

But how do you get there?Well we made other good financial decisions. We bought our first home when we got engaged, in 1988. And we paid off that mortgage within three or four years, taking advantage of the 10% prepayment privileges every year. This was when interest rates were almost 12%. There’s a book called How Much Is Enough, and the author talks about four money personalities in couples. And basically there are spenders, savers, builders, and givers. I am a saver. And luckily my wife is also a saver. When I met my wife, she already had a nest egg. She already had her portion of a down payment for a house—I had to tap my parents for mine.

Recommended for you

The World Wouldn't Make a Place for Angelica Ross. So She Made One for Herself

Money Diaries

Natasha Rothwell's Character in “The White Lotus” Finds an Angel Investor. Her Real Life Didn't Quite Work That Way.

Money Diaries

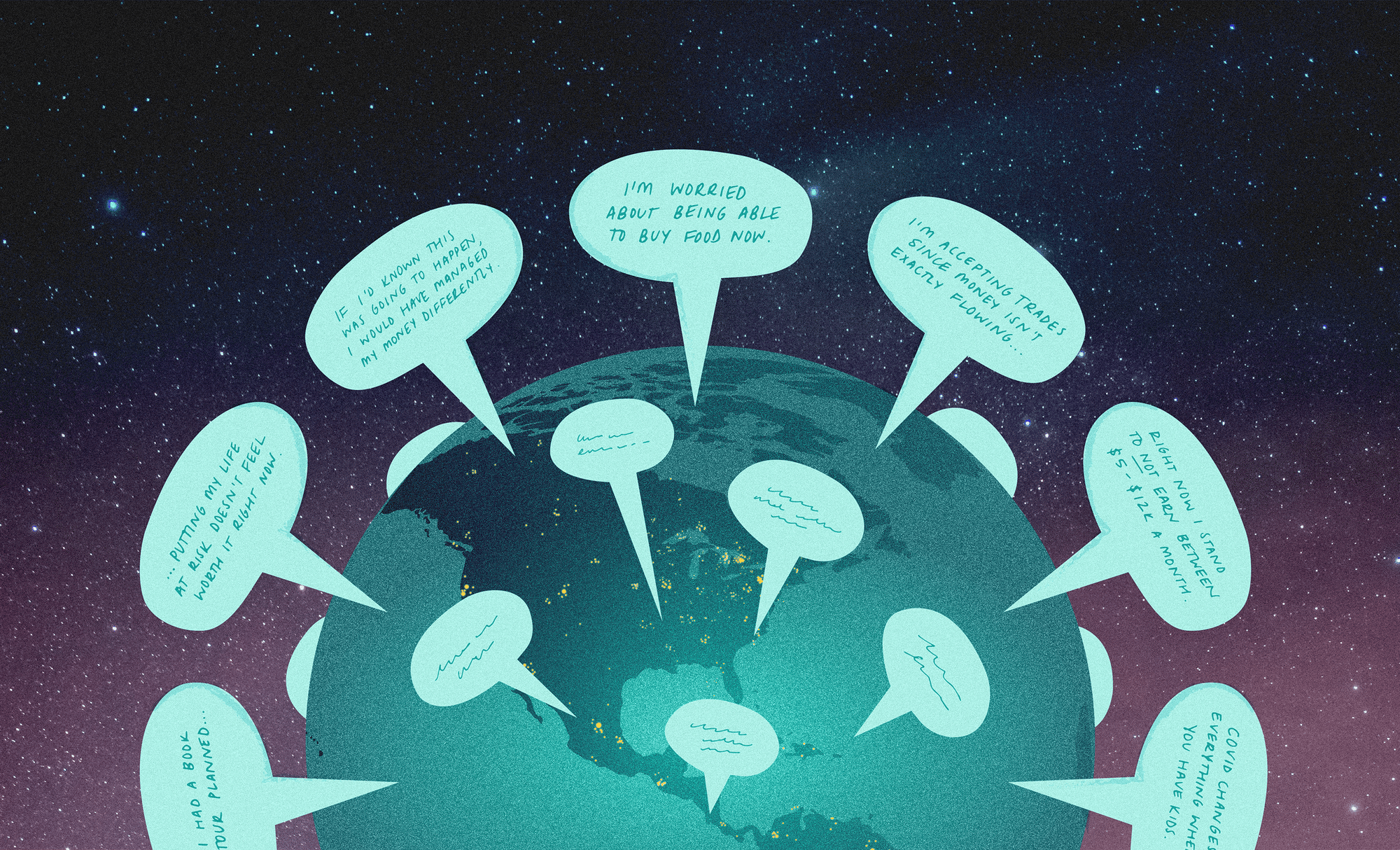

Pandemic Money Diaries — Panic at Trader Joe’s Edition

Money Diaries

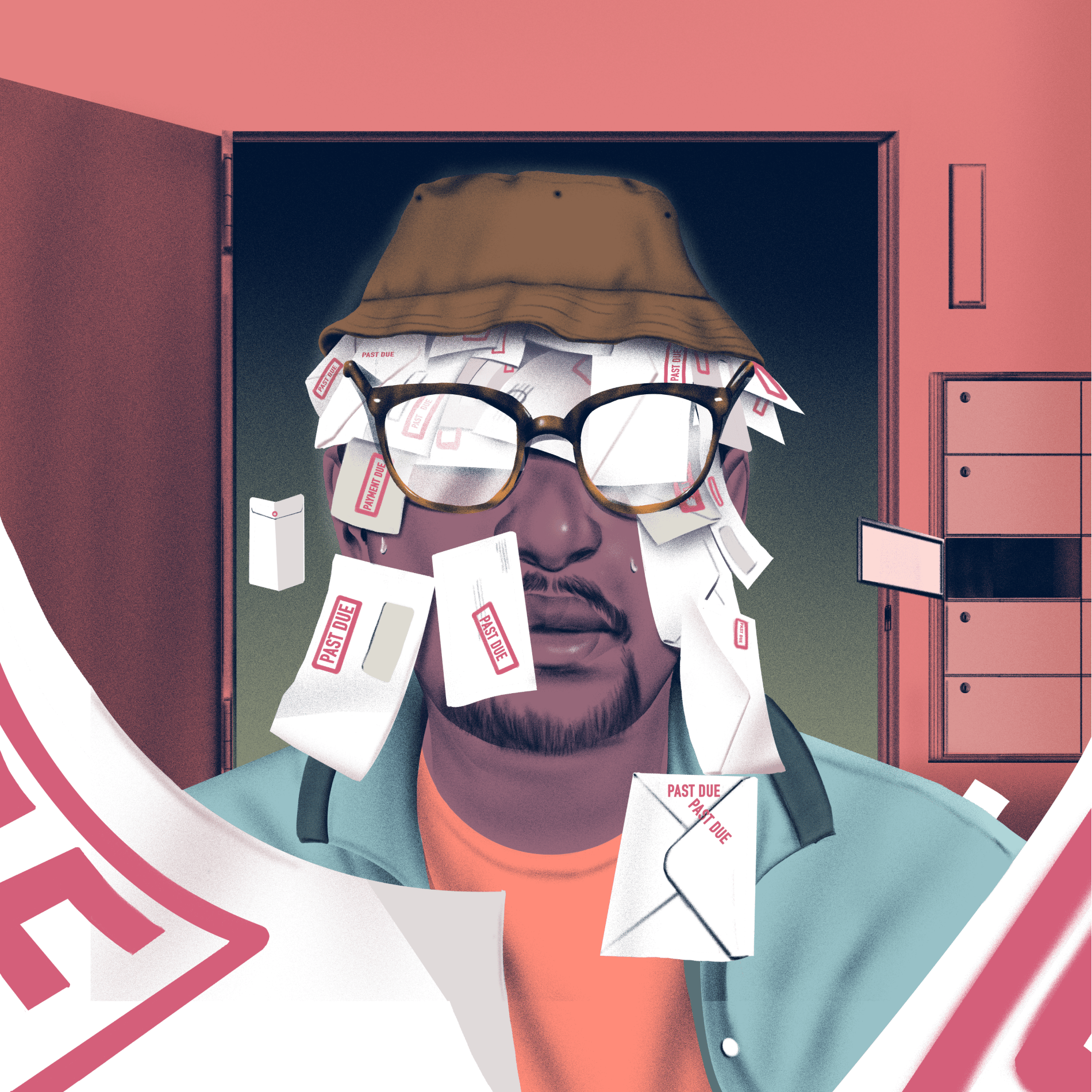

It’ll Work Itself Out (It Actually Won’t)

Money Diaries

I’m financially independent, but I’m still working—I call it “victory lap retirement.” We’re going to live a lot longer, maybe 10 more years than we’d reckoned. So I think we're going to have this 20-year period, that's the victory lap, when we’re financially independent, but we’re still healthy and vibrant and want to have the social interactions of working with other people and the stimulation of projects. So we'll continue to work not because we have to but because we want to. In my case, I'm trying to sell books; I'm doing some public speaking; I have three or four writing clients; I have the Financial Independence Hub.

I recently wrote a series of articles that will become my next book, Victory Lap Retirement. I talk about the seven eternal truths of personal finance. One is live within your means. You remember the old Dickens analogy: If you spend a little more than you’re making, that's misery; if you spend a little less, that's pleasure. Another is pay yourself first. Pay off your debt—no investment is as good as paying off 20% on a credit card. Another is be an owner, not