Money Diaries

Gary Numan and the Economics of Going Broke on £6 Million

The artist behind hits like “Cars” on making millions, going broke, the profitability of meet-and-greets and what went through his mind when his plane was going down over the Pacific.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

I tell you, man, I've been absolutely shit with money my entire life. My entire life. Me and my wife, Gemma, even now, we're useless. We're like children. Absolute children. And I've always been like that. I've never been particularly good with being sensible — you know, putting a little bit to one side, living within your means.

I had no appreciation of money whatsoever, to be honest, when I was a kid. My brother came along when I was seven, but up until then I was an only child and I was pretty spoiled. Not in a huge extravagant way because mum and dad were very much working class and struggling, but despite that I was definitely spoiled. If I did want something, then they used to do their best to get it for me — so I never really understood value. I was really into airplanes as a kid so it was toys of airplanes. Racing cars. Usual boys’ toy stuff.

When my parents first got married they were renting little rooms in dodgy little houses and had no money whatsoever, and my dad was working three jobs a day just really, really determined to get us out of that. Which he did — I think I was about ten or eleven when they actually did buy their own house. But the price of that was I didn't really know him very well until I was a bit older.

I had a few little jobs before I became successful doing music. I put air conditioning units into office buildings, and I was a courier driver for a little bit. The main job I had, I used to work at WHSmith in a warehouse just off of Heathrow Airport, and we would deliver goods into the terminal shops. We’d do three weeks in the warehouse, one of those on the forklift, and then one week on the truck, delivering stuff. I think it was £40 a week or something like that. But a lot of that time I was actually on the dole [the UK’s unemployment benefit], so I didn't really have much money and my mum and dad were still supporting me.

Making music, the dream is that you're going to make it big, become rich and famous and travel all over the world, do all those lovely things. So you go into it with that hope and that dream. You know there's only a tiny, tiny fraction that do it, so there's a realistic part in you that knows it's really difficult and the chances are against you, but there's an optimistic part that says, “Yeah, but I'm gonna be one of the few.” I certainly had that. To me, it wasn't a case of “if,” it was just a case of how long it was going to take me. It happened pretty quick: I got my contract in February ’78, just before my 20th birthday. And April or May of ’79, I was number one with the single “Are ‘Friends’ Electric?”

When I made it in the music business, I was 21, and I was still living at home, so I was never independent. My dad was head of the family. We tried to get management and we couldn't find anyone that we felt comfortable with so my dad said, "Well, I'll look after it for now until the right person comes along." And I just liked it that way, so we never did get managers. In ’79 I had two number one albums, “Replicas” and The “Pleasure Principle,” and two number one singles, “Are ‘Friends’ Electric?” and “Cars”. It was massive, absolutely massive. We were selling shit tons of albums all over the world.

My uncle once worked it out that in the first two years I earned £6 million. But I don't know that for a fact.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I put a huge amount of it back into touring. I did two world tours in the first twelve to fifteen months — huge, huge tours, and we had all custom-made equipment. There were no lights available in the world that did what I wanted these things to do, so we designed and made our own. I said to the guy that I wanted the set to look like a skyscraper city, where the buildings themselves would glow, because it was all part of these science fiction stories that I'd been writing. It just cost a ridiculous amount of money. These tours were so extravagant that even though they were selling out, they actually lost money. Which used to drive my dad crazy. But I thought it was worth it, because I thought I was building a platform that would give me longevity.

Towards the end of the 80s we were really getting into trouble. I think that's when I began to grow up in a sense, and realized how bad things were.

I don't think that way anymore — I actually think it's a ridiculous way to think. But that's what I thought at the time. My dad didn't agree. He would offer advice and try very, very hard to convince me. But if I absolutely was adamant — “this is what it's gonna be!” — then that was the way it would be. So I was allowed to get away with some things that I shouldn't have done, really. I think that’s one of the problems perhaps of having a family relationship. I think my dad often would give me fantastic advice, and when I didn't listen to it my dad would just accept it.

I also spent a fortune living the life, to be honest. Travelling, Concorde, first class, and all that. And I bought a lot of shit — like I say, I'm not very good with these sorts of things. Houses. Ferraris. Aeroplanes. I had three aeroplanes at one point at the same time — that's pretty stupid. I mean, it was great, but it’s ridiculous.

