Money Diaries

“My Finances, in Brief,” an Essay by David Sedaris

Featured

Wealthsimple Magazine

Conversations with geniuses and weirdos, help with investing and taxes, and stories that help you understand the big strange world we live in

Money Diaries

Anthony Bourdain

Wealthsimple

Smart investing tools and personalized advice designed to build long term wealth.

Popular right now

Stocks Hit Fresh Highs. Is It a Bad Time to Invest?

Money & the World

Money 2023: The Year of ‘Wow, That Wasn’t So Bad After All’

Money & the World

Five Tax Enigmas That Confuse Basically Everyone

Finance for Humans

Why Giving You A $1,000 Phone Is Smart for Us

News

How 2023 Cracked Wall Street’s Crystal Ball

Money & the World

Featured Topic

The latest news from Wealthsimple

Why Giving You A $1,000 Phone Is Smart for Us

Phones are expensive. Isn't it a bad idea for a company to give you one? Well, it depends. Here's our answer, with receipts.

Private Equity Gets a Little More Public

Wealthsimple Private Equity offers exciting potential for long-term savers

The Wealthsimple Report: September 2023

New this month: higher interest on your cash, FHSAs, a time-saver for options traders, a new way to track your transfers, and more.

The Government Wants to Help You Save Money for Your First Home

The new FHSA lets you save up to $40,000, completely tax-free.

Our Deposit Coverage Just Got Three Times Bigger

We were able to increase the protection we get by working with multiple banks — and pass it on to you.

The Deadline for RESPs is Coming! It's About More Than Free Money

All hail the Wealthsimple RESP! Now that we’ve eliminated the confusing paperwork and high fees, there's no good reason not to start planning for your kids' future. (The deadline is December 31)

Announcing the New Wealthsimple App. It Does... Everything?

Stocks and ETFs, crypto, cash, and managed investing, now all in a single, simple place.

We Made It So You Can Be a Venture Capitalist Even if You Don’t Have a Billion Dollars

The Wealthsimple Venture Fund I lets you bankroll the next big thing like a Silicon Valley tycoon — no matter how many commas you’ve got in your net worth.

Our Leadership Team Still Wasn’t Diverse Enough. So We Changed Our Hiring Strategy

Plus, six challenges facing women at Wealthsimple, and what we’re doing about it.

We’ve Got Wallets (Crypto, Not Velcro!)

You can now buy, sell, send, and receive crypto all in one app. Which is really handy if you believe that blockchain is the future (like we do).

Featured Topic

Candid money stories from interesting people

“My Finances, in Brief,” an Essay by David Sedaris

The author always had a strange, difficult relationship with his father — in part because of money. We asked him if he’d go there in an essay. And, to our surprise, he really, really went there.

Kim Kardashian, Mogul, Tells Us Her Money Story

The financial life of arguably the most American businesswoman in existence, from learning to balance her chequebook to running a beauty brand.

Jon Hamm Would Like to Buy a Time Machine

Wealthsimple discovers that Don Draper is actually a soulful guy who was a waiter almost as long as he’s been an actor. We talk to him about how to have your head screwed on straight about money.

Money Diaries: Pride Edition

For the last five years, our “Money Diaries” series has been all about telling truths. In honour of Pride Month, we share some of the greatest conversations we’ve had with LGBTQ+ icons.

The Snack-Cake Economy: How I Learned Money in Prison

The author picked up some valuable skills while behind bars — like how to make a microwave cake and how to reuse stamps. He also discovered that the most innovative (and brutal) parts of capitalism survive even in a world without paper currency.

“All My Opportunities Came From Cold Emailing or DMing Someone on Twitter”

Before she was a VC backed by Marc Andreesen and Alexis Ohanian, Brianne Kimmel was an international vagabond, an ad agency hustler, and a Pharrell bootlegger.

Novelist Omar El Akkad on Being the Engine and Being the Fuel

The Giller award-winning writer gives us his money story, from the inequities of Qatar to the inequities of capitalism.

Friends With Money: Steve Aoki

The EDM superstar (and Benihana heir) talks about starting out with zero capital, investing in people, not ideas, and why society ought to do more to embrace failure.