a loaner. We taught our daughter this: Instead of buying them something they don't really need or want for their birthday, you say, “Here's a couple of shares of Disney or Apple.” My daughter insisted on Apple and Netflix in her TFSA. And what happens is you say, “Hold on, I'm an owner now.” Another of the eternal truths is never say no to free money from your employer. They may offer stock options at a discount; they may offer a pension plan, matching retirement funds. And likewise, never say no to a tax break from the government. So an RSP, a TFSA, you should maximize them. You build your wealth by living within your means, putting away ideally 10% of your paycheque, investing it properly for the future in a diversified portfolio of ETFs—often the costs are like a twentieth of other funds. You have to use every available trick in the book.

I’m trying to think of the dumbest thing I ever bought. I'd have to think about that. I'm pretty frugal. I'm sure I've bought some dumb stuff, but what? I can’t say cars. Clothing? I certainly bought things I didn't research properly, and then I had to replace them.

I have an Apple Watch, but I don't regret it. It actually helps keep me healthy. It keeps track of the 10,000 steps a day. What else would be along those lines? I don't know. I've never been a jewelry kind of person. I don't think I'm a candidate for really dumb purchases because I'm pretty frugal. I know the value of stuff and money and freedom.

Wait. Here’s something. I bought Prince's greatest hits after he died, and I really didn't like the music very much. So there was a waste of 25 bucks. Is that dumb enough?

I don't have big desires. I like reading and watching good little TV shows, and I like exercise. I mean yoga, yoga is expensive, I guess, a hundred bucks a month, but that's worth it, too. I don't like shopping. To me the idea of going to a mall is like purgatory. I have no interest in clothes or impressing people. But we're all different. I'm just an old guy who is kind of set in his ways and kind of frugal and starting to enjoy the fruits of it, which is what it's all about.

As told to Wealthsimple. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.