Towards the end of the 80s we were really getting into trouble. I think that's when I began to grow up in a sense, and realized how bad things were. We were getting into debt — my mom and dad were starting to drive around to cash machines every night trying to get enough money out of the machines to pay bills. It got pretty bad. When I met Gemma in ’92, fans would write in nasty letters saying that she was a gold digger and all this sort of nonsense, and she actually bought my groceries for the first year or two. I don't think I had any money whatsoever. She walked into this person that was absolutely broke, whose career was completely at a standstill, in a terrible state, virtually no money coming in. I had no record contract, it looked very unlikely that I'd ever get one, tours were still losing money, and the attendance was becoming embarrassing. It was just awful, absolutely awful.

Rather than being a gold digger, she actually paid to keep me going for the first couple of years.

It was a very difficult time. I had a sofa in my house and all the springs had gone on it, and I used to put a piece of wood underneath it so you didn't sink down into it, and I pretended that I was eccentric and I liked it that way. I had a tiny little twelve-inch portable TV that my granddad had given me many years before on an old kitchen stool, and again I would pretend that that I loved that TV because it had sentimental value or some weird shit like that. It was because I was absolutely broke. I think at the worst we were £650,000 in debt, about a million [US] dollars.

I didn't start making money touring until I'd been doing it for fifteen, twenty years. Again, that's my own fault.

So then there was a huge amount of belt tightening. You absolutely live as lightly as you possibly can. For a while, me and Gemma were living on £600 a month, total. No holidays, nothing. You live as minimally as you can and then you do as much as you can to try to make money come in. We started to offer things to fans. Competitions. We started doing telephone information lines, where I would record these long messages on the phone, and the fans would call in, and they generated a significant amount of money. That was really helpful. Then I did an album in ’94, the first album post absolutely hitting the bottom. I did it all at home, because I couldn’t afford a studio. As luck would have it, that really started to turn things around musically — fans really loved it, and I was able to claw back a whole load of fans I'd lost in the years before, and I think I got another record deal based on that album.

Slowly but surely we started to crawl out of this hole, and eventually we managed to pay off all of our debts, pay off the mortgage. But we got far cleverer than we had been before, with the music and with the way we interacted with the fans, and how we could lean on them to help us. And to a large degree we still use a lot of the lessons that we learned there.