In February, He Was a Ukrainian Corporate Dealmaker. In March, He Became a Resistance Fighter

An executive for mining company Metinvest talks about Ukraine’s economy and conducting business during war.

How Canada’s Greatest Poker Player Learned He Wasn’t Lucky

Daniel Negreanu (aka Kid Poker) began his life playing snooker, and eventually became the number one poker player in the world. He tells us what he learned about money, work, and confidence.

Featured Topic

How to be a better money person

A Six-Step Financial Plan for Every Human (or at Least Every Canadian)

Whether you just landed your first job or inherited a million dollars, the basics of what to do with your money are the same.

A No-Tears Guide to Mortgage Renewals

How to save money (and stress) the next time your mortgage is up.

Should You Buy or Rent? A Quick Formula to See

There’s no 100%, can’t-miss way to figure out whether you’ll come out ahead owning or leasing a place. But one easy calculation will at least give you a hint.

RRSP vs TFSA: What’s the Better Choice?

In this battle of the tax-sheltered accounts (and who doesn’t love to see a good fight between tax shelters?), we tell you when you should put your money in an RRSP, when you should pick a TFSA, and when you should do both (if you can!).

Five Tax Enigmas That Confuse Basically Everyone

OK, OK: they’re not technically enigmas, but these are the things most likely to trip you up when it comes time to file. We make sense of the madness and hopefully spare you some confusion.

OMG You’re Having a Baby! (A Guide to That and Other Big Life Moments That’ll Affect Your Taxes)

The government won’t help you raise your kid, furnish your home, study for exams, or pick the right engagement ring. But they will help you save money on all of those things.

How Do I Diversify, Anyway?

You’ve probably heard this advice before: diversify your investments or else bad things could happen! Well, how do you actually do that smartly? And why should you in the first place? We’ve got answers.

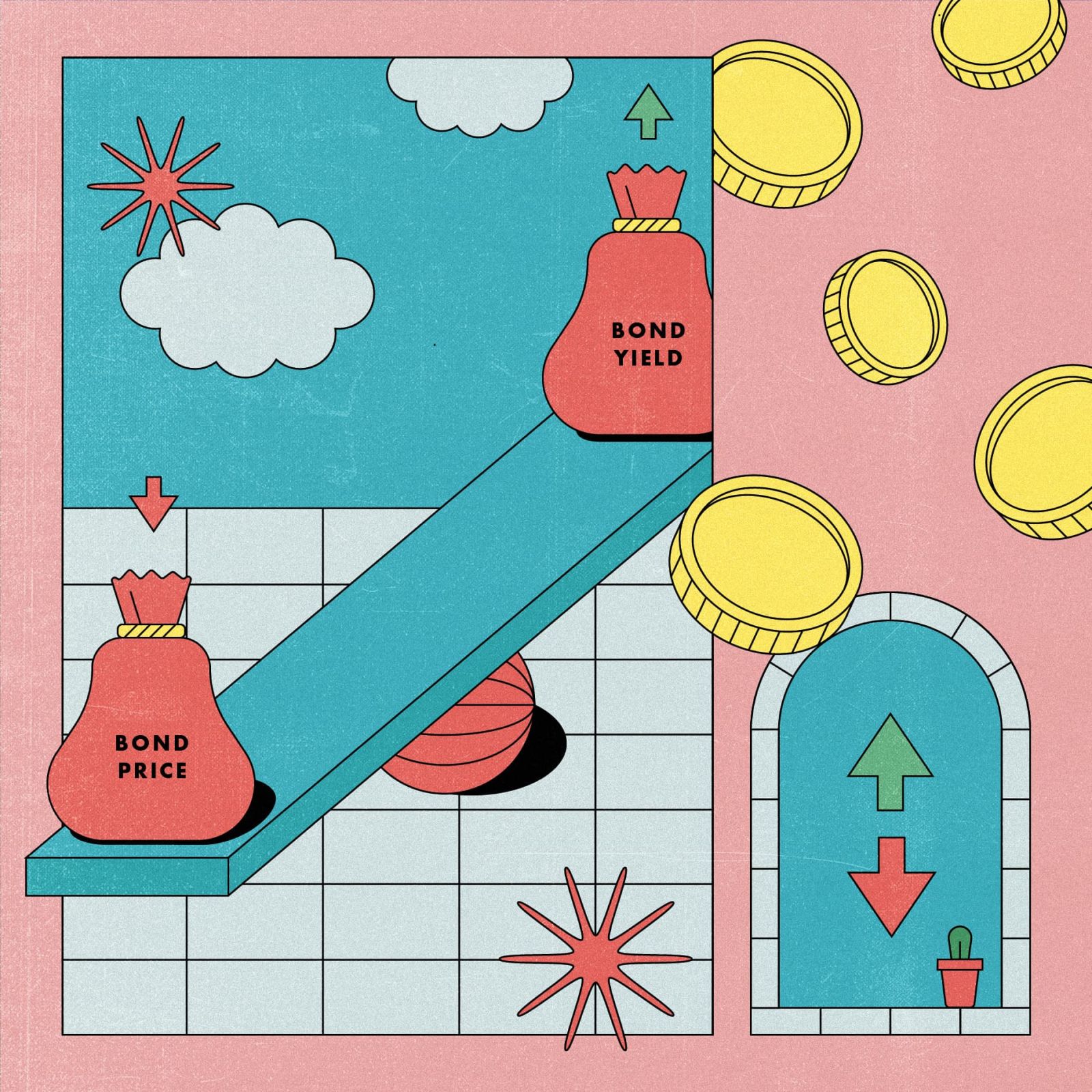

The Bond Market Fell, Hard. An Explainer for Normal Humans

A steep selloff in government securities has unnerved Wall Street — and made individual investors question whether bonds are even worth holding anymore. Here’s what’s going on.

How to Make Your Money Make Money

One problem with having so many great places to earn a return on your money? It can be hard to keep them straight — and even harder to choose the right one.

How to 10x Your Tax Refund (Without Breaking the Law)

If you’re among the millions of Canadians getting a tax refund this year, you have a choice to make. You can spend that money, which would be fun. Or you can turn it into more money, which would be smart.

Featured Topic

How money shapes the world we live in

Everyone Knows Canadian Monopolies Are a Problem. Why Can’t We Do Anything About It?

If you thought a regular Monopoly game was long and boring, Canada’s been playing its own version for, oh, 200 years. The host of the Canadaland podcast “Commons” explains how we got here, how limited competition hurts everyone, and what we can do about it.

Anxious Investors Are Scooping Up Gold. Is That a Good Idea?

Mr. T and preppers love the stuff, and some traditional investors do too. Here’s why gold has become a popular hedge.

We Can Fix the Housing Crisis! (Maybe! If We Follow These Steps!)

In just a few years, housing has gone from merely pricey to unattainably expensive for most Canadians. We asked policy experts how to make homes affordable again

Stocks Hit Fresh Highs. Is It a Bad Time to Invest?

All-time highs spook some investors, who fear if they buy at the top they’ll end up overpaying. We dove into the data to see if their anxieties are justified.

Money 2023: The Year of ‘Wow, That Wasn’t So Bad After All’

The investing world expected a brutal 2023. Instead, stocks soared and the economy is (probably) headed toward a soft landing, which underscores an important economic truth: predictions are often wrong.

What’s the Legacy of the $GME Mania? We Asked the “Dumb Money” Writers to Weigh In

It has (somehow) been almost three years since a group of Very Online retail traders cost Wall Street hedge funds billions of dollars by piling into GameStop shares. Here is what has, and hasn’t, changed in the time since.

How 2023 Cracked Wall Street’s Crystal Ball

We asked Kyla Scanlon — a writer, video creator, and podcaster (surely you’ve seen her financial explainers on social media, right?) — to unpack why pro investors guessed all wrong about what would happen this year.

2023: The Year of FOMM (Fear of Making Money)

Stocks have boomed this year. Yet many DIY investors have sprinted from markets — and missed out on big returns. What spooked them?

The 10 Most Interesting People in Money Right This Second

End Times for Tech Stocks?

OK, OK: tech stocks aren’t dying. But there’s a case to be made that rising interest rates could end their decade-plus-long dominance, which has everyone wondering: what comes next?