Recommended for you

Joel Kim Booster Was in Massive Student Debt Until Two Years Ago

Money Diaries

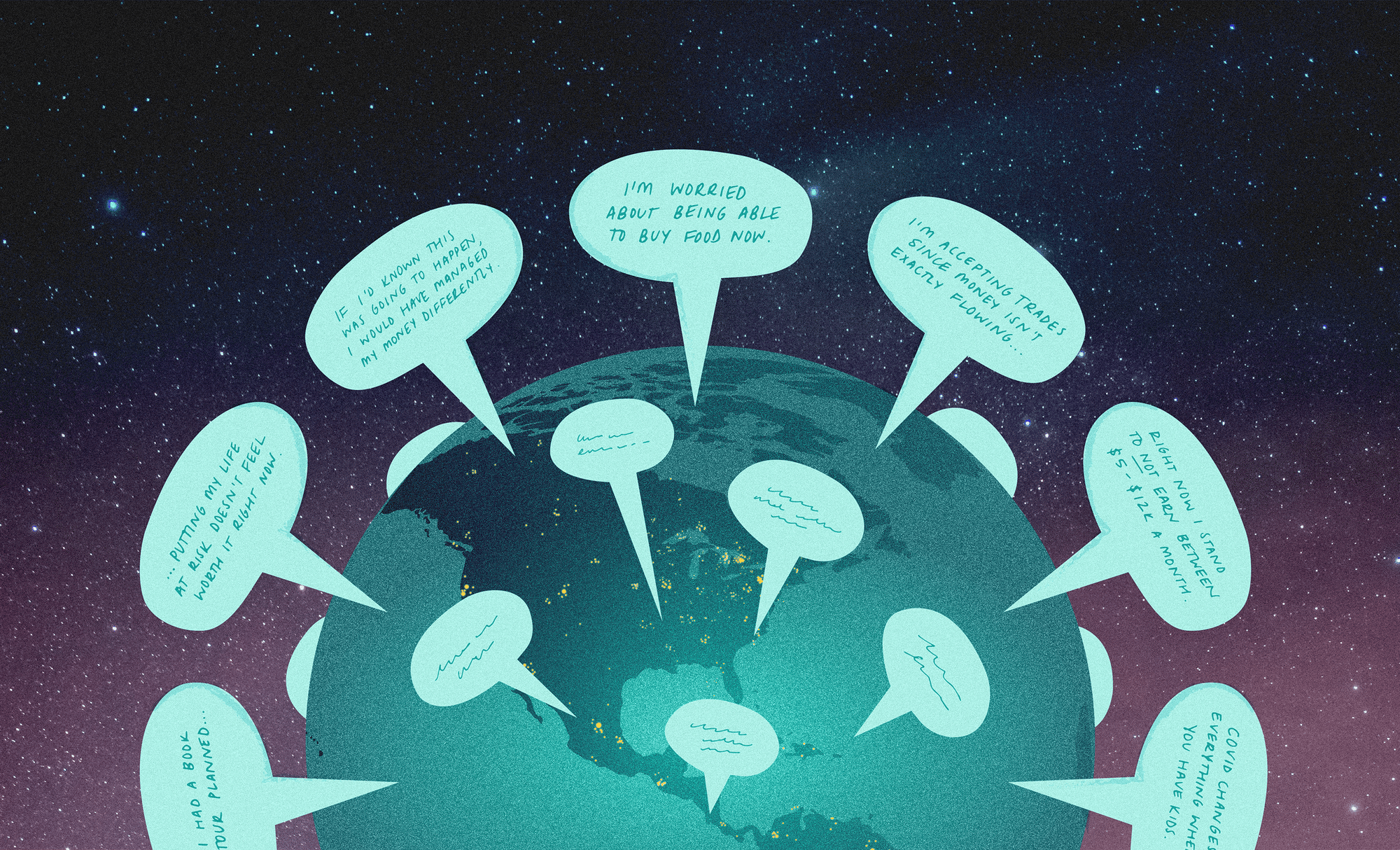

Pandemic Money Diaries — Panic at Trader Joe’s Edition

Money Diaries

She Was Living in a Shelter Six Years Ago. Now She’s the CEO of Her Own Beauty Company

Money Diaries

How I was Conned by the “Fake German Heiress”

Money Diaries

I didn't start making money touring until I'd been doing it for fifteen, twenty years. Again, that's my own fault. You start out having these massive light shows and they become expected, and then as the career starts to slide you feel this sort of pressure that you've got to keep trying to make it look as if everything's fine. So you keep pumping money into these big tours.

We did cut back, but the way my dad explained it, which is a really good way of putting it, is that we were kind of always one step behind the decline. So we would go out and do something, lose a bit of money, and we'd go out again the next year but we just cut back a little bit, tried to make it look as spectacular as possible, but with all these different things to try to make it more cost effective. But by then the career would have gone down a little bit further, and so we hadn't cut back enough and we'd lose again. As the career nosedived we kind of followed it almost one step behind.

My dad managed me up until about 2009, 2010. Thirty years or so. I didn't really have anything to do with money. I mean, I don't think I wrote a cheque until I was about 35 years old. Didn't know how to. Honest to God. Gemma and I got together in ’92, and I absolutely know that I'd never written out a cheque before then. I didn't start looking after my own finances until 2010. I took over everything. It was a bit of a steep learning curve because I really had completely ignored it. That's the first time ever I'd really been in charge of my own money — having my own bank account that I actually went and opened, that sort of thing.

Things have changed, of course, because technology has come along. The income from streaming is so pitiful. I had a statement come through, maybe a year and a half ago, and was just under a thousand pages, and I actually worked out the paper it was printed on would have actually cost about a pound if I had gone out and bought it at Staples, and the statement gave me 37 pence, it literally wasn't worth the paper it's printed on. So apart from the very few big people that do millions of streams, most of us just see it as a promotional tool. It’s a way of building profile, allowing people to get into what you're doing, and then they come to see your gig and buy a t-shirt.

But I actually think things are very good for artists these days in some ways. I decided a long time ago that the standard model for record deals sucks pretty badly as far as an artist is concerned — you get very little out of it and you don't own your own music at the end of it.

I went independent in the late 90s and I’ve been fiercely independent since. Social media has made a huge difference in being able to reach out to fans directly. Things like meet-and-greets are now very, very important, I think pretty much every band on the planet now does meet-and-greets. I've looked to expand that, so I've been having people come into rehearsals, for example. Today we had eighteen people come in and sit through rehearsals for a four-hour session: three hours of music and one hour of just chatting, trying out the gear, signing stuff. So you're giving fans access to something that historically they would never ever have seen or got involved in at all. But you're charging for it.

It doesn't really seem to matter how dire the situation, I seem to be sort of quite optimistic I'm going to find a way through it. So far, it's all worked out.

My pet project at the moment is like ‘An evening with…,’ where I just go onstage and talk about my life. You're just constantly trying to come up with ideas to augment what's going on at the moment. A lot of people talk about the music business at the moment with a doom and gloom sort of attitude about it, which seems to be inherently focused on the record sales side of it only. And I think that's a very narrow view. I see it as something of a golden age. We're just given so much more power now. I think it's great. I find the whole thing really exciting. And I'm currently doing better than ever, so for me it's working out really, really well.

Luckily I've got a few songs that are used in adverts all the time. An Aviva advert at the moment here in the UK [for a British insurance company] is using one of my songs, and that pays really well. Often these things are sort of £10,000, £15,000, £25,000, but that's what they call per side — you get that for the publishing and you also get that for the mastering side of it. But for one advertising campaign I had at the Superbowl once, I think it was $240,000 a side, using “Cars”. Unbelievable money. I've only got about two or three of them in forty years — they're pretty rare but it can happen.

Overall I don't think I've learned a great deal at all about money. I'm still pretty rubbish. But I'm trying to formulate one-year plans. I know what my fixed outgoings are now, so I know that as an absolute minimum I need to be generating X amount of money per month.

But as I said, if you asked me to categorize how me and Gemma are with money, I would say childlike, still. You know, when you have irregular income, if a big chunk comes in, the sensible thing to do would be to put away as much of that as you can and live on as little of it as possible. What we'll do is rent a boat in Croatia and invite all of our friends and have this mega holiday for two or three weeks and then run out of money halfway through it. And then just giggle. You know: “Ah fuck, done it again.” I do have a bookkeeper now, a lady called Michelle who works for me, and she's really good. She does treat us like children — she's on the phone couple of times a week: “Don't do that, don't spend that.” It’s like having my mum or my dad sort of keeping us in check a little bit.

And we try to take our children everywhere. We're forever trying to take the children to one beautiful place or another to just give them as lovely a life as we can give them, before they move on and start their own lives. And I think if anything that's probably where we go a bit mad. We got this amazing house in Los Angeles — it's like a castle, it's got secret corridors and secret staircases and trap doors in the floors that go through to a secret compartment. It's just amazing, this place. One of the main reasons that we got that was cause the kids would love it. It’s like Disneyland. It’s just brilliant. So I think that's our weakness really. We're just throwing money at the children.

But I have always been optimistic, funny enough. Stupidly optimistic. About money, but about everything — things will work out. I thought the same when I was in an aeroplane once, and I'm in the middle of the Pacific with a friend of mine, we were flying around the world as an adventure, and we had a double engine failure mid-Pacific at night, about fifteen hundred miles away from San Francisco and about fifteen hundred miles from Hawaii. Pretty much halfway. And all of a sudden the aeroplane was going down.

We were sitting up at about 12,000 feet, just above the clouds, beautiful night, actually — the stars were out, it was lovely, moon glowing. And then the engines quit, both of them, and we go into the cloud and out the other side and of course then it's pitch black, there's no ambient light from cities or anything out there, and the starlight doesn't get through because the cloud mass is too thick, so you're just relying on instruments to give you information. You can't see the sea…you'd never see it. I think we were down to about 1,800 feet or so when we got the engines running again.

You’re absolutely convinced you're going to hit the water, but you're also kind of optimistic that you're going to survive. It's shocking how you can be effectively seconds away from plunging into the ocean at night in an aeroplane full of fuel and still think you're gonna get away with it somehow.

Same with money, you know. It doesn't really seem to matter how dire the situation, I seem to be sort of quite optimistic I'm going to find a way through it. So far, it's all worked out. And to be honest we’re actually very, very happy. We have a lovely life, and I'm able to keep enough money coming in. I'm able to generate enough money to allow for our slightly scatty way of going about things.

As told to Chris Heath exